25-6-2025 – The Bank for International Settlements (BIS), often dubbed the “central bank for central banks,” has declared that stablecoins—digital assets tethered to fiat currencies—fall short of qualifying as true money. A meticulously crafted report, unveiled on Tuesday, asserts that these assets falter against three pivotal benchmarks essential for a robust monetary framework: singleness, elasticity, and integrity.

Stablecoins fall short of core monetary principles, says BIS

The BIS authors underscore that stablecoins, such as Tether’s USDT, face inherent limitations due to their design. Unlike central bank reserves, which can expand or contract to meet economic demands, stablecoins require full upfront payment for issuance, imposing a rigid “cash-in-advance” constraint that stifles elasticity. Moreover, the notion of “singleness”—where money issued by various institutions is universally accepted without question—is undermined by the centralised nature of stablecoin issuers. Each issuer operates with distinct standards, leading to assets that may trade at fluctuating exchange rates, reminiscent of the fragmented private banknotes of 19th-century America’s Free Banking era.

Integrity, the third pillar, also proves elusive. The report highlights that not all stablecoin issuers adhere to stringent anti-money laundering (AML) or know-your-customer (KYC) protocols, raising concerns about their vulnerability to financial crime. The BIS warns that widespread adoption could erode governmental monetary sovereignty, potentially through “stealth dollarisation,” and exacerbate risks to global financial stability.

Acknowledging the appeal: Cross-border utility and crypto On-ramps

Yet, the BIS acknowledges the allure of stablecoins. Their programmability, pseudonymity, and accessibility offer undeniable advantages, particularly in regions grappling with high inflation, capital controls, or restricted access to dollar accounts. For cross-border payments, their technological edge promises swifter transactions and reduced costs. Stablecoins also serve as vital conduits for entering and exiting the cryptocurrency ecosystem, cementing their niche in the financial landscape.

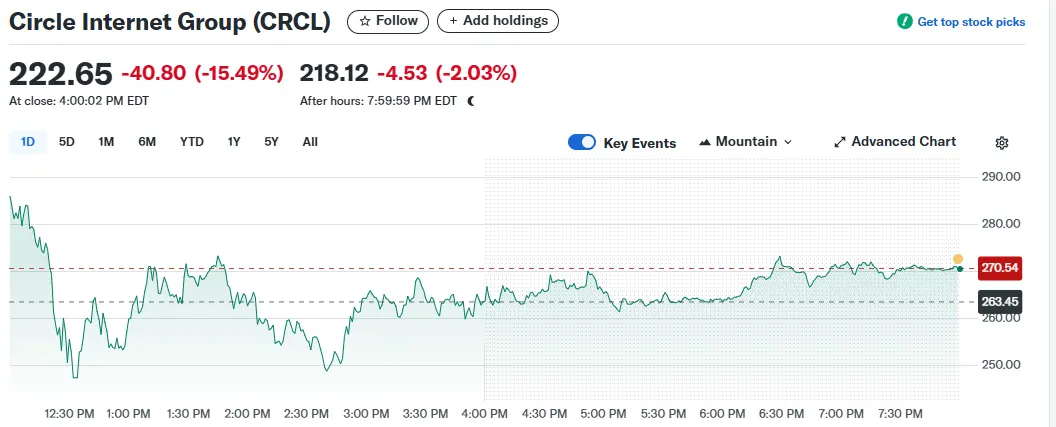

Despite these merits, the BIS firmly contends that stablecoins cannot supplant traditional cash or serve as the cornerstone of tomorrow’s monetary system. Their role, while significant, remains peripheral. The report’s publication coincided with a sharp market reaction: Circle, the issuer of USDC, saw its shares plummet by over 15% on Tuesday, a stark contrast to Monday’s record high of $299, a meteoric rise from its IPO price of approximately $32.

Tokenisation: BIS sees promise in the underlying technology

Looking ahead, the BIS strikes an optimistic note on tokenisation, heralding it as a “transformative innovation” with the potential to revolutionise everything from international payments to securities markets. Platforms anchored by central bank reserves, commercial bank money, and government bonds could pave the way for a next-generation financial system, the authors suggest. While stablecoins may not claim the mantle of money, their underlying technology hints at a future where digitised assets reshape global finance.