28-4-2025 – In the volatile realm of digital currencies, where fortunes can soar or plummet in mere hours, the spectre of price manipulation looms large. Far from the organic ebb and flow of genuine market forces, these orchestrated schemes exploit human psychology, leaving unsuspecting traders in their wake. When a coin surges inexplicably only to collapse just as swiftly, it’s seldom a stroke of market serendipity—it’s often the handiwork of cunning manipulators.

The mechanics of market deception

At its core, cryptocurrency price manipulation involves deliberate tactics to skew a coin’s value, orchestrated by insiders or coordinated groups. These actors don’t rely on authentic demand but instead deploy a repertoire of deceptive ploys—fabricating trading volume, stoking hype, or engineering sudden sell-offs—to lure traders into traps. In traditional markets, such conduct would invite hefty fines or prison sentences. Yet, in the loosely regulated crypto sphere, where emotions often trump reason, these schemes thrive, particularly in low-liquidity corners with minimal oversight.

The playbook is chillingly effective: create an illusion of demand or panic, watch as traders react impulsively, then capitalise on the chaos. The fallout? Ordinary investors are left reeling, while the orchestrators pocket the gains.

Sophisticated stratagems of manipulation

Beyond the headline-grabbing scams, some tactics are subtler, leveraging technology or privileged access. High-frequency trading bots, for instance, can execute spoofing or front-run trades at lightning speed, outpacing human traders. Insider trading—acting on confidential information like an imminent exchange listing—remains a persistent issue, granting unfair advantages. Even decentralised finance (DeFi) isn’t immune: hackers have targeted oracles, the data feeds that inform smart contracts, to falsify prices and siphon millions. A notorious 2020 incident saw a flash loan exploit on the bZx protocol, underscoring the audacity of such schemes.

The emotional engine of exploitation

Why do these ploys succeed? They prey on the hardwired instincts of traders. In crypto’s high-stakes arena, decisions are often snap judgments, driven by greed, fear, or the dread of missing out (FOMO). A cleverly timed tweet or a celebrity endorsement can transform a lacklustre token into a must-have asset, blinding investors to its lack of substance. Conversely, a sharp price drop can spark panic, prompting mass sell-offs that manipulators exploit to buy low. The 2021 Squid Game token frenzy, which skyrocketed before vanishing entirely, stands as a stark reminder of how hype can drown out caution.

Tactics of the trade: How scammers operate

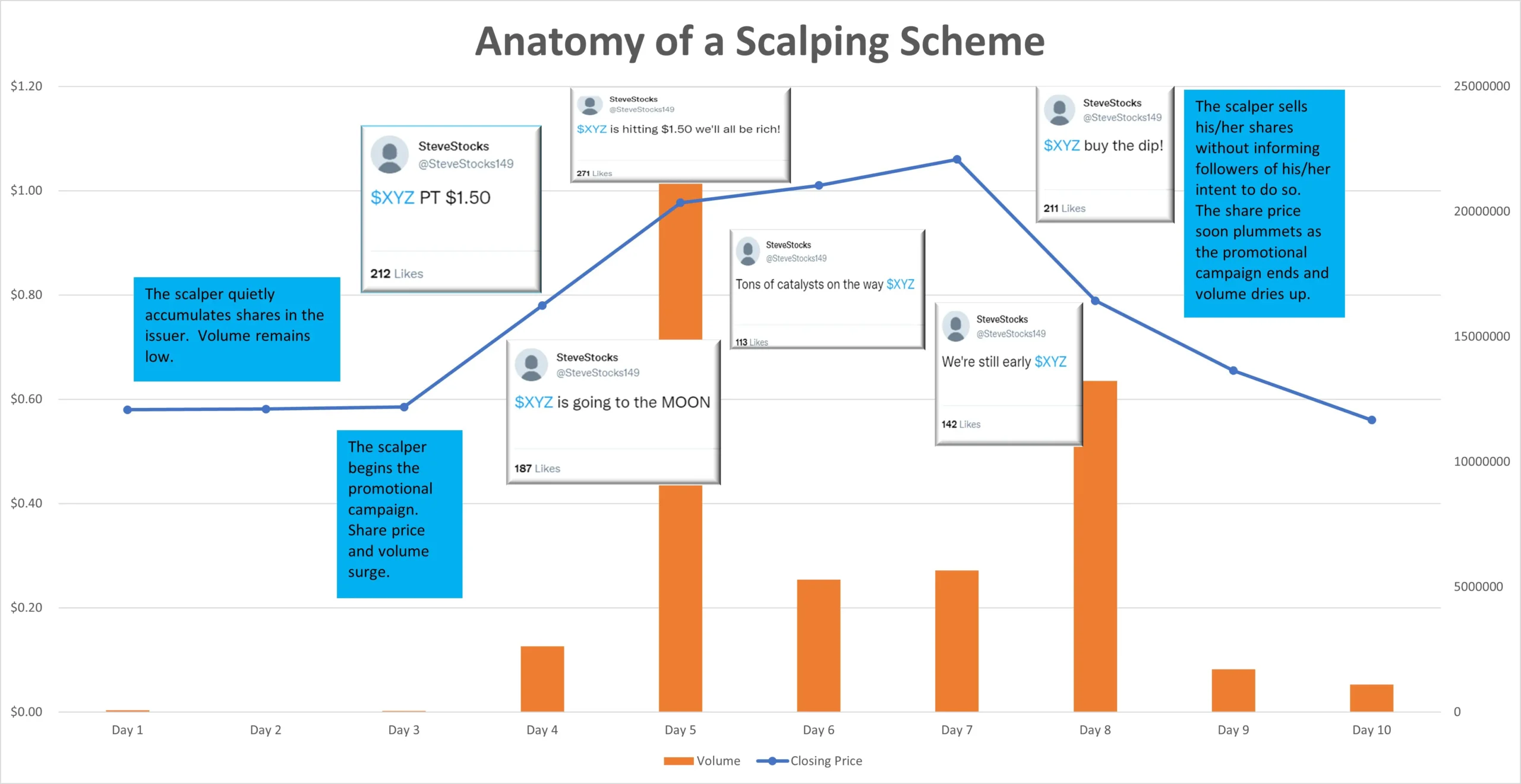

The arsenal of manipulation is diverse, each method exploiting market vulnerabilities. Pump-and-dump schemes see groups quietly amassing a cheap token before unleashing a barrage of hype—via influencers or fabricated news—to inflate its price. As eager retail investors pile in, the instigators sell, leaving latecomers with worthless holdings. Wash trading, meanwhile, involves a single entity trading with itself to fake high volume, creating a mirage of legitimacy. Spoofing and layering use illusory buy or sell orders to mislead traders about market interest, only to vanish once real money follows.

Whales—holders of vast crypto reserves—wield outsized influence. A single large trade can sway prices, triggering herd-like reactions from smaller players. Some whales exploit this deliberately, orchestrating moves to profit from the ensuing volatility. A 2022 study revealed that up to 70% of trades on unregulated exchanges were wash trades, highlighting the scale of these deceptions.

The ripple effects on the crypto ecosystem

The damage from manipulation extends far beyond individual losses. Each scam erodes trust, the bedrock of the crypto vision. Newcomers, burned by a pump-and-dump or a whale-driven crash, often abandon the space entirely, their faith in decentralised finance shattered. This cynicism fuels regulatory scrutiny, as governments point to high-profile frauds to justify tighter controls. Legitimate projects, meanwhile, struggle to stand out amid the din of scam tokens and shady promotions, stifling innovation and progress.

The memecoin mania of recent years, amplified by celebrity endorsements, has only muddied the waters. In 2024, several star-backed tokens collapsed spectacularly, raising questions about the line between influence and deceit.

Safeguarding against the scammers

While the market remains a minefield, investors can arm themselves with vigilance. Thorough research—scrutinising a project’s team, purpose, and trading patterns—is non-negotiable. Anomalies like sudden volume spikes or suspiciously low liquidity often signal trouble. Tools like blockchain explorers or services such as Whale Alert can help track significant wallet movements. Sticking to reputable exchanges, which increasingly deploy AI to detect illicit activity, adds another layer of protection. Above all, staying informed about evolving tactics is crucial—knowledge is the sharpest shield.

The fight for fairer markets

The crypto landscape is not without its champions. Exchanges are rolling out sophisticated AI surveillance to catch wash trading and spoofing in real time. DeFi protocols are embracing transparent governance, empowering communities to monitor and challenge suspicious activity. Regulators, too, are stepping up, with new laws targeting market abuse and insider dealing. While the system is far from watertight, these efforts mark progress toward a more accountable ecosystem.