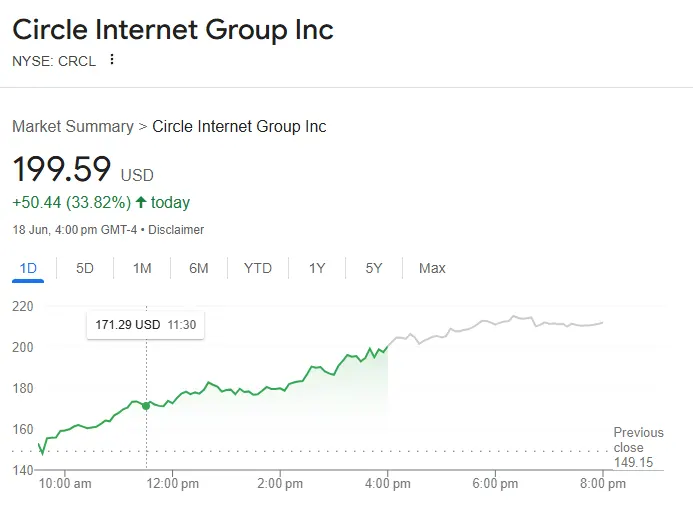

In a dazzling display of market momentum, Circle Internet Group (CRCL), the issuer of the prominent stablecoin USDC, has seen its share price soar in the fortnight following its initial public offering on 5 June 2025. Closing at $199.59 on Wednesday, the stock marked a remarkable 33.8% climb from its opening price of $153.22, with trading volumes hitting an unprecedented 63.5 million shares, as reported by Yahoo Finance.

The upward trajectory persisted, with a further 6% gain in after-hours trading, underscoring robust investor enthusiasm. Since its debut at $31, CRCL’s stock has skyrocketed by approximately 530%, a surge that some attribute to the recent passage of the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act in the Senate on Tuesday. This landmark legislation, aimed at establishing a comprehensive regulatory framework for stablecoins, now awaits approval in the House of Representatives, with President Donald Trump publicly pressing for its swift passage.

The ripple effects of the GENIUS Act have also buoyed other crypto players, notably Coinbase, which enjoyed a 16% stock price increase on the same day. Circle’s stellar performance reflects a broader resurgence of confidence in stablecoins, which have increasingly captured the attention of major banks and tech giants in 2025. This optimism may herald a fertile market for other cryptocurrency firms, such as Gemini and Kraken, both reportedly eyeing public listings next year.

As the issuer of USDC—the second-largest USD-pegged stablecoin with a market capitalisation of $61.4 billion, commanding 25% of the $243 billion stablecoin market, per The Block’s Data Dashboard—Circle’s meteoric rise signals a pivotal moment for the digital asset landscape, with investors betting on the enduring potential of regulated cryptocurrencies.