26-6-2025 – Bitcoin has displayed remarkable fortitude amid the recent flare-up of tensions between Iran and Israel, climbing towards its record peak of $111,970, while the US dollar, typically a bastion in times of geopolitical strife, has faltered. According to CoinMarketCap, Bitcoin traded at $107,930 as markets absorbed the news, rebounding swiftly after a fleeting drop below $100,000 on Sunday—the first such dip since early May. This recovery followed a delicate ceasefire brokered by US President Donald Trump on Monday, which steadied the cryptocurrency’s course.

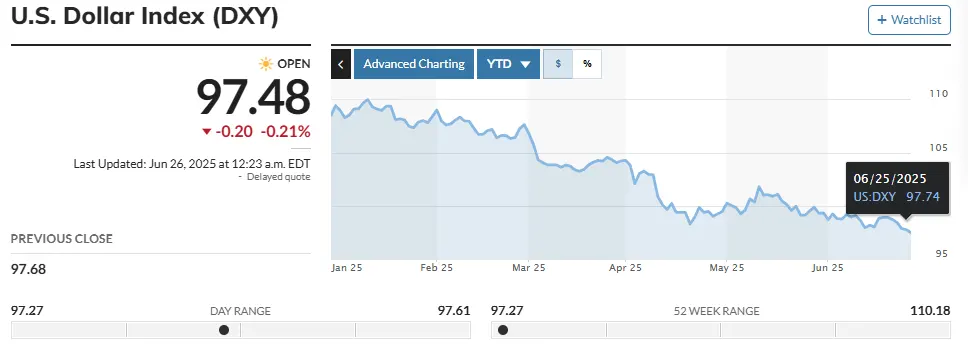

Dollar index hits three-year low

In contrast, the US Dollar Index (DXY), which gauges the dollar’s vigour against a basket of major global currencies, has slumped to its lowest ebb since February 2022, languishing at 97.50, per Marketwatch data. This level mirrors the index’s position on June 13, when Israel’s airstrikes on Iran first intensified hostilities. Macroeconomist Lyn Alden noted in a Wednesday post that the dollar has shown scant signs of its customary safe-haven appeal, remarking that the DXY is “dabbling in new cycle lows” with little uplift from recent global uncertainties.

Analysts: “Fiat Is fading” as crypto takes the lead

Crypto analyst Jamie Coutts of Real Vision has been more forthright, declaring that “fiat is fading” as Bitcoin and other digital assets gain traction. Coutts draws parallels with the early 2000s, a period when a depreciating dollar spurred investment into emerging markets and commodities. “Between 2002 and 2008, a weakening dollar ignited a surge in emerging market equities and commodities, with the former outpacing developed markets threefold,” he observed. Coutts argues that cryptocurrencies now represent the modern equivalent of those high-growth markets, stating, “Capital is flowing to where the dynamism lies, and crypto is today’s emerging market.”

Historically, geopolitical shocks like October 2024’s Iranian missile barrage on Israeli targets would prompt investors to seek refuge in the dollar or government bonds, shunning volatile assets like cryptocurrencies. That month, the DXY surged by 2.67%. Yet, the current conflict has defied such expectations, with Bitcoin shrugging off risk-averse sentiment. Crypto analyst Matthew Hyland remarked that “bulls are firmly in the saddle,” while Rekt Capital highlighted Bitcoin’s ability to break two consecutive two-week downtrends over the past month, underscoring its resilience.