25-7-2025 – Capital flowing into digital assets has reached $60 billion in 2025, representing a nearly 50% increase since late May and positioning the sector to exceed last year’s record totals, according to new analysis from JPMorgan.

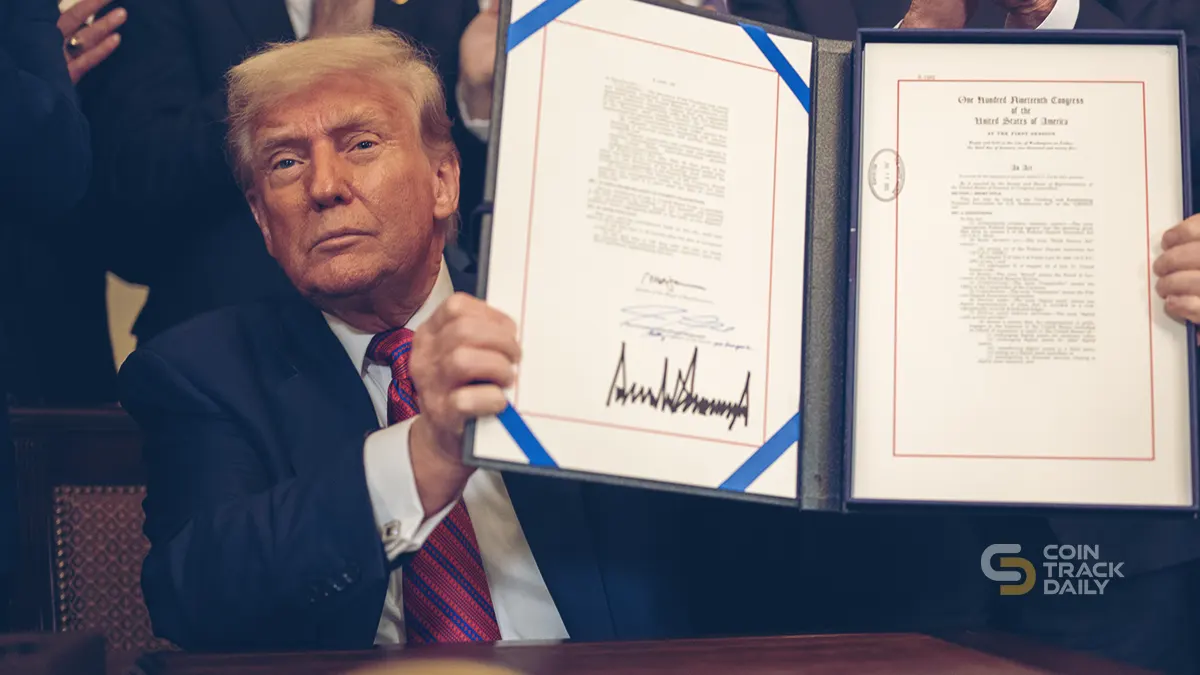

The investment bank’s research team, led by managing director Nikolaos Panigirtzoglou, attributes the acceleration to an increasingly favorable U.S. regulatory environment. The recently passed GENIUS Act has provided crucial clarity for stablecoin operations while establishing what analysts describe as a global standard for the sector. Meanwhile, the CLARITY Act continues advancing through Congress with provisions to definitively classify digital assets as either securities or commodities—a framework that could make the U.S. more competitive against European Union regulations under MiCA.

The improved policy backdrop is generating momentum across both private and public crypto markets. Venture capital funding for crypto projects has rebounded, while public markets have witnessed renewed activity including Circle’s successful IPO and increased SEC filings. JPMorgan analysts note that companies may be pursuing elevated valuations, citing MicroStrategy’s continued premium trading relative to its bitcoin treasury holdings.

Ethereum has emerged as a particular beneficiary of the inflow surge, driven by its central role in decentralized finance and smart contracts, plus growing adoption in corporate treasuries alongside bitcoin. Asset managers are also showing heightened interest in launching altcoin-based ETFs that incorporate staking mechanisms, reflecting broader institutional appetite for yield-generating crypto products.

The $60 billion figure encompasses crypto fund flows, CME futures activity, and venture capital fundraising across the digital asset ecosystem. This contrasts sharply with weaker fundraising conditions in traditional private equity and credit markets, where institutional investors appear to be rotating toward digital assets and hedge fund strategies.