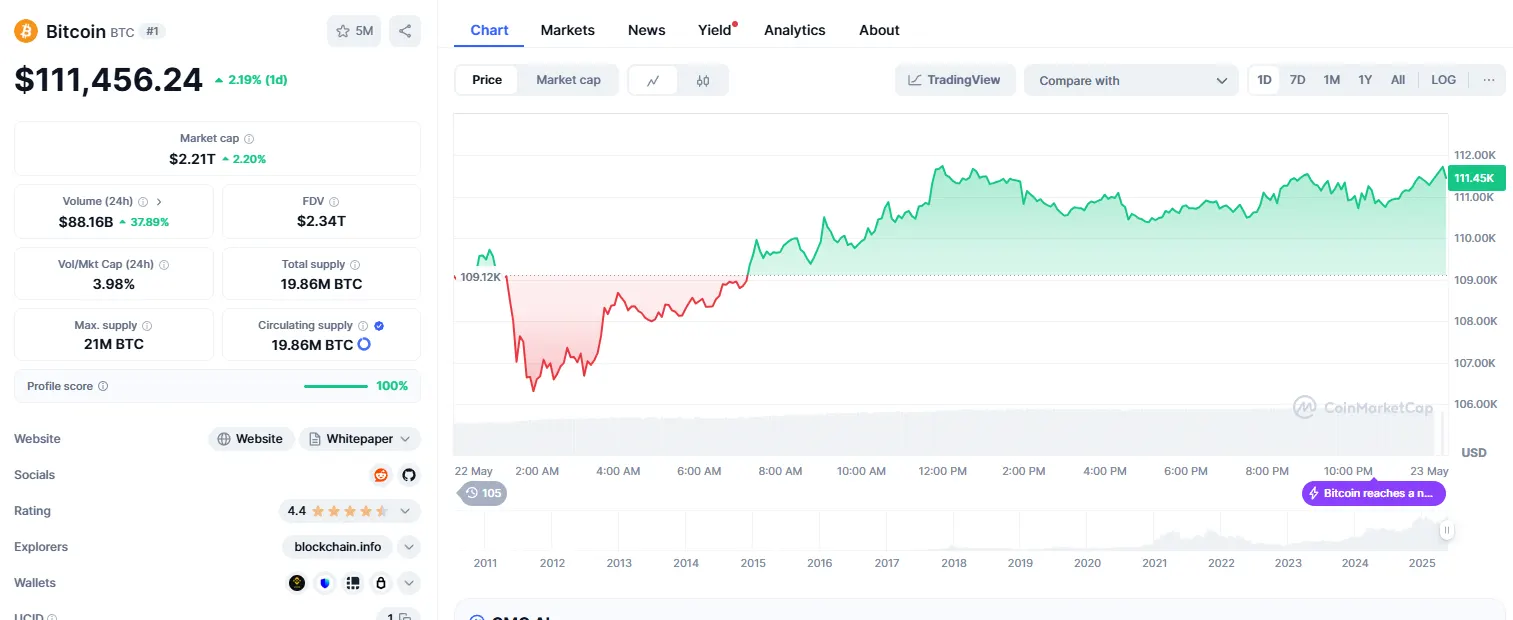

23-5-2025 – Bitcoin has stormed to a fresh annual peak, brushing the $111,000 mark, with its current trading price hovering at $110,510. This milestone signals a decisive break through a formidable resistance zone between $105,000 and $110,000, a range that had previously repelled price surges. Yet, beneath the surface of this technical triumph, a curious divergence emerges: the ranks of small-scale investors—those holding less than one Bitcoin—have dwindled dramatically. From a robust 590,000 addresses in 2021, their numbers have plummeted to a mere 260,000 today. This stark retreat suggests that the everyday investor’s enthusiasm has yet to catch fire, despite the cryptocurrency’s glittering ascent.

The rally’s momentum, it seems, rests firmly in the hands of deep-pocketed players and steadfast long-term holders, rather than the retail crowd. The Realized Cap HODL Waves, a metric tracking coin movement, reveals scant activity from short-term speculators, with the 0–1 day band dropping to a mere 0.33. This points to a market driven by those with resolute conviction, a foundation that historically underpins durable uptrends. However, the absence of smaller players casts a shadow over the rally’s potential to ignite exponential growth. Without a resurgence of retail interest, Bitcoin’s upward trajectory may remain tethered to the whims of whales and institutions.

On-chain metrics offer a mixed but intriguing picture. The NVT Golden Cross, a gauge of price relative to transaction value, has fallen sharply by 49.46% to 0.79. In past cycles, such a decline has often signalled a cooling of speculative froth, reducing the risk of an imminent peak. This suggests Bitcoin’s rally is on firmer footing than during previous overheated surges. Yet, caution lingers. The NVT ratio, which compares market capitalisation to transaction volume, has soared to 374.17, hinting at potential overvaluation. Without a corresponding rise in network activity, this disconnect could foreshadow a pullback, though bull markets have historically tolerated elevated NVT levels for extended periods.

Market sentiment, meanwhile, is riding a wave of exuberance. The Weighted Sentiment index has spiked to 5.15, a level that screams crowd euphoria. Historically, such peaks have often heralded consolidation or reversals, particularly when retail participation is lacking. Should momentum falter, traders would be wise to brace for short-term corrections. On the technical front, the daily Relative Strength Index (RSI) has climbed above 77, a threshold that typically flags overbought conditions. While this might suggest an impending cooldown, strong bullish trends can sustain such levels if demand holds firm and profit-taking remains restrained.

Bitcoin’s breakout, bolstered by robust on-chain signals, paints a picture of cautious optimism. The conviction of long-term holders and the tempered NVT Golden Cross lend credence to the rally’s staying power. Yet, the glaring absence of retail fervour caps its potential for explosive growth. For now, Bitcoin’s fate hinges on whether smaller investors will rejoin the fray, or if the market will continue to be steered by the steady hands of its most resolute believers.