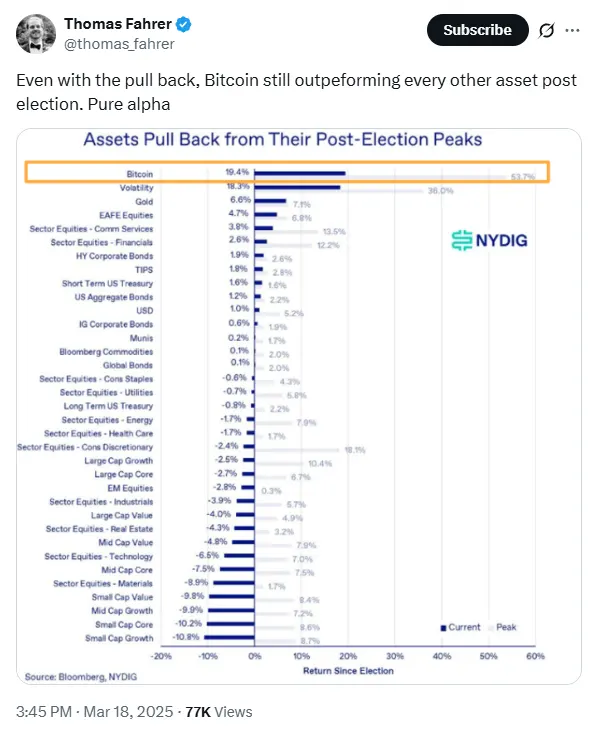

24-6-2025 – Bitcoin’s dominance in cryptocurrency portfolios is surging, propelled by a more accommodating regulatory landscape in the United States and a swell of institutional enthusiasm, according to a comprehensive report from Bybit. The world’s pioneering cryptocurrency now commands nearly a third of investor portfolios, accounting for 30.95% of total assets as of May 2025, a marked rise from 25.4% in November 2024. Priced at $105,225, Bitcoin has solidified its position as the pre-eminent asset in the crypto sphere, outpacing all other major global investments since the inauguration of US President Donald Trump in early 2025.

Spot Bitcoin ETFs ignite institutional interest

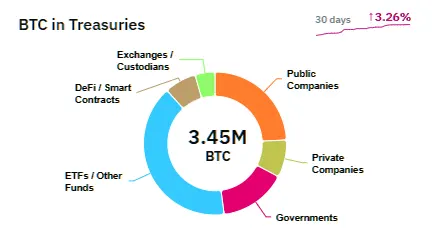

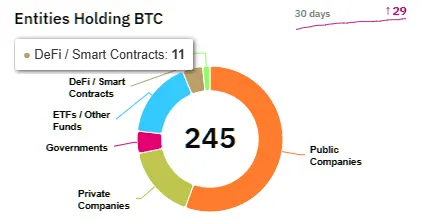

The introduction of spot Bitcoin exchange-traded funds (ETFs) has been a pivotal catalyst, drawing significant institutional interest. Data from BitcoinTreasuries.NET reveals a near doubling of corporate Bitcoin holders since early June, with 244 companies now incorporating the asset into their balance sheets, up from 124 in mere weeks. Collectively, treasuries hold 3.45 million Bitcoin, with public companies accounting for 834,000 coins (3.97% of the total supply) and spot Bitcoin ETFs holding 1.39 million coins (6.6% of the supply). This institutional embrace has sparked bold predictions, with Joe Burnett, director of market research at Unchained, forecasting that Bitcoin could reach $1.8 million by 2035, positioning it as a formidable rival to gold’s $22 trillion market capitalisation.

Institutional vs. retail allocation gap widens

Yet, while institutional adoption soars, retail traders appear to be pivoting. Their Bitcoin allocations have plummeted by 37% since November 2024, dropping to just 11.6% of portfolios, roughly half the proportion held by institutions. The Bybit report suggests retail investors are redirecting capital towards altcoins, notably XRP ($2.17), which has seen its portfolio share double from 1.29% to 2.42% over the same period, fuelled by anticipation of a Ripple spot ETF approval ahead of Solana’s. Meanwhile, Solana ($SOL) holdings have dwindled by 35%, falling from 2.72% to 1.76% of portfolios, reflecting a shift in institutional focus towards XRP.

Ether ($2,410), by contrast, has seen its relative standing erode, with the Ether-to-Bitcoin holding ratio dipping to a 2025 low of 0.15 in April before recovering to 0.27. This indicates that for every dollar invested in Ether, investors hold approximately four dollars in Bitcoin, underscoring the latter’s unrivalled appeal.