12-6-2025 – Bitcoin’s meteoric ascent beyond $110,000 multiple times this week has ignited a wave of optimism across the cryptocurrency landscape, propelling market sentiment to its most bullish state in seven months. According to crypto analytics firm Santiment, this fervour mirrors the exuberance last witnessed in the wake of US President Donald Trump’s election victory on November 6, when Bitcoin first shattered the $70,000 ceiling.

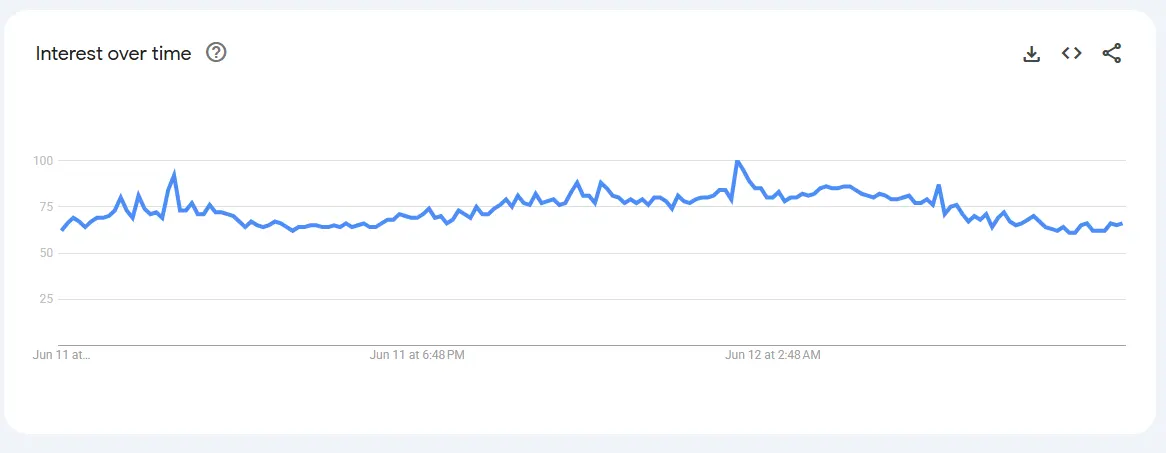

Social media platforms, including X, Reddit, Telegram, and others tracked by Santiment, are abuzz with positivity, registering a striking ratio of 2.12 positive Bitcoin comments for every negative one as of June 11. This surge in enthusiasm, with 504.54 positive remarks outweighing 237.71 negative ones, underscores a renewed zeal among retail investors, who Santiment notes have “gotten bullish” as Bitcoin repeatedly breached the $110,000 mark.

Despite this social media euphoria, broader retail engagement remains subdued compared to historical peaks. Google Trends data reveals that search interest in “Bitcoin” lingers at a modest 32 out of 100 relative to its 12-month high during the week of November 10-16, when Bitcoin soared 18.6% to eclipse $90,000 for the first time.

Even more starkly, current search interest pales at 19 out of 100 compared to its zenith in late 2017, suggesting retail investors have yet to fully rekindle their fascination with the cryptocurrency. Instead, Bitcoin’s recent price surges, which saw it peak at an all-time high of $112,000 on May 22 before settling at $108,635—a 3% dip—have largely been driven by institutional and nation-state adoption.

The Crypto Fear & Greed Index further corroborates this bullish tide, placing market sentiment firmly in the “greed” zone with a score of 71 out of 100. While robust, this figure falls short of the near-euphoric 94 out of 100 recorded on November 22, when Bitcoin’s price catapulted from a monthly low of $67,700 to $99,250, buoyed by Trump’s election triumph.