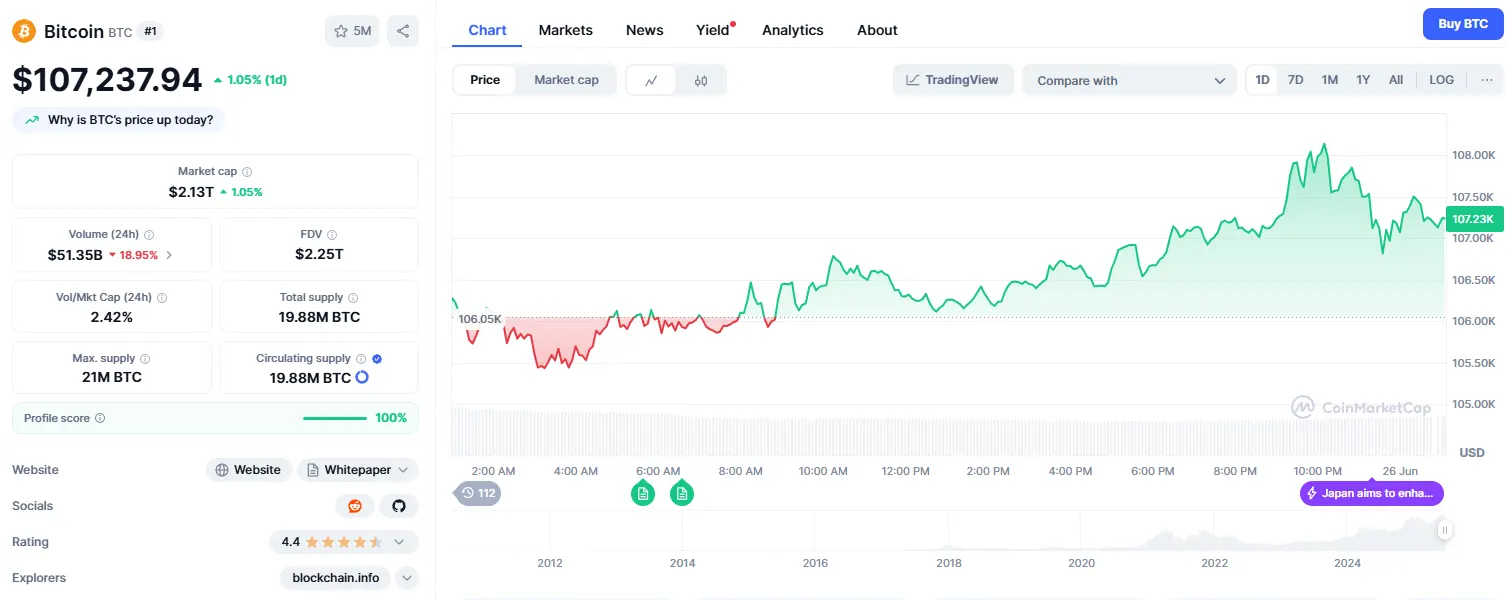

26-6-2025 – The cryptocurrency sector experienced a remarkable resurgence on Wednesday, with Bitcoin breaching the $107,000 threshold amid reports of a provisional ceasefire agreement between Iran and Israel. This dramatic recovery followed a weekend tumble that had seen the world’s largest digital currency slip beneath the psychologically significant $100,000 mark.

Geopolitical winds shift market sentiment

The tentative truce announcement provided immediate relief to crypto markets, which had been rattled by escalating Middle Eastern hostilities. Weekend trading sessions witnessed considerable volatility as investors reacted to missile exchanges between the regional powers, with Iranian airstrikes responding to Israeli military action creating uncertainty across global markets.

Market participants appear to have interpreted the ceasefire developments as a de-escalation signal, prompting renewed appetite for risk assets. The broader cryptocurrency ecosystem reflected this optimism, with the total market capitalisation bouncing back to $3.4 trillion—a figure that underscores the sector’s resilience despite geopolitical headwinds.

Altcoins join the recovery rally

Beyond Bitcoin’s impressive performance, alternative cryptocurrencies demonstrated their own recovery momentum. Ethereum posted modest gains alongside Solana, suggesting that investor confidence had returned across the digital asset spectrum rather than concentrating solely on the flagship cryptocurrency.

The GMCI 30 Index, which tracks the performance of the thirty most valuable cryptocurrencies by market capitalisation, captured this broader market uplift with notable advances. This diversified strength indicates that the relief rally extended well beyond Bitcoin’s boundaries, encompassing the wider ecosystem of digital assets.

Traditional markets mirror crypto optimism

Equity markets demonstrated parallel enthusiasm, with the S&P 500 climbing 1.1% on Tuesday to reclaim the significant 6,000 milestone. This correlation between traditional and digital assets highlighted how geopolitical developments continue to influence both sectors, despite their distinct characteristics and investor bases.

However, futures markets showed signs of hesitation following Federal Reserve Chair Jerome Powell’s measured commentary on monetary policy. The central bank chief’s balanced approach to discussing potential interest rate adjustments appeared to temper some of the earlier optimism in forward-looking contracts.

Fed policy outlook remains cautious

Powell’s testimony before House lawmakers reinforced the Federal Reserve’s commitment to data-dependent policy making. The Fed Chair emphasised the continued strength of both the American economy and labour market whilst signalling that any policy adjustments would await comprehensive analysis of forthcoming economic indicators.

Market observers anticipate similar messaging when Powell appears before the Senate Banking Committee, with the central banker likely to maintain his measured tone regarding future monetary policy directions. This cautious approach reflects the Fed’s determination to avoid premature policy shifts that could undermine economic stability.

December rate cut expectations emerge

Timothy Misir, head of research at BRN, has revised his expectations for Federal Reserve policy action, now anticipating the first potential rate reduction in December rather than the previously forecast September timeframe. This adjustment reflects growing consensus that the Fed will require additional economic data before implementing any significant policy changes.

“This aligns with our expectation that the Fed will wait for September and October CPI prints before acting, likely delivering a 50bp cut in December rather than earlier moves,” Misir explained in research notes. This perspective suggests that monetary policy will remain supportive of current market conditions through the autumn months.

Institutional appetite remains robust

Despite Powell’s cautious monetary policy stance, institutional investors continued their steady accumulation of digital assets. U.S. spot Bitcoin exchange-traded funds attracted $588.5 million in fresh investment on 24 June, demonstrating sustained appetite from traditional finance participants.

Ethereum-focused investment products similarly benefited from renewed interest, drawing $71 million in inflows as cumulative investments surpassed the $4 billion threshold. These figures, compiled by SoSoValue, underscore the continuing institutional embrace of cryptocurrency exposure despite broader market uncertainties.