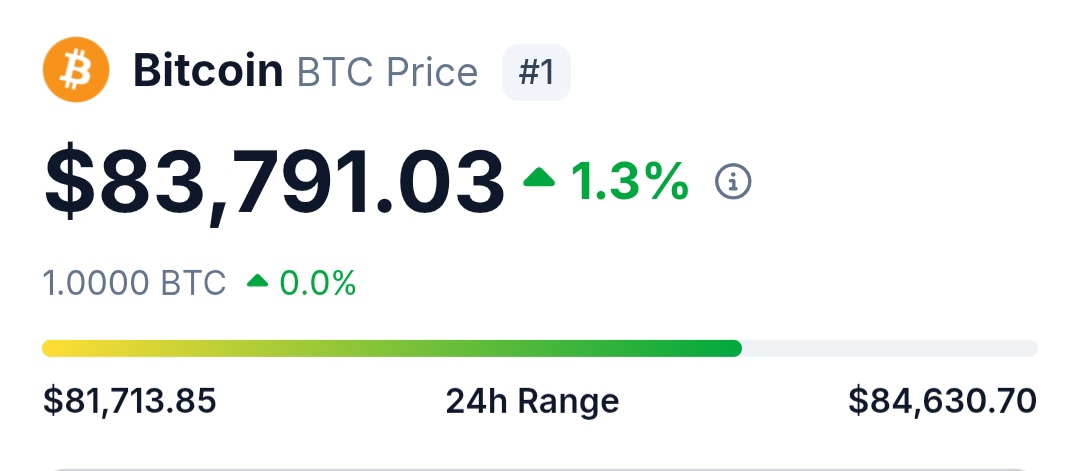

5-4-2025 – Amid the economic turbulence unleashed by Donald Trump’s tariff policies, which have sent traditional financial markets into a tailspin, Bitcoin has emerged as an unexpected beacon of stability. While the S&P 500, a barometer of America’s 500 largest listed firms, nosedived by 5% on Friday, and the tech-centric Nasdaq mirrored that steep decline, the world’s leading cryptocurrency bucked the trend. Over the past 24 hours, Bitcoin climbed 2%, reaching a robust $83,900.

James Seyffart, a Bloomberg ETF specialist, took to X to express his astonishment at this resilience. “I’m genuinely taken aback by Bitcoin’s strength,” he remarked. “In a market rout like this, with risk assets tumbling, I wouldn’t have wagered on it holding above $80,000.”

The broader financial landscape paints a grim picture. Tesla’s stock slumped 9%, Nvidia shed 7%, and even gold—long revered as a sanctuary in stormy times—slipped 2.3%. Yet Bitcoin’s defiance has sparked intrigue among observers, who point to a surge in corporate investment as a possible lifeline. Seyffart speculated that firms like Marathon, GameStop, and Strategy might be underpinning this buoyancy, a notion that once raised eyebrows as a potential red flag.

This week alone, corporate moves have fuelled the narrative. GameStop unveiled plans on Tuesday for a $1.5 billion Bitcoin reserve, echoing the playbook of Michael Saylor’s Strategy, which bolstered its coffers with $1.9 billion of the cryptocurrency by March 31. Stablecoin giant Tether, meanwhile, snapped up $735 million worth in the year’s opening quarter. Against this backdrop, Thursday saw most Bitcoin exchange-traded funds haemorrhaging value—save for BlackRock’s IBIT, which drew in $65 million.

For Bitcoin enthusiasts, this moment feels like a vindication. Long touted as “digital gold,” the cryptocurrency appears to be shedding its old skin as a volatile cousin of tech stocks, which historically rose and fell in lockstep with market tides. Crypto analyst Dennis Porteaux highlighted a striking shift: today marks the first time Bitcoin has danced to its own tune during the S&P 500’s ten worst days. “I’m seeing genuine signs of decoupling,” he observed.

Still, not everyone is ready to herald a new dawn. Chris Burniske, a seasoned crypto venture capitalist, urged caution. “Bitcoin’s outperformance over the Nasdaq might reflect Treasury dynamics, or it could be whispering something deeper as the market’s most perceptive sentinel,” he mused. Whether this is a fleeting anomaly or the start of a seismic shift, Bitcoin’s latest chapter has undeniably seized the spotlight.