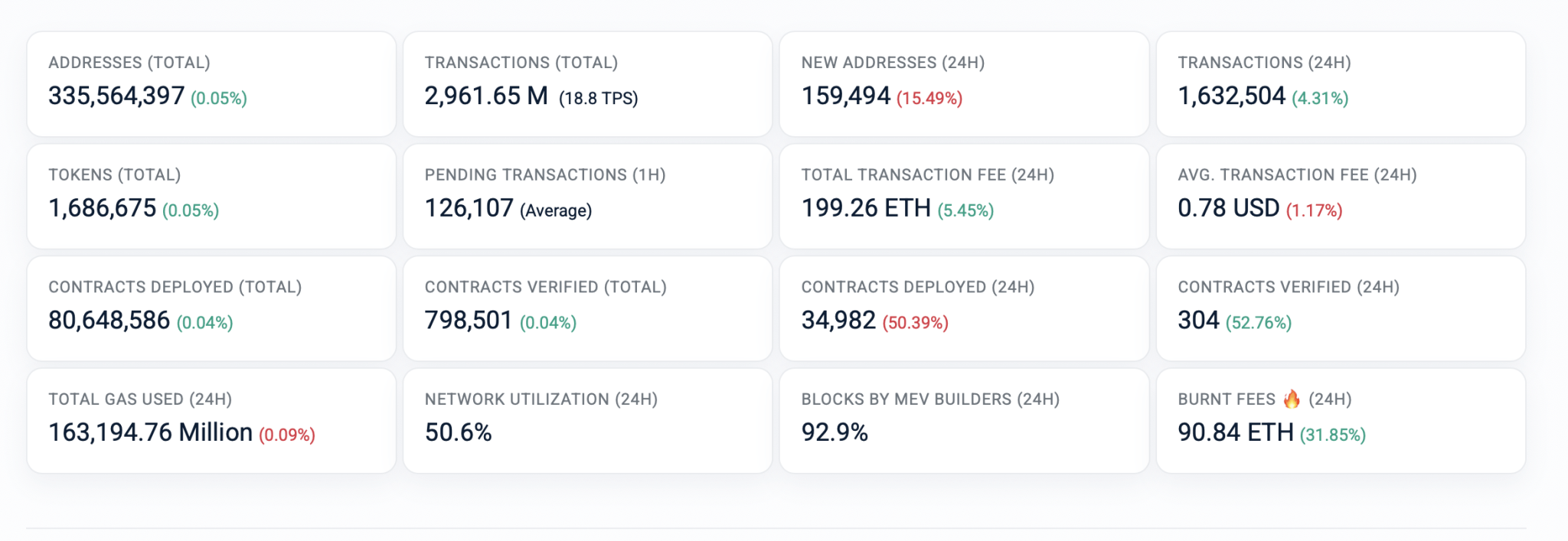

28-8-2025 – Ethereum’s network demonstrated resilience in recent data, processing 1.63 million transactions over the last 24 hours while keeping average fees at $0.78, signaling efficient operations despite market fluctuations. This stability reflects Ethereum’s ongoing health, with a base fee averaging 16.3 gwei in the past week and network utilization at 50.6%. Cumulative transactions have surpassed 2.96 billion since inception, and daily new addresses reached 159,494, underscoring consistent user engagement in DeFi and NFTs.

Leading fee burns from platforms like Uniswap V2 and OpenSea highlight robust activity in decentralized applications, even as total supply edges toward 121 million ETH with modest net issuance. Adding to the positive outlook, VanEck CEO Jan van Eck described Ethereum as the “Wall Street token,” predicting its dominance in stablecoin adoption by banks.

In a recent interview, he emphasized that financial firms must integrate stablecoin capabilities, stating, “The winner is going to be Ethereum or something that uses Ethereum kind of methodology.” This comes as stablecoin supply exceeds $280 billion and Ethereum’s price hovers near $4,566 following an all-time high above $4,900 earlier this month. VanEck’s Ether ETF, approved in July 2024, now holds over $284 million in assets.

Market observers should track Ethereum’s response to regulatory shifts like the U.S. Genius Act for potential impacts on institutional inflows.