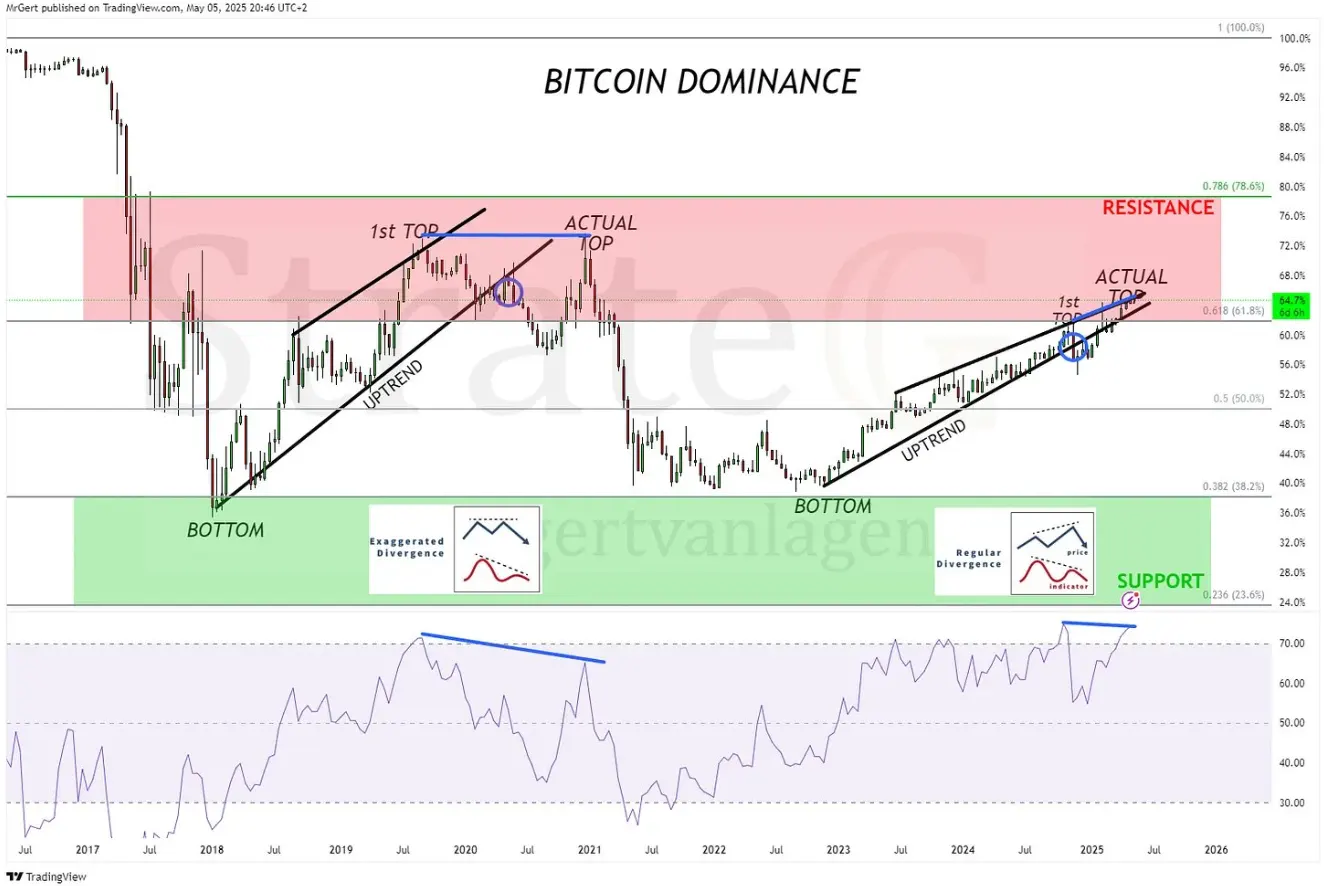

7-5-2025 – Bitcoin’s grip on the cryptocurrency market, now commanding a 57.64% share, teeters at a critical juncture, brushing against a formidable long-term resistance zone. Technical analyst Gert van Lagen, in a detailed study released on 5 May 2025, draws striking parallels between today’s market structure and a pivotal moment in 2021 that foreshadowed a dramatic shift. Back then, a comparable setup culminated in a sharp retreat for Bitcoin’s dominance, paving the way for alternative cryptocurrencies to seize the spotlight.

The current chart paints a vivid picture: Bitcoin’s market share is carving out a rising wedge, a formation often heralded as a precursor to bearish reversals. This pattern echoes a similar wedge that spanned 2018 to 2021, which ultimately fractured, unleashing a vibrant altcoin season. Van Lagen’s analysis highlights a recurring motif—price action marked by an initial peak followed by a definitive summit. Today’s market appears to mirror this, with resistance stubbornly holding at the 0.618 Fibonacci retracement level, aligning with the 57.64% dominance mark. This level sits within a multi-year red zone above 57%, a ceiling that has repeatedly repelled upward moves, casting a shadow over Bitcoin’s prospects.

Compounding the cautionary signals, the Relative Strength Index (RSI) reveals a stark bearish divergence. While Bitcoin’s dominance climbs to loftier highs, the RSI traces a downward trajectory, forming lower peaks. This mismatch, strikingly reminiscent of the pronounced divergence that preceded the 2021 dominance plunge, suggests momentum is waning. Van Lagen notes the eerie similarity to that earlier cycle, where an exaggerated RSI divergence heralded a swift pivot to altcoins. Blue lines on the updated chart underscore this divergence, mapping the disconnect between price trends and RSI signals.

Historical patterns offer further clues. Past reversals have seen dominance tumble to support levels near 40% and 32%, zones that could serve as targets if the current structure falters. With Bitcoin’s market share now testing its third major peak since 2017, the confluence of a rising wedge, RSI divergence, and unyielding resistance paints a precarious picture. Analysts speculate that a breakdown could redirect capital and enthusiasm toward altcoins, potentially igniting a new altseason.