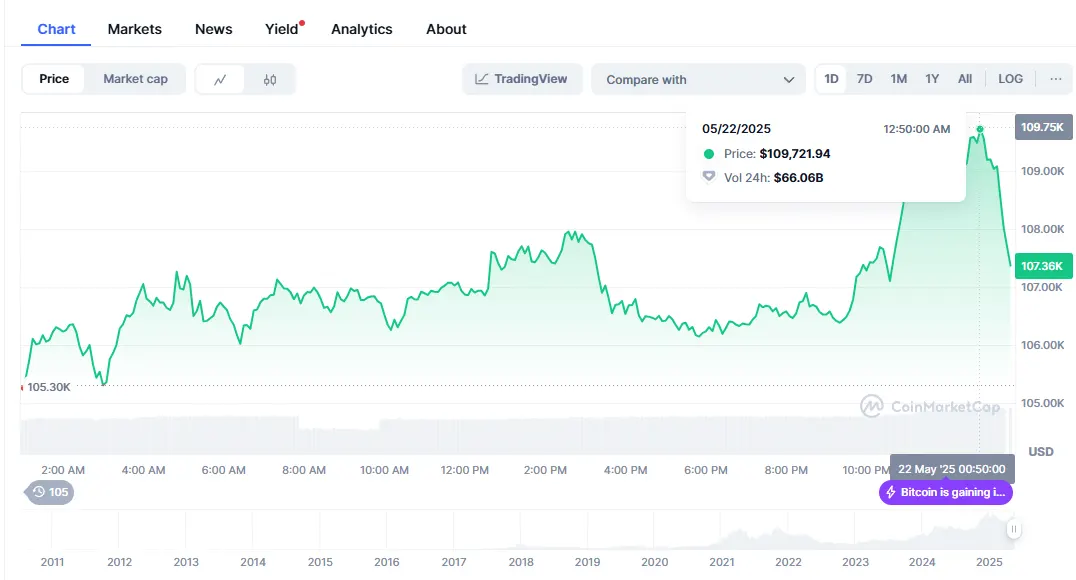

22-5-2025 – Bitcoin (BTC) has stormed to an unprecedented pinnacle, reaching a record high of $109,721, eclipsing its earlier peak of $109,114 set within the year. This remarkable ascent, unfolding against a backdrop of softening global trade frictions and progressive regulatory strides, underscores the cryptocurrency’s growing stature in financial markets.

Market catalysts driving Bitcoin’s surge

Several dynamics have converged to propel Bitcoin’s meteoric rise. A pivotal 90-day trade truce between the United States and China, announced on 12 May, has temporarily eased import tariffs, dispelling economic uncertainties and invigorating investor sentiment. Meanwhile, the U.S. Senate’s advancement of a bipartisan bill to regulate stablecoins has been warmly received, signalling a more defined and supportive framework for cryptocurrencies. Adding fuel to the rally, institutional investors have increasingly embraced Bitcoin, injecting significant momentum into its upward trajectory.

Technical signals point to sustained momentum

Market analysts highlight robust technical indicators underpinning Bitcoin’s bullish run. The 50-day Simple Moving Average (SMA) is poised to cross above the 200-day SMA, forming a “Golden Cross”—a pattern widely regarded as a harbinger of sustained upward trends. The Relative Strength Index (RSI), hovering in overbought territory, reflects intense buying pressure, further affirming market confidence. Analysts are eyeing short-term price targets of $116,000, with some speculating a potential “blow-off top” at $128,000. Looking further ahead, factoring in the expansion of global money supply (M2), projections suggest Bitcoin could climb to $132,000 by year’s end.

Ripple effects across the crypto landscape

The bullish tide lifts more than just Bitcoin. Ethereum (ETH), the second-largest cryptocurrency by market capitalisation, has risen 4.52% to trade at $2,591.09, reinforcing its pivotal role in the digital asset ecosystem. The broader cryptocurrency market has swelled to a total valuation of $3.36 trillion, with Bitcoin commanding over 60% of this figure, cementing its dominance.

A bright horizon for Bitcoin

As geopolitical tensions ease, regulatory clarity emerges, and technical indicators flash green, Bitcoin appears poised for further gains. With the market’s gaze fixed on the psychological threshold of $110,000, investors and analysts alike are closely tracking these developments, anticipating whether Bitcoin’s remarkable rally will continue to redefine the boundaries of financial possibility.