13-6-2025 – The cryptocurrency market, often a theatre of dizzying volatility, has seen altcoins languish in the shadow of Bitcoin’s dominance, though glimmers of promise flicker among select assets. Solana (SOL) and Hyperliquid (HYPE) have defied the trend, soaring to unprecedented peaks, yet the broader altcoin landscape remains subdued. The CoinMarketCap Altcoin Season Index, sitting at a modest 29/100, signals that liquidity continues to favour Bitcoin, leaving most altcoins starved of momentum. Yet, beneath this apparent inertia, subtle market dynamics hint at a potential shift—one that could herald the next altcoin surge.

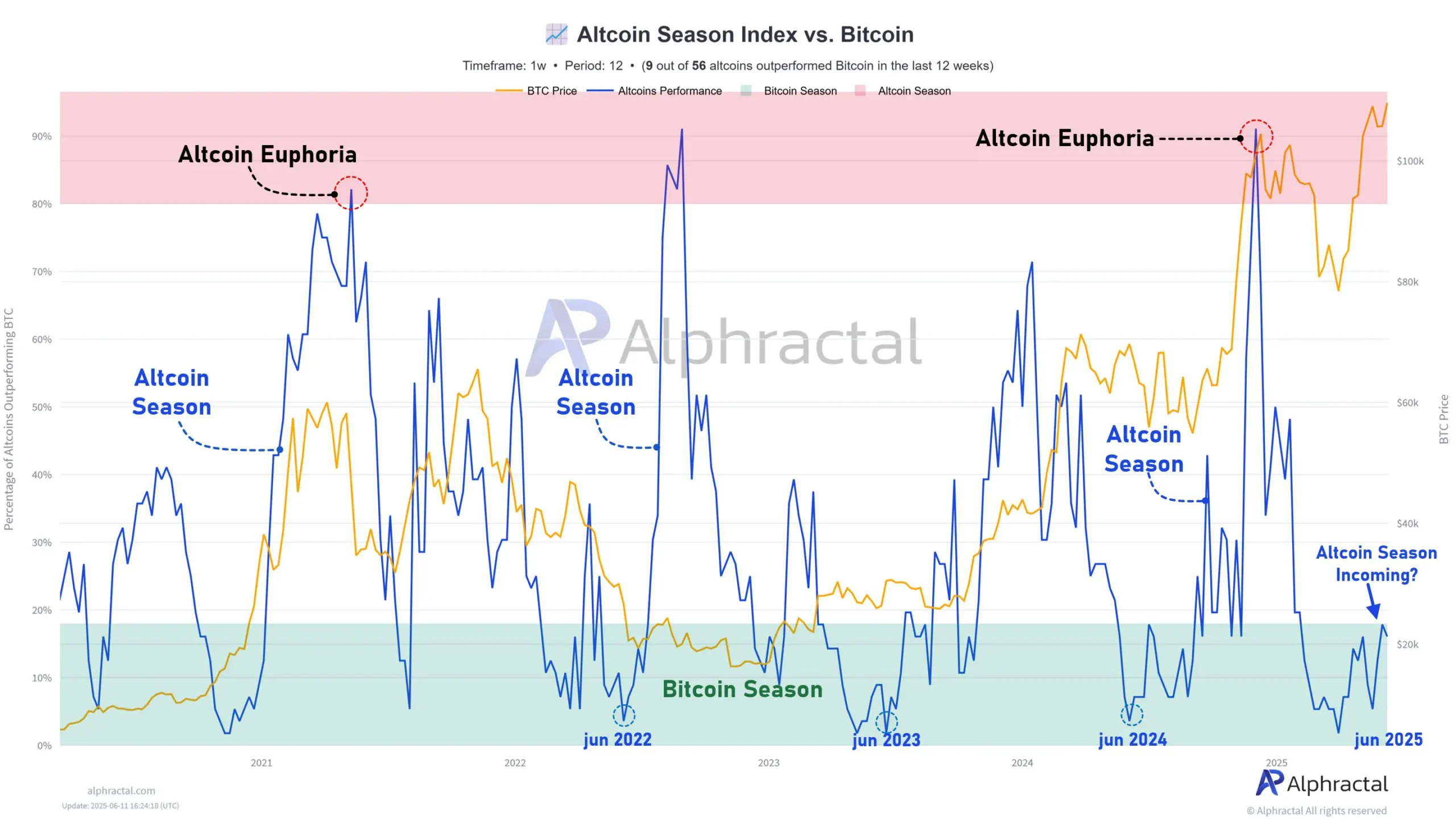

Historical patterns offer a roadmap for what might lie ahead. Analysis from Alphractal, overlaying the Altcoin Season Index against Bitcoin’s price movements on a weekly chart, reveals a telling pattern: altcoin rallies often ignite when Bitcoin’s bullish charge falters, settling into a range-bound phase. Alternatively, significant Bitcoin declines or historic lows can also spark altcoin activity, though such rallies tend to be tepid, with only about 20% of altcoins posting notable gains in these conditions. The more potent catalyst, historically, is Bitcoin’s post-rally consolidation, which has driven roughly 80% of altcoins to surge.

Currently, the market lingers in what analysts describe as an accumulation zone—a phase marked by volatility where altcoins can either rocket or plummet, often hinging on Bitcoin’s next move. Since 2022, altcoin seasons have frequently kicked off in June, a trend that suggests 2025 could follow suit. Already, 23% of altcoins have outpaced Bitcoin over the past three months, hinting at early stirrings of momentum. Yet, caution is warranted: since 2019, only the 2021 altcoin season delivered outsized returns. Subsequent cycles have been muted, and the next may follow this restrained pattern unless a significant catalyst emerges.

Liquidity could be that spark. In the first quarter of 2025, $3.8 billion flooded into the crypto ecosystem—the highest influx since mid-2022—fuelling speculation of a potential rally reminiscent of 2019’s altcoin boom. However, second-quarter inflows have tapered, tempering optimism. Should capital flows rebound, the stage could be set for a more robust altseason. For now, the market remains poised on a precipice, with conditions ripening for a shift.