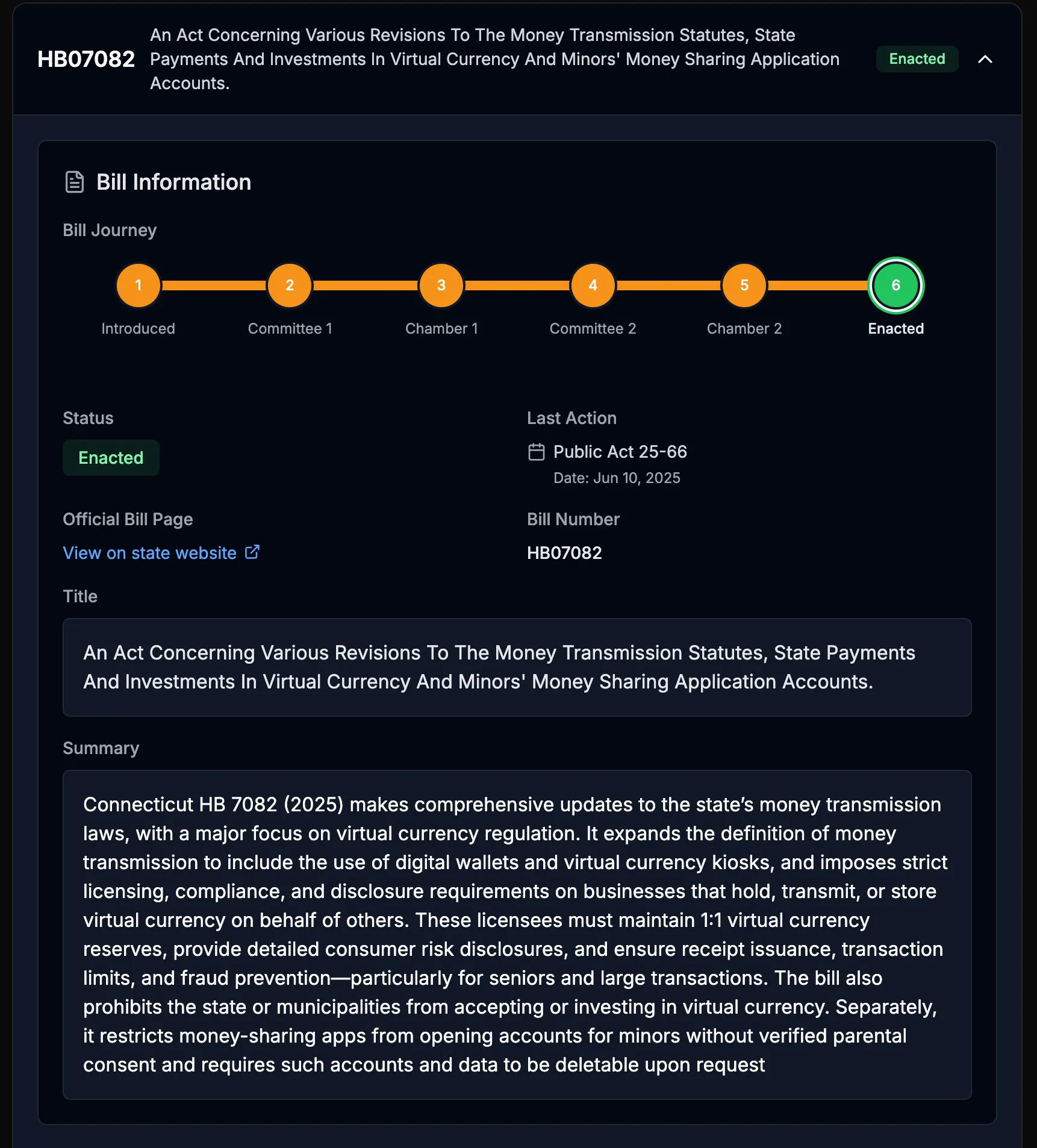

11-6-2025 – Connecticut has joined a chorus of US states firmly closing the door on state-backed cryptocurrency reserves, enacting a sweeping ban on government entities engaging with digital assets. On Tuesday, House Bill 7082, formally titled “An Act Concerning Various Revisions to the Money Transmission Statutes, State Payments and Investments in Virtual Currency,” was unanimously passed by lawmakers and signed into law, cementing the state’s stance against embracing crypto as a financial tool for public institutions.

The legislation, which garnered bipartisan support, explicitly bars Connecticut’s state and local government bodies from accepting cryptocurrency payments or investing in digital assets. It also unequivocally prohibits the establishment of a state cryptocurrency reserve, placing Connecticut among a select group of US states taking a resolute stand against such initiatives. The bill’s passage, marked by 148 votes in favour and only three abstentions, reflects a rare unity in the state’s legislature, driven in part by the Democratic Party’s commanding majority and its broader scepticism of digital currencies, particularly in light of President Donald Trump’s association with memecoins.

Introduced in February 2025 by the joint committee on banking, the bill was championed by Democratic lawmakers, including State Representative Ken Gucker and Senators Patricia Miller and Matthew Lesser. Since its initial vote in May, where it secured 105 votes in the House against 42 dissenters, the proposal has sailed through with overwhelming support. Some observers attribute this momentum to political posturing, noting the Democratic Party’s criticism of Trump’s involvement in digital assets, including a related federal proposal, the Modern Emoluments and Malfeasance Enforcement Act (MEME Act), aimed at curbing officials’ profiteering from memecoins.

However, the ban has sparked debate among industry voices. Aaron Brogan, founder of Brogan Law, dismissed the legislation as largely symbolic, arguing it “does nothing of substance” by prohibiting activities that were not occurring in the first place. Speaking to Cointelegraph, Brogan suggested the move signals Connecticut’s opposition to cryptocurrency innovation, potentially alienating states that have embraced Bitcoin reserves. He also flagged additional disclosure requirements for private-sector money transmitters embedded in the bill, warning they could impose costly compliance burdens akin to California’s privacy laws.

Connecticut’s decision aligns with a broader trend among US states rejecting strategic Bitcoin reserves (SBRs). According to Bitcoin Laws, 31 SBR bills have been proposed nationwide, spurred by the Trump administration’s pro-crypto stance, yet several states have pushed back. In February, Montana, Wyoming, North Dakota, South Dakota, and Pennsylvania quashed similar proposals, while Utah’s Senate amended a Bitcoin bill in March to strip out provisions for state investment. Oklahoma followed suit in April, with its Senate Revenue and Taxation Committee narrowly rejecting an SBR bill, and in May, Florida postponed its SBR proposal indefinitely, while Arizona’s governor vetoed two crypto-related bills.

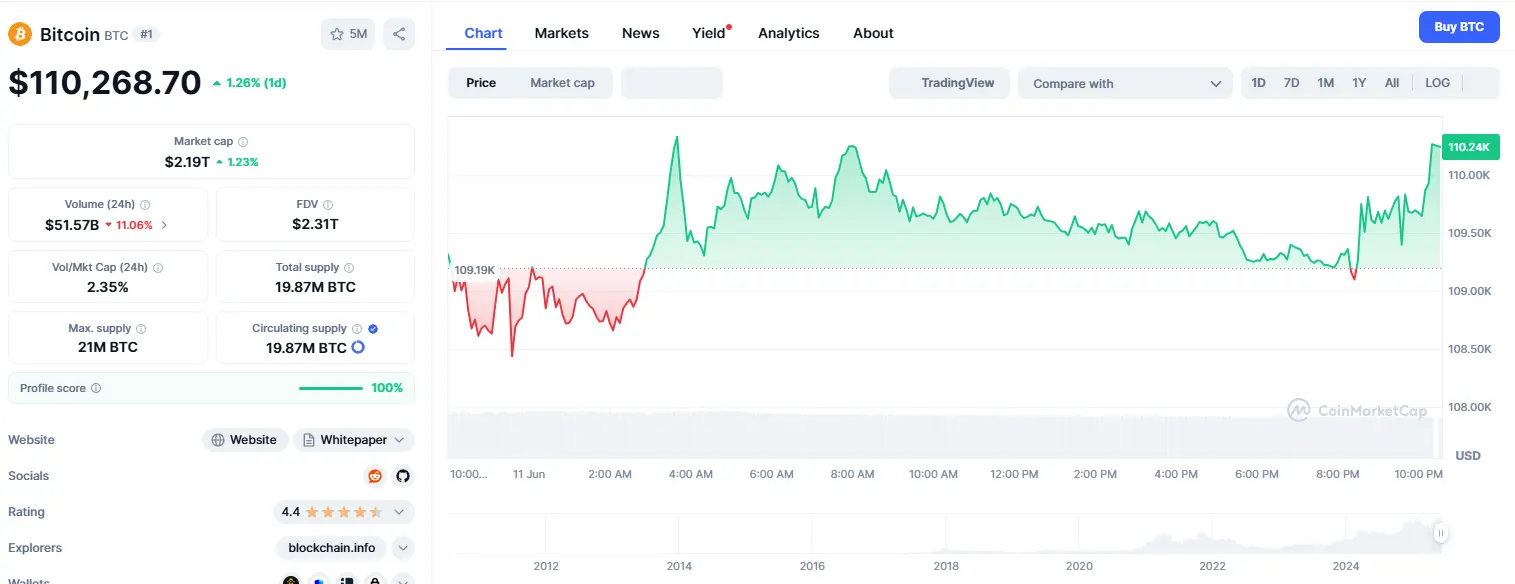

Critics of Connecticut’s ban argue it may stifle innovation amid a volatile but rapidly evolving crypto landscape, where Bitcoin’s value recently stood at $110,279. Supporters, however, view it as a prudent safeguard against regulatory and financial uncertainties. As the law awaits the governor’s final signature, Connecticut has drawn a clear line in the sand, prioritising caution over the transformative potential of digital currencies, even as the global race for crypto integration intensifies.