7-5-2025 – As the financial world holds its breath before the Federal Reserve’s looming policy pronouncement on May 7, Bitcoin stands tall, shrugging off the jittery caution gripping broader markets. With Federal Reserve Chair Jerome Powell poised to deliver his verdict—widely expected to maintain steady interest rates—analysts warn of a possible short-term dip in Bitcoin’s value within the next two days. Yet, the cryptocurrency’s robust performance, outshining both gold and the S&P 500 over the past month, fuels a burgeoning belief in its relentless upward trajectory, even amidst economic unease.

Bitcoin’s allure as a potential safe haven is gaining traction. In April, it soared by more than 7%, leaving gold’s modest 5% gain and the S&P 500’s lacklustre showing in its wake. This surge hints at a subtle shift in investor sentiment, with capital traditionally parked in gold or defensive stocks now finding a home in Bitcoin. As recession fears loom and equities waver, the cryptocurrency’s resilience suggests it is carving out a new role in portfolios wary of traditional havens.

Historical patterns, however, cast a shadow. Analysis from Jim Paulsen reveals a sobering trend: since the 1970s, whenever the real federal funds rate has significantly surpassed the natural rate of interest, the U.S. economy has either slumped into recession or endured a growth slowdown. Today’s elevated real rate echoes those precarious peaks, raising concerns about economic headwinds. President Trump’s push for rate cuts, coupled with his tariffs stoking inflationary fears, adds further complexity to the Federal Reserve’s delicate balancing act, as it navigates a first-quarter GDP contraction alongside robust April employment figures.

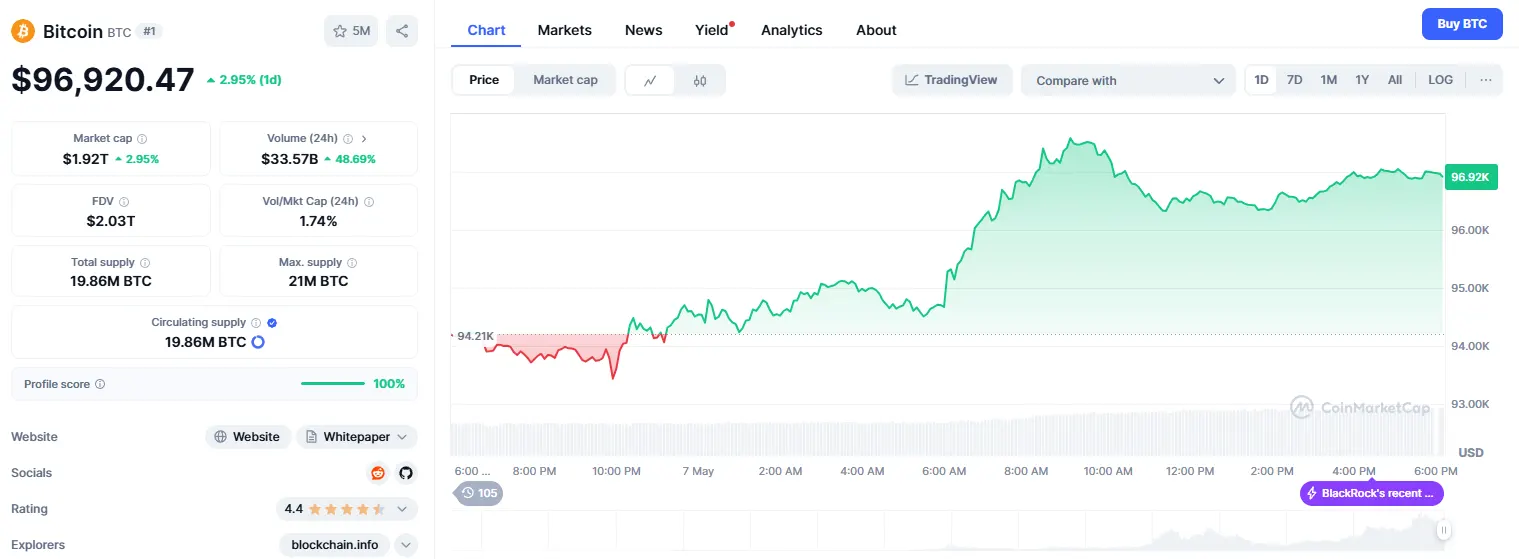

Despite these crosswinds, Bitcoin’s market stance remains firm. Analyst Michael Van De Poppe notes that the cryptocurrency is weathering pre-FOMC selling pressure with poise, potentially forming a low in the coming days. Liquidity is pooling around the $61,500 to $62,500 range, marking a critical zone for re-entry if prices soften. Following a vigorous late-April rally, Bitcoin has settled into a consolidation phase, a familiar pause before major Fed announcements. Yet, the broader trend holds strong, with market sentiment tilting towards optimism for an eventual easing cycle. Should rate cuts emerge later this year, Bitcoin could ride a wave of renewed liquidity and emboldened risk appetite, reigniting the “up-only” narrative. For now, if it clings to this pivotal green zone, bullish momentum may soon take the reins, propelling Bitcoin to new heights.