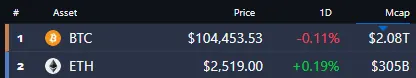

20-6-2025 – The cryptocurrency market is weathering a storm of uncertainty, with Bitcoin and Ethereum clinging to stability after a sharp tumble triggered by escalating tensions in the Middle East. Since the Israel-Iran conflict flared on June 3, Bitcoin has slipped 3% to hover around $104,000, while Ethereum has endured a steeper 10% drop, settling at $2,500. Over the past day, both digital currencies have stalled, locked in a cautious holding pattern as investors brace for what comes next.

Middle East conflict sends shockwaves across crypto and global markets

Geopolitical tremors are rattling global markets, and cryptocurrencies are no exception. US President Donald Trump’s recent warning to Iran’s Supreme Leader Ali Khamenei, coupled with his abrupt exit from a G7 summit to convene the National Security Council, has heightened fears of US military involvement. Polymarket’s latest odds peg the likelihood of a US strike on Iran before July at 61%, a slight dip from 70% earlier this week. This sabre-rattling has sent ripples across asset classes: US stocks have faltered, oil prices have surged, and gold has lost its lustre. Shares in crypto giants like Coinbase and Circle also took a hit, dropping as much as 4%, though they later rebounded following the US Senate’s passage of the GENIUS Act, a pivotal stablecoin regulation.

Vincent Liu, chief investment officer at Kronos Research, told DL News that the crypto market’s trajectory hinges on two key forces: updates from the Middle East and fluctuations in Bitcoin exchange-traded fund (ETF) flows. This week alone, Bitcoin ETFs absorbed nearly 10,000 Bitcoin—equivalent to $1 billion—pushing their total holdings to an impressive $131 billion, according to Coinglass. Yet, options traders remain wary. Data from Deribit reveals a surge in Bitcoin put options, particularly around the $100,000 mark, signalling a defensive stance. “It’s not about expecting a collapse,” Liu explained. “Puts are a hedge for spot holders, a way to manage short-term risk amid shifting sentiment.” XRP traders are similarly cautious, positioning for potential price dips.

Fed policy and global economics add further pressure

Adding to the unease, macroeconomic headwinds are gathering force. Federal Reserve Chair Jerome Powell dashed hopes of monetary easing on Wednesday, affirming that high interest rates will persist as inflation remains stubbornly elevated. This environment is particularly punishing for risk-heavy assets like cryptocurrencies. Meanwhile, Iran’s strategic position—producing 4% of global oil and sitting at the gateway to the Strait of Hormuz, a conduit for 30% of the world’s seaborne oil and 20% of its liquefied natural gas—amplifies the stakes.