7-5-2025 – Bitcoin’s ecosystem reveals a tale of contrasting convictions. Over the past two months, the number of wallets holding at least one BTC has dwindled by 3,400, a subtle yet telling sign of waning confidence among smaller investors. This retreat among retail holders unfolds against a backdrop of market turbulence, casting a shadow over Bitcoin’s immediate prospects.

Yet, beneath this surface unease, a different story emerges. Large-scale investors, often dubbed “whales,” have been quietly amassing their holdings, adding 81,338 BTC to their coffers in just six weeks—a 0.61% uptick in their collective stash. In stark contrast, smaller wallets have offloaded 290 BTC, trimming their holdings by a near-identical 0.60%. This divergence paints a classic picture: retail investors, rattled by volatility, are heading for the exits, while heavyweight players seize the moment to accumulate. History suggests such patterns often precede sharp price surges, as retail selling creates fleeting opportunities for strategic buyers.

Bitcoin’s market dynamics offer further clues to its trajectory. As of now, the cryptocurrency commands a price of $96,678.63, reflecting a 2.28% gain over the past 24 hours. Analysts, however, keep a watchful eye on the $93,198 support level—a critical threshold. Should it falter, the next line of defence lies at $83,444. For now, this support holds firm, bolstering cautious optimism among market observers.

Exchange activity reinforces this narrative of quiet confidence. Over the past week, Bitcoin outflows from exchanges have soared by 182.36%, dwarfing the 26.15% rise in inflows. This surge in withdrawals signals a growing preference for long-term storage over immediate trading, a move that typically eases selling pressure and lays the groundwork for upward momentum.

The market’s health is further illuminated by Bitcoin’s MVRV Z-score, currently at 2.42. This metric suggests that investors are sitting on moderate profits but remain far from the euphoric peaks that often herald a downturn. Historically, MVRV scores above 3.5 have flagged overheated markets, but Bitcoin’s current reading indicates room for growth before such risks emerge. For now, this balance encourages holders to stay the course rather than cash out.

Meanwhile, Bitcoin’s scarcity—a cornerstone of its value proposition—has reached new heights. Following the latest halving, the Stock-to-Flow ratio has surged to 669.72, a figure that underscores severe supply constraints. Such elevated readings have historically aligned with long-term price appreciation, particularly when paired with rising demand. This dynamic strengthens the case for Bitcoin’s enduring appeal, with many long-term investors viewing current prices as a bargain in light of future supply shocks.

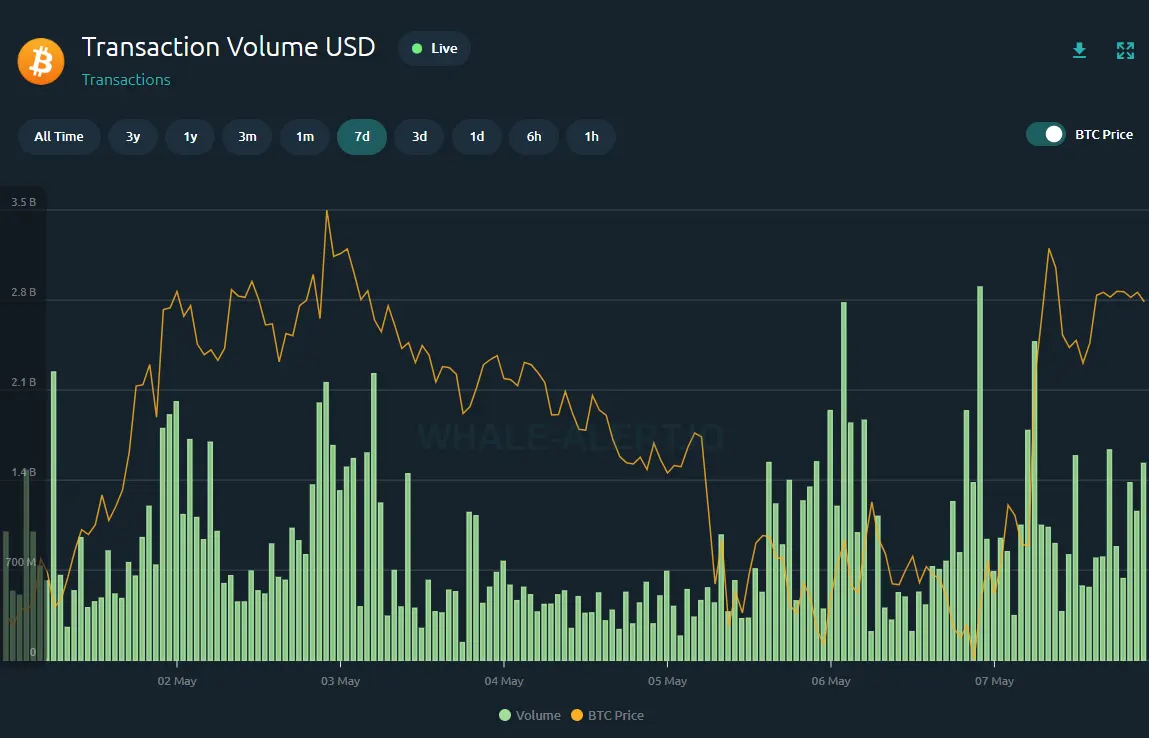

However, not all signals are unequivocally bullish. Bitcoin’s NVT Ratio, now at 380.12, ranks among the year’s highest. This metric, which compares price to transaction volume, suggests that the cryptocurrency’s value is outpacing network activity. While such readings can accompany early-stage rallies, they also serve as a cautionary note, hinting at potential overvaluation if transaction growth lags further.