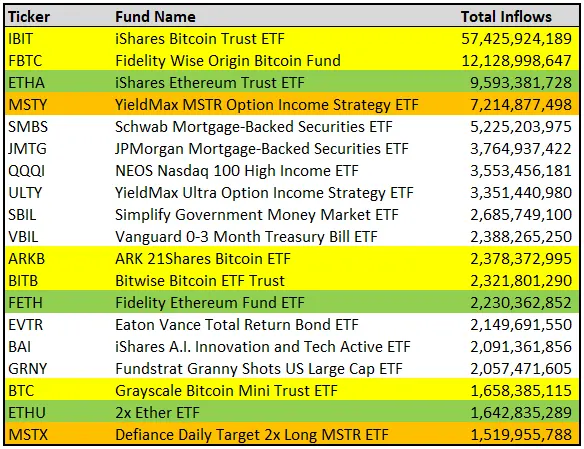

12-8-2025 – Cryptocurrency exchange-traded funds (ETFs) have taken the lead among new financial products, with 10 of the top 20 ETFs by inflows since last year being crypto-related, according to data shared by Nate Geraci on August 10. The list, featuring funds like iShares Bitcoin Trust ETF (IBIT) with $57.4 billion and YieldMax MSTR Option Income Strategy ETF (YMSTR) with $7.2 billion, highlights a surge in institutional interest.

Spot Bitcoin and Ethereum ETFs, including Fidelity’s offerings, dominate the top ranks, reflecting a $69 billion influx for Bitcoin alone. This trend underscores a broader shift in investment patterns, with crypto ETFs outpacing traditional assets like mortgage-backed securities and high-income funds. The data, covering over 1,300 ETF launches, shows the market’s appetite for digital assets, bolstered by regulatory approvals and growing mainstream adoption.