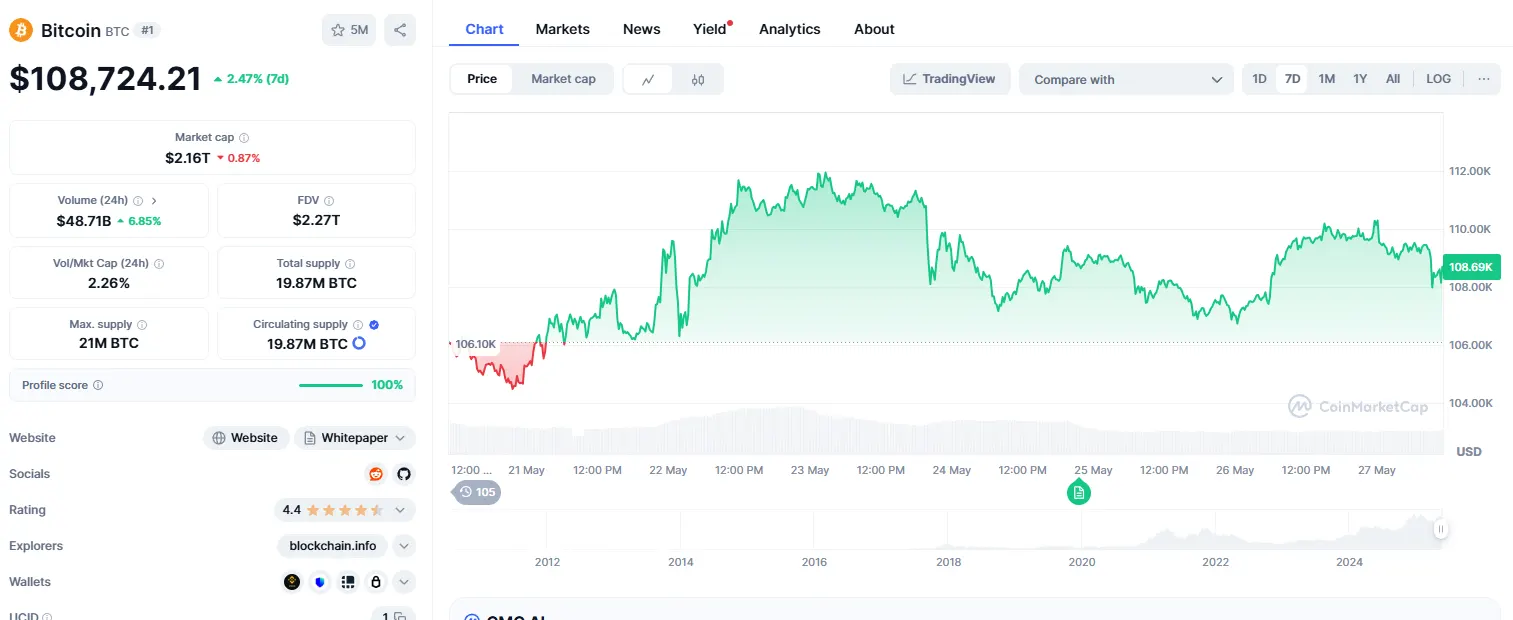

27-5-2025 – Bitcoin’s relentless ascent persists, its value steadfast just shy of $110,000, a testament to its unyielding momentum in recent weeks. The cryptocurrency has deftly transformed a once formidable barrier at $103,000 into a robust foundation, setting the stage for a bullish surge that captures the imagination of investors. With sights now fixed on the $115,000 horizon, the market’s architecture suggests a potent upward thrust is imminent.

Technical indicators lend further credence to this optimistic outlook. The emergence of a golden cross—where the 50-day exponential moving average gracefully surpasses its 200-day counterpart—heralds a shift from bearish shadows to a prolonged bullish dawn. This revered signal, long cherished by traders, often marks the genesis of sustained rallies, hinting that Bitcoin’s current trajectory may only be in its infancy.

Market dynamics, as reflected in volume trends and the Relative Strength Index (RSI), reveal a landscape far from overheated. Hovering just below the 70 mark, the RSI suggests ample room for further gains before the asset ventures into overbought territory. This measured ascent underscores a market poised for growth without the recklessness of irrational exuberance.

While the $115,000 target looms large, Bitcoin’s history of shattering ambitious milestones fuels confidence in its attainability. The cryptocurrency’s structural resilience, coupled with its decisive breach of previous resistance, fuels speculation of a new all-time high in the months ahead. Though brief pauses in its climb may occur, the confluence of technical strength and buoyant market sentiment firmly tilts the scales toward continued gains. Traders would be wise to monitor the short-term trendline anchoring this rally and the critical support zone near $103,000, both pivotal in charting Bitcoin’s next chapter.