16-6-2025 – Bitcoin (BTC) is carving a path of newfound resilience, underpinned by a seismic shift towards steadfast long-term ownership, as market dynamics tilt decisively in favour of those holding for the future. Data paints a vivid picture: whale inflows have plummeted to their lowest ebb since 2024, while retail investor activity has similarly dwindled to levels unseen in over a year. This convergence of restraint among both institutional and individual players signals a collective resolve to cling to Bitcoin rather than cash out, forging a robust foundation for its market stability.

Brazil’s bold proposal: A tax-free future for Bitcoin?

The bullish undercurrent is amplified by developments in Brazil, where a bold legislative proposal could reshape the cryptocurrency landscape. Congressman Biondini has tabled a bill to abolish capital gains taxes on Bitcoin transactions, a move that, if enacted, could catapult Brazil to the forefront of global Bitcoin adoption. By creating a tax-free haven for BTC, the proposal promises to lure both retail and institutional capital, potentially inspiring other nations to follow suit and accelerating Bitcoin’s march towards mainstream acceptance.

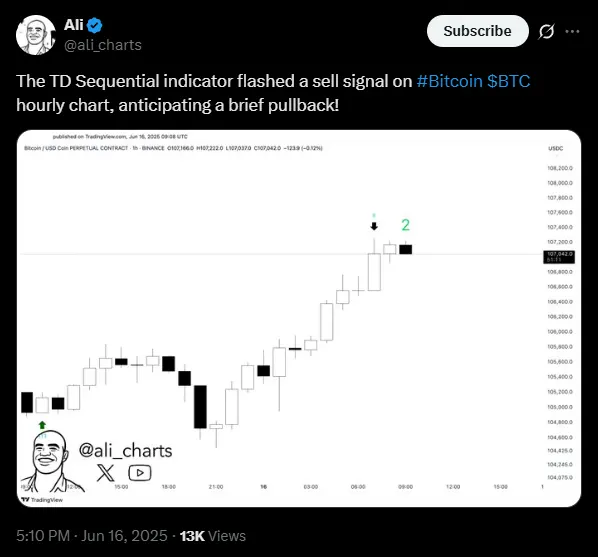

Yet, the market is not without its complexities. Short-term volatility remains a focal point for traders, with Glassnode’s analysis revealing a pronounced bullish shift in Bitcoin’s 25 Delta Skew, hinting at expectations of sharp price swings or upward momentum in the near term. Ali Charts, however, cautions of a potential hiccup, noting that a TD Sequential sell signal on Bitcoin’s hourly chart suggests a brief retreat may be on the horizon.

Metaplanet leads the institutional wave

Despite such fluctuations, the broader sentiment remains upbeat, buoyed by the unyielding grip of long-term holders who dominate the supply, as corroborated by CryptoQuant’s insights into liquidity and market depth.

This long-term confidence is mirrored in the actions of institutional heavyweights like Metaplanet, which has amassed an impressive 10,000 BTC as of 16 June 2025, acquired at an average price of $94,697 per coin.

Metaplanet’s relentless accumulation underscores a deepening faith in Bitcoin’s enduring value, fuelling optimism across the market. While liquidity around the $105,000 mark suggests room for price oscillations, the prevailing trend leans bullish, with buyers—particularly those with a long-term horizon—outnumbering sellers.

In this intricate tapestry of short-term uncertainty and long-term conviction, Bitcoin stands at a pivotal juncture, its trajectory shaped by the interplay of prudent holding strategies, institutional bold moves, and transformative policy proposals.