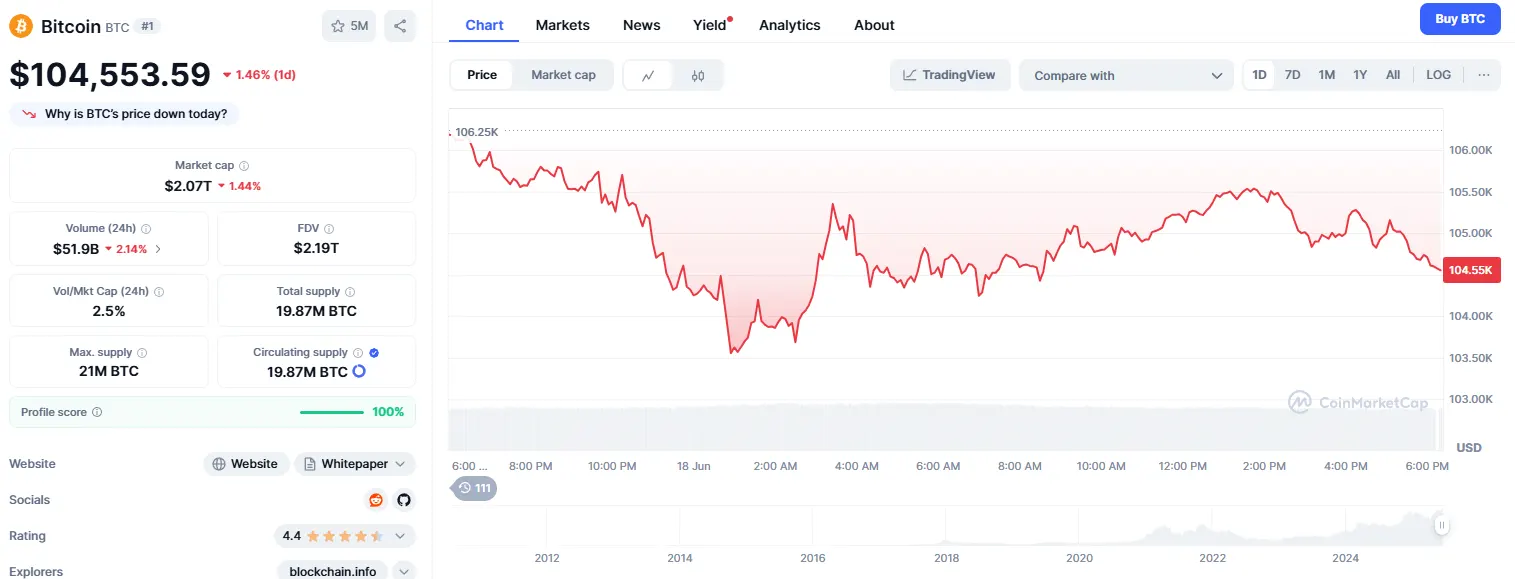

18-6-2025 – The escalating turmoil in the Middle East has sent shockwaves through the cryptocurrency markets, as geopolitical tensions cast a pall over digital assets. Bitcoin, the bellwether of the crypto sphere, has shed 3% of its value, slipping to around $105,000 since hostilities between Israel and Iran flared on June 12, according to CoinGecko’s data. Ethereum, the second-largest cryptocurrency, has endured a steeper 8% decline, hovering near $2,500, while the broader crypto market haemorrhaged nearly $200 billion in just six days.

The catalyst for this financial tremor lies in the intensifying rhetoric from U.S. President Donald Trump, who hinted at potential American intervention in the Israel-Iran conflict. In a provocative social media post, Trump declared, with pointed reference to Iran’s Supreme Leader Ali Khamenei, that U.S. patience was waning, stoking fears of escalation. This followed Israel’s retaliatory airstrikes last week, launched in response to assaults by Iran-backed militants. Iran, a significant oil producer contributing roughly 3.3 million barrels daily—about 4% of global output—sits at the heart of these tensions, amplifying concerns about disruptions to energy markets.

Global markets have shuddered in response. U.S. equities dipped, oil prices surged, and gold, often a haven in turbulent times, unexpectedly faltered. Risk assets like cryptocurrencies and stocks typically wobble when conflict erupts, as investors recoil from uncertainty. Wars disrupt supply chains, threaten economic stability, and can ignite inflation, particularly when oil markets tighten. The crypto sector felt the sting acutely: Coinbase’s stock slid 4%, Strategy dipped 3%, and Circle, fresh from a blockbuster public debut last week, saw its shares drop nearly 3%, though all have since clawed back some losses.

Intriguingly, the longer-term trajectory for Bitcoin amid global strife remains enigmatic. Historical patterns offer mixed signals. Bitcoin analyst James Check, in his Checkonchain newsletter, noted that during Russia’s 2022 invasion of Ukraine, Bitcoin plummeted 40% in the first year, outpacing gold’s 5% decline, though both suffered amid the U.S. Federal Reserve’s aggressive rate hikes and a pervasive bear market. Conversely, after the October 7, 2023, Hamas attacks on Israel, both assets soared—gold climbed 38%, while Bitcoin rocketed 70%, buoyed by the launch of Bitcoin ETFs and robust central bank demand for gold. Check suggests that factors beyond Middle Eastern tensions may be influencing current market dynamics.

Market sentiment has tilted towards apprehension, with Polymarket’s odds of a U.S. military strike on Iran by August leaping to 70%. As the world watches the skies over Tehran and Tel Aviv, the interplay of geopolitics and finance continues to shape the volatile dance of cryptocurrency prices, leaving investors braced for what lies ahead in this precarious global moment.