14-5-2025 – South Korea is poised to redefine its digital economy with sweeping cryptocurrency reforms, as the Democratic Party’s newly formed Digital Asset Committee takes centre stage. Launched on 13 May 2025 at Seoul’s National Assembly, this initiative signals a bold shift towards a unified crypto framework, with proposals for a won-pegged stablecoin and relaxed restrictions on spot crypto ETFs. As global markets watch, South Korea’s moves—mirroring Singapore’s regulatory prowess—could position it as Asia’s next fintech hub. But what does this mean for investors, exchanges, and the nation’s youth-driven crypto boom?

The digital asset committee: A new era for crypto policy

The Democratic Party’s Digital Asset Committee, chaired by Min Byeong-deok, convened its first meeting with a clear mission: to dismantle outdated regulations and foster innovation. Industry heavyweights from exchanges like Upbit and Bithumb joined policymakers and academics, highlighting the collaborative approach. Min critiqued the restrictive “one exchange, one bank” system, which ties each crypto platform to a single bank for real-name accounts, stifling growth. “This model suffocates our digital potential,” he declared, advocating for a more flexible framework.

The committee’s agenda is ambitious. Beyond streamlining regulations, it aims to enhance user protections and boost market liquidity. A key proposal is a won-pegged stablecoin, championed by presidential candidate Lee Jae-myung. Unlike volatile cryptocurrencies, a stablecoin tied to the Korean won could stabilise trading and attract institutional investors. However, the Bank of Korea has raised concerns about monetary policy impacts, urging early oversight to prevent inflation risks.

“A won-pegged stablecoin could be a game-changer, but it must balance innovation with economic stability,” says Professor Kim Min-jung, a fintech expert at Yonsei University. “South Korea’s youth, who drive crypto adoption, will be watching closely.”

Lee Jae-myung’s crypto vision: Courting the youth vote

Lee Jae-myung, the Democratic Party’s presidential frontrunner, has made cryptocurrency a cornerstone of his campaign, resonating with South Korea’s tech-savvy younger generation. A 2024 Statista survey found that 40% of South Koreans aged 18–34 own cryptocurrencies, compared to just 12% of those over 50. Lee’s promises include legalizing spot crypto ETFs—currently banned by the Financial Services Commission (FSC)—and expanding banking access for exchanges.

On 7 May 2025, Lee pledged to push for spot crypto ETF approval, citing the success of US Bitcoin ETFs, which have drawn billions in trading volume. The FSC has softened its stance, agreeing to explore ETFs as underlying assets, a shift from its 2024 ruling that cryptocurrencies lack legal grounding for such products. This policy pivot could unlock new investment opportunities, particularly for retail traders.

However, Lee’s crypto ambitions face hurdles. His legal battles, including a Supreme Court case over election law violations, cast uncertainty over his candidacy. If resolved favourably, his policies could galvanise the crypto market, but opponents argue they risk speculative bubbles.

Comparing global crypto frameworks: Singapore and beyond

South Korea’s regulatory overhaul draws inspiration from Singapore, where a comprehensive crypto oversight model balances innovation and consumer protection. Singapore’s Monetary Authority regulates exchanges under the Payment Services Act, requiring robust anti-money laundering (AML) controls. South Korea’s committee aims to emulate this, with added focus on stablecoin rules and token listing transparency.

Globally, other nations are also tightening crypto regulations. In the UK, Finance Minister Rachel Reeves announced draft rules on 29 April 2025, mandating transparency for crypto exchanges and stablecoin issuers. The US, under SEC Chair Paul Atkins, is crafting guidelines for crypto tokens classified as securities, signaling a friendlier regulatory stance. South Korea’s approach, however, stands out for its emphasis on youth engagement and domestic stablecoin development, potentially giving it an edge in Asia.

The role of exchanges: Upbit, Bithumb, and KuCoin’s return

Major exchanges are pivotal to South Korea’s crypto reforms. Upbit and Bithumb, which dominate local trading volume, are active committee members, advocating for relaxed banking restrictions. Their involvement ensures industry perspectives shape policy, but critics warn of potential conflicts of interest.

Meanwhile, global exchange KuCoin is eyeing a return to South Korea after being blocked in March 2025 for non-compliance. CEO BC Wong said KuCoin is prioritizing compliance in major markets like the US and EU before re-entering South Korea, underscoring the country’s stringent regulatory landscape. This dynamic highlights the challenge of balancing global ambitions with local rules.

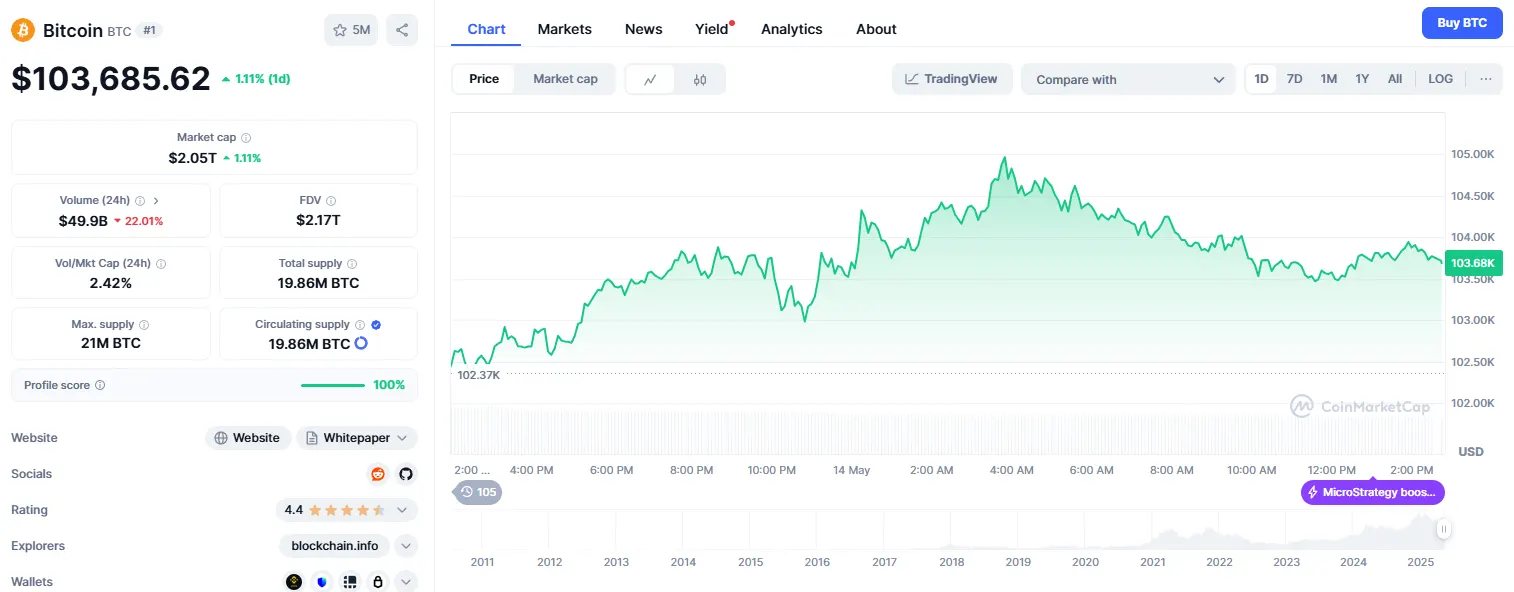

Bitcoin and market context: A global perspective

As South Korea refines its crypto policies, global markets remain buoyant. Bitcoin (BTC), trading at approximately $104,000 on 14 May 2025, boasts a market cap of $2.06 trillion and a 61.06% dominance, per CoinMarketCap. Its 1.28% daily gain and 22.89% monthly surge reflect strong investor confidence, which could amplify the impact of South Korea’s reforms.

The People Power Party (PPP), the Democratic Party’s rival, has also embraced crypto, pledging spot ETF trading and security token offerings by year-end. This bipartisan support suggests South Korea’s crypto market could see significant growth, especially if institutional investors gain easier access.

Despite the optimism, South Korea’s crypto reforms face challenges. The FSC’s cautious approach to ETFs and stablecoins reflects concerns about market volatility and fraud, as seen in global cases like the Celsius fraud conviction in the US. Additionally, the committee must address AML controls and “listing beams” (manipulative token listings), as outlined by the FSC’s Virtual Asset Committee in June 2025.

Public sentiment, especially among younger voters, will also shape outcomes. Lee’s focus on financial planning programs and interest-bearing savings for youth aligns with his crypto pledges, but delivering tangible results before the 3 June 2025 election is critical.

Why South Korea’s crypto push matters

South Korea’s crypto revolution is more than a policy shift—it’s a bid to lead Asia’s digital economy. By fostering a stablecoin, legalizing ETFs, and easing exchange restrictions, the Digital Asset Committee could unlock billions in market liquidity and attract global investors. Yet, balancing innovation with stability remains the key challenge, as the Bank of Korea’s warnings underscore.

For investors, the implications are clear: South Korea’s market could become a hotspot for crypto trading, especially if Lee’s vision materializes. For policymakers, the task is to craft rules that protect users without stifling growth. As Professor Kim Min-jung notes, “South Korea has a chance to set a global standard, but it must tread carefully.”