24-5-2025 – As Bitcoin (BTC) scales new peaks, shattering records with a recent high above $111,000, a wave of optimism ripples through the cryptocurrency market. TradingShot, a respected voice in trading circles, has ignited excitement with a compelling forecast: Bitcoin could soar to $200,000 by the close of 2025, a prediction rooted in meticulous analysis of historical patterns and technical indicators shared in a May 23 TradingView post.

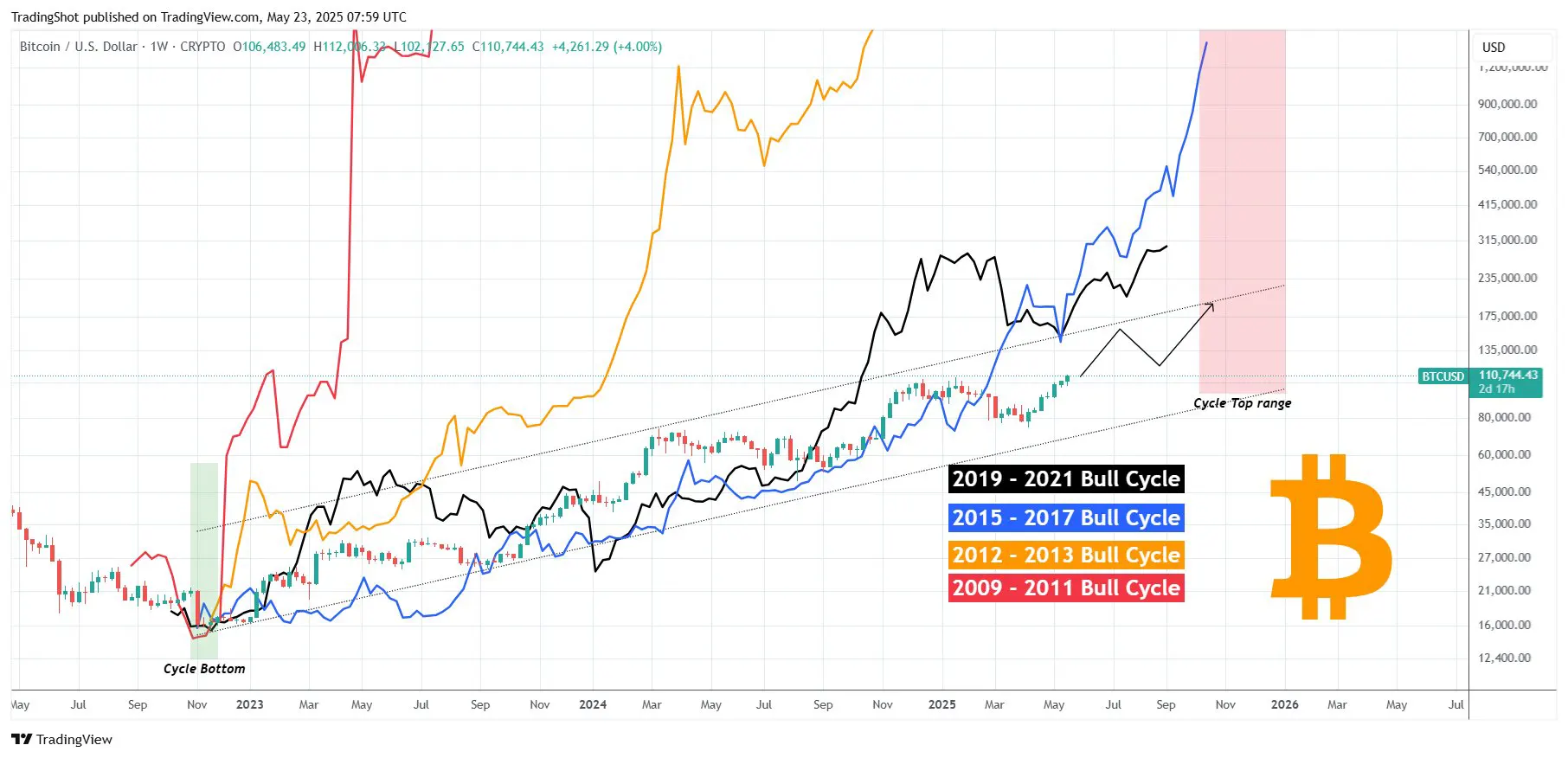

The journey of Bitcoin, as TradingShot articulates, reflects the Theory of Diminishing Returns. In its infancy, Bitcoin’s bull cycles delivered staggering gains, but as the market matures, growth has tempered, mirroring the steadier rhythms of traditional finance. By mapping Bitcoin’s past cycles—spanning 2009–2011, 2012–2013, 2015–2017, and 2019–2021—TradingShot reveals a shift from explosive surges to more measured, yet still impressive, ascents. The cycles of 2015–2017 and 2019–2021, for instance, share striking similarities, with temporary deviations eventually converging back to a consistent upward trajectory.

The current cycle, TradingShot observes, is unfolding within a well-defined upward channel. A brief divergence is anticipated around February 2025, but Bitcoin is expected to realign with its historical trend, buoyed by a robust six-week recovery. This momentum underpins TradingShot’s bold projection of a cycle peak between October and December 2025, with Bitcoin potentially reaching a price range of $150,000 to $200,000. “Timing your exit strategy can perhaps be more effective than assigning a certain target,” TradingShot advises, highlighting the importance of strategic precision in navigating this volatile ascent.

This bullish outlook is echoed by other experts. Veteran trader Peter Brandt, as reported by Finbold, points to Bitcoin’s technical formations, suggesting a climb to $150,000 by August 2025. Meanwhile, Gert van Lagen, in a May 24 post on X, underscores Bitcoin’s historical penchant for exponential growth. From its humble beginnings at $1 to its current perch above $100,000, Bitcoin has traced recurring bullish patterns, such as cup-and-handle formations. Van Lagen posits that the true peak could be three to six times higher than present levels, driven by the compounding nature of its rise.

At the time of writing, Bitcoin trades at $108,811, reflecting a 2% dip over the past 24 hours but a 5% gain over the week. The broader sentiment remains firmly bullish, with the price comfortably above the 50-day and 200-day simple moving averages, signalling a resilient upward trend.