23-6-2025 – The digital asset ADA has encountered considerable headwinds throughout recent trading sessions, with market sentiment remaining decidedly pessimistic towards the blockchain platform’s native token. Current market dynamics suggest that any potential recovery attempts may face substantial resistance from profit-taking activities.

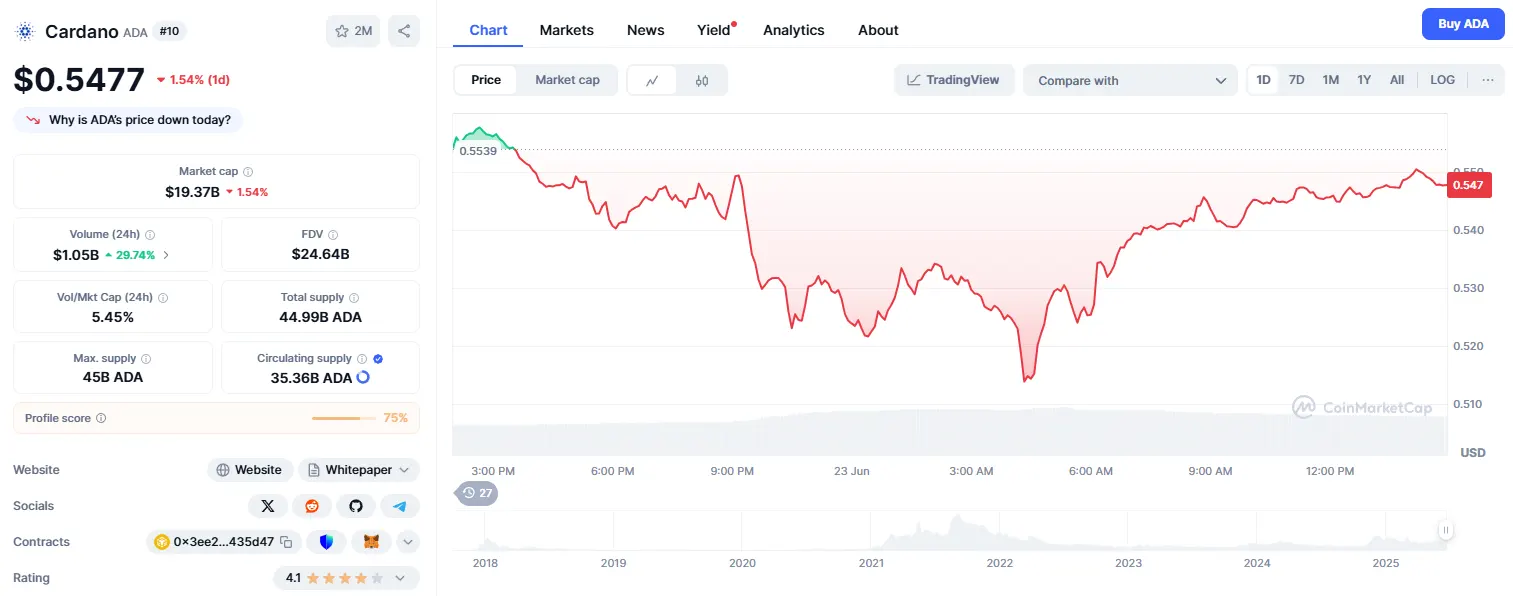

Cardano is currently trading at approximately $0.5477, reflecting a modest intraday decline as selling pressure continues to dominate short-term price movements. Technical analysis reveals that the cryptocurrency remains precariously positioned above a crucial demand zone, which has served as a temporary buffer against further downside momentum.

The broader cryptocurrency market’s performance during the spring months had initially provided some optimism for ADA holders. When Bitcoin experienced its remarkable surge from $76,000 to peak levels above $111,000, Cardano demonstrated resilience by recording gains of approximately 46%. However, this rally merely restored the token to previous range lows, highlighting the underlying weakness in ADA’s market structure.

Development and network activity slows

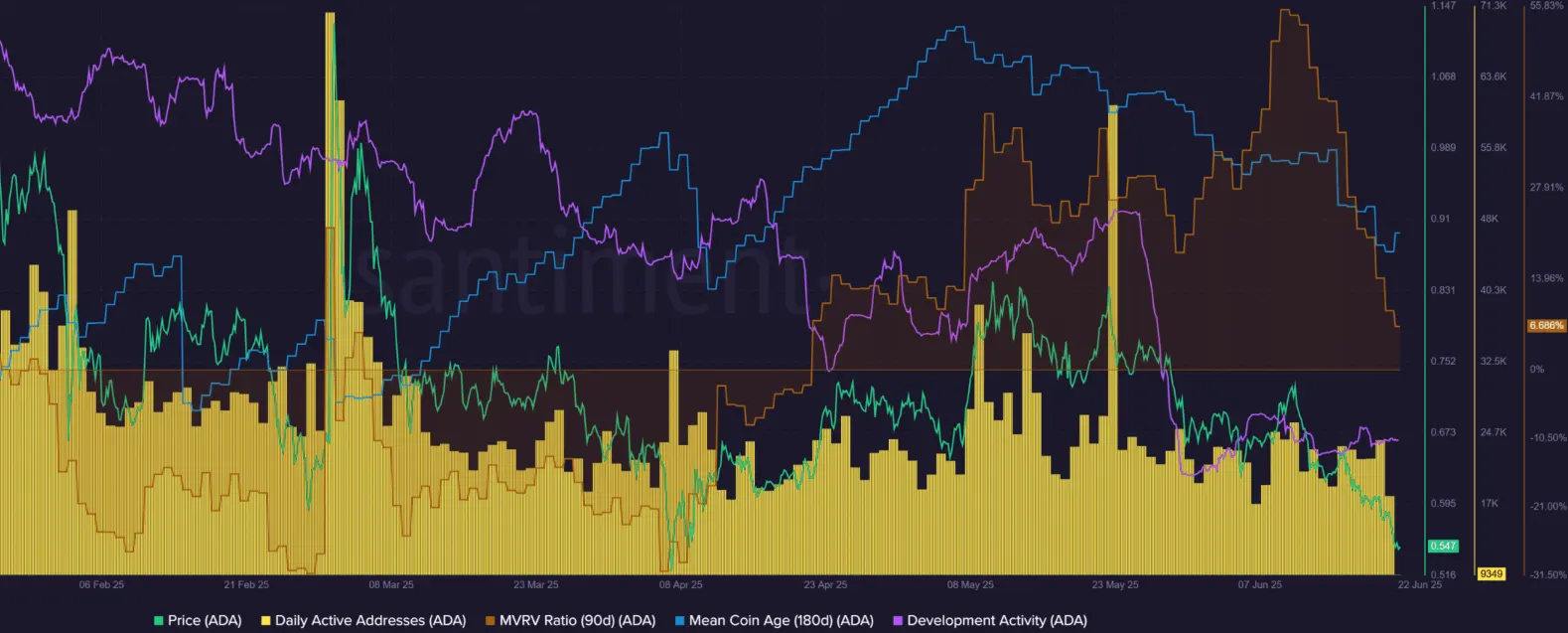

Market intelligence indicates that developmental activity surrounding the Cardano ecosystem has experienced a notable decline since February, presenting concerns for institutional and long-term investors who rely on consistent network improvements and innovation. This reduction in development momentum coincides with relatively stable daily active addresses, suggesting that while user engagement remains steady, the pace of technological advancement has decelerated.

The 90-day Market Value to Realised Value (MVRV) ratio has maintained positive territory for nearly two months, initially following Cardano’s recovery from $0.57 levels in April. This metric subsequently climbed as the token reached $0.8 by mid-May, with another swift bounce from $0.65 to $0.72 contributing to the ratio’s elevation.

However, beneath these superficially encouraging metrics lies a more complex narrative. The proportion of holders maintaining profitable positions has been declining rapidly, indicating that any bullish attempts to drive prices higher would likely encounter significant selling pressure as investors seek to exit positions at break-even points or marginal profits.

Network-wide distribution patterns, as evidenced by the declining mean coin age metric, further reinforce the bearish outlook. This trend suggests widespread selling activity across the Cardano network, a pattern that would require reversal before any sustainable recovery could materialise.

Key levels to watch: Resistance and support

The market structure experienced a decisive bearish shift on 30 May, when ADA breached the critical $0.71 support level. Technical analysis suggests that the immediate downside target lies at $0.51, with a potential break below this level opening the door for further declines towards $0.427 support.

Short-term forecasts indicate that if ADA loses the $0.620–$0.613 support range, further downside toward $0.600 or even $0.584 becomes likely, though analysts note that a bounce from current levels could potentially trigger a retest of higher resistance zones.

At present, the strength of selling forces appears to overwhelm any nascent bullish sentiment. While the formation of a short-term trading range might signal an early bottom formation, such consolidation would require accompanying increases in demand metrics, particularly an upward trend in mean coin age, to validate any potential reversal.

The current market environment presents limited opportunities for immediate bullish recovery, with technical indicators suggesting that sellers maintain firm control over price action. Any meaningful turnaround would likely require not only technical improvements but also renewed confidence in Cardano’s developmental trajectory and ecosystem growth.