30-6-2025 – The financial world is keenly observing developments that could sway both cryptocurrency and conventional markets. The European Central Bank’s annual policy forum and an eagerly anticipated address by U.S. Federal Reserve Chair Jerome Powell on Tuesday are at the forefront of investors’ minds. These high-profile occasions could redefine central bank strategies, potentially influencing risk appetite across asset classes.

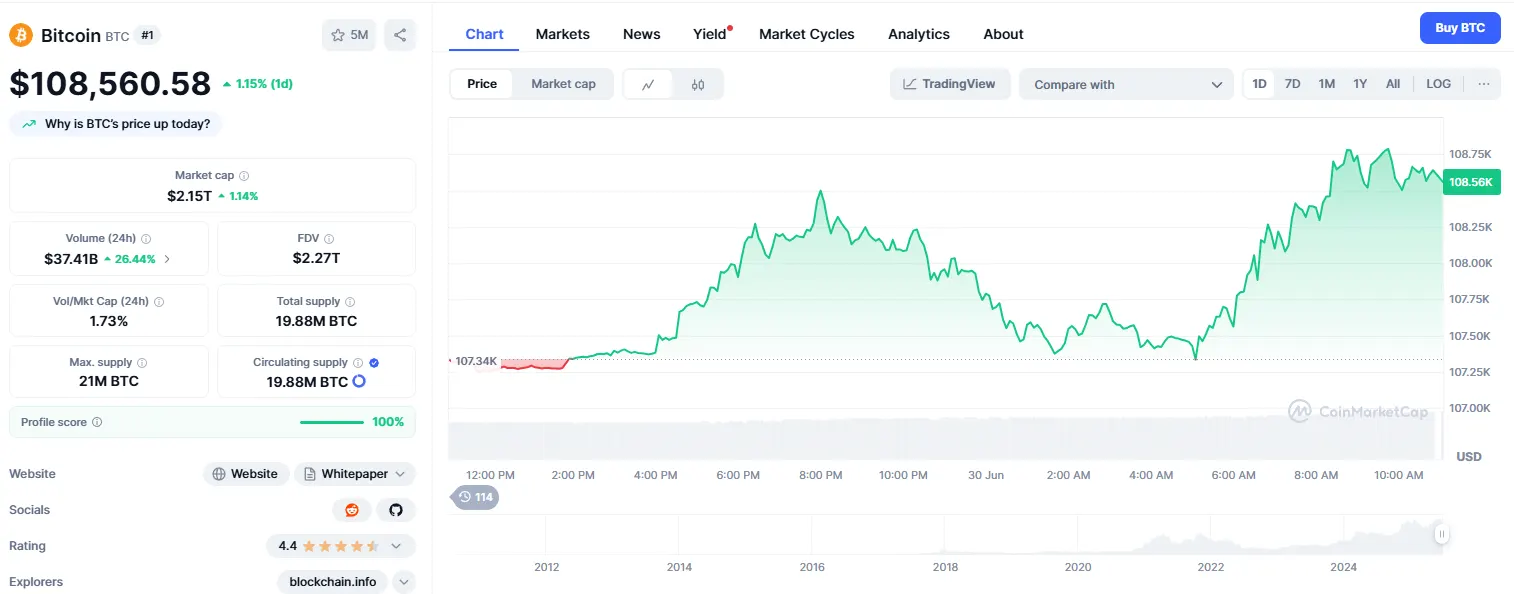

Despite Bitcoin holding steady above the $108,000 mark, market undercurrents hint at an imminent resurgence of volatility. Analyst Axel Adler Jr. highlights a notable trend: large-scale investors, or “whales,” are funnelling substantial sums into centralised exchanges. This movement, coupled with dwindling platform reserves and a noticeable dip in stablecoin inflows, often foreshadows turbulent market conditions. Should Bitcoin sustain its perch above $108,000, analysts project a continued climb, with sights set on a potential $112,000 milestone. Yet, the crypto market’s next chapter hinges on the delicate interplay of macroeconomic signals and trader sentiment.