18-7-2025 – After eight years of being dismissed as “just another crypto,” Ethereum is having its institutional moment—and it’s about time the rest of us acknowledged what the smart money already figured out.

BlackRock’s reported $34.7 million Ethereum purchase on June 6, 2025, following 14 consecutive days of Ethereum ETF inflows isn’t just another headline in the crypto news cycle. It’s the clearest signal yet that institutional investors have moved beyond Bitcoin curiosity into serious Ethereum conviction. Institutional investors now allocate approximately 67% of their portfolios to Bitcoin and Ethereum, compared to just 37% for retail investors, according to Wintermute’s latest OTC Market Report. This isn’t speculation anymore—it’s portfolio allocation strategy.

The numbers tell a story that should resonate with anyone who lived through the dot-com boom and bust. Ether ETFs have seen two consecutive months of net inflows, with these funds now managing around $11 billion in assets. Sure, that’s still modest compared to Bitcoin’s $138 billion, but remember when Amazon was “just another online bookstore” competing with Barnes & Noble’s massive physical footprint? Sometimes the most transformative shifts start quietly.

The infrastructure play that changes everything

What’s happening with Ethereum isn’t just about price appreciation—it’s about fundamental infrastructure adoption. BlackRock, Deutsche Bank, Coinbase, and Kraken are all building directly on Ethereum’s rails, with Robinhood becoming the first public U.S. company to launch tokenized stocks on-chain using Ethereum’s Arbitrum network. This is the kind of institutional commitment that creates lasting value, not speculative bubbles.

For those of us who remember the early internet, this feels familiar. In 1995, skeptics questioned whether businesses would ever really need websites. By 2000, having a web presence wasn’t innovative—it was essential. We’re seeing the same pattern with Ethereum’s blockchain infrastructure. Companies aren’t just buying ETH as a speculative asset; they’re building their future business models on Ethereum’s foundation.

The parallel to our generation’s experience with technology adoption is striking. We witnessed the transition from dial-up to broadband, from physical media to streaming, from brick-and-mortar to e-commerce. Each time, the winners weren’t necessarily the first movers, but the platforms that provided the most reliable, scalable infrastructure. Ethereum is positioning itself as that infrastructure layer for the next phase of digital finance.

Why this time really is different

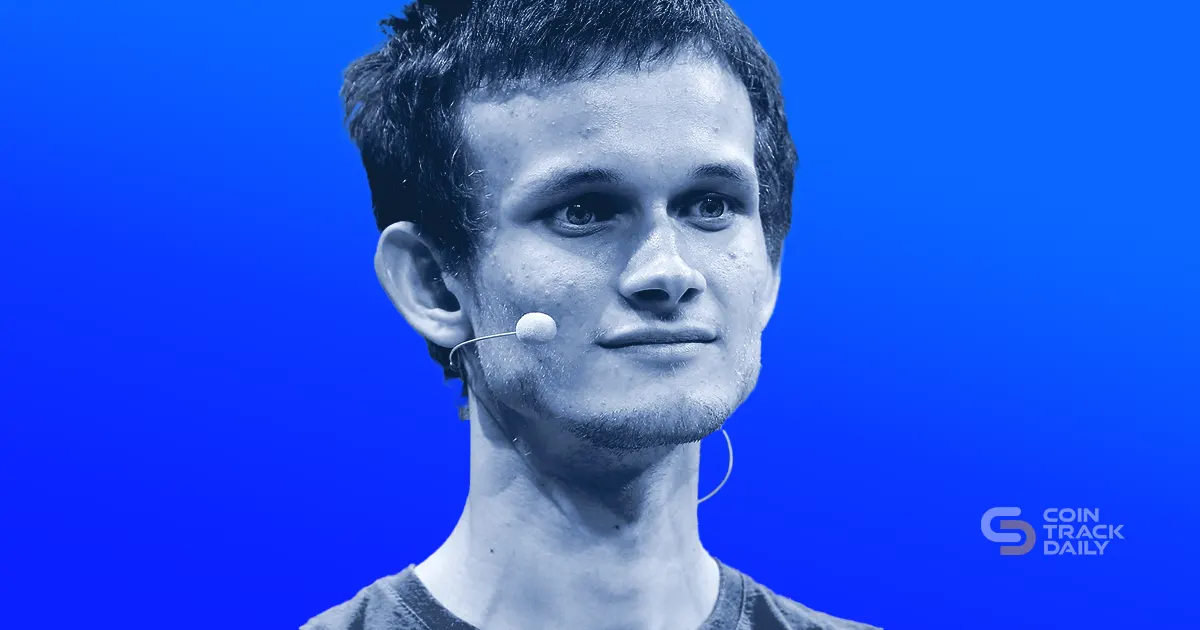

The institutional adoption we’re seeing now is fundamentally different from the retail-driven hype cycles of 2017 and 2021. During EthCC 2025, Ethereum’s co-founder Vitalik Buterin emphasized the network’s stability and dependability as key reasons for institutional adoption. This isn’t about meme coins or NFT speculation—it’s about boring, reliable infrastructure that Fortune 500 companies can build on.

The maturation is evident in the numbers. Over 1,400 previously active tokens have disappeared in 2025, signaling a market cleanse that leaves only the most resilient projects. This winnowing process mirrors what happened to dot-com companies after 2000—the survivors became the foundation of today’s digital economy.

For Gen X and older millennials, this institutional validation should feel like vindication. We’ve been through enough boom-bust cycles to recognize the difference between speculation and genuine technological adoption. The current Ethereum momentum has the hallmarks of the latter: steady institutional accumulation, infrastructure development, and real-world utility rather than retail FOMO.

The counterargument worth considering

Skeptics will point out that institutional adoption doesn’t guarantee success. They’ll remind us that even blue-chip companies made disastrous tech investments during the dot-com era. They’re not wrong—institutional money isn’t infallible, and the crypto space remains volatile and unpredictable.

But here’s what’s different: the institutions investing in Ethereum today aren’t speculating on revolutionary technology—they’re implementing it. When Deutsche Bank builds on Ethereum or BlackRock creates tokenized products, they’re not making bets on future possibilities. They’re responding to current market demand and regulatory clarity that didn’t exist in previous cycles.

The risk isn’t that Ethereum will fail to deliver on its promises—it’s already delivering. The risk is that we’ll overthink ourselves out of recognizing a generational shift when it’s happening.

The long view for patient capital

Ethereum ETFs recorded inflows exceeding $4.3 billion, solidifying ETH’s position as a preferred institutional investment. This institutional backing provides the price stability and growth trajectory that long-term holders need. For those of us approaching or in our peak earning years, this represents an opportunity to allocate capital toward infrastructure that will likely define the next decade of financial innovation.

The smart money isn’t just buying Ethereum it’s building on it. That’s the kind of commitment that creates lasting value, not speculative bubbles. As the institutional adoption curve accelerates, individual investors who understand this shift have a chance to position themselves alongside the world’s most sophisticated financial players.

The question isn’t whether Ethereum will succeed the infrastructure momentum suggests it already has. The question is whether we’ll recognize the opportunity while it’s still unfolding, or whether we’ll wait for mainstream acknowledgment when the best returns are already behind us.

For a generation that lived through the internet’s transformation from curiosity to necessity, this moment should feel familiar. The infrastructure is being built. The institutions are committing capital. The only question left is whether we’ll be part of the next chapter or watching from the sidelines.