28-6-2025 – The cryptocurrency sector has demonstrated remarkable fortitude this week, with Bitcoin staging a compelling recovery following a turbulent period triggered by escalating tensions across the Middle East. The flagship digital currency has successfully reclaimed the $107,000 threshold, underlining its capacity to withstand global uncertainties that continue to unsettle traditional financial markets.

Market resilience amid regional instability

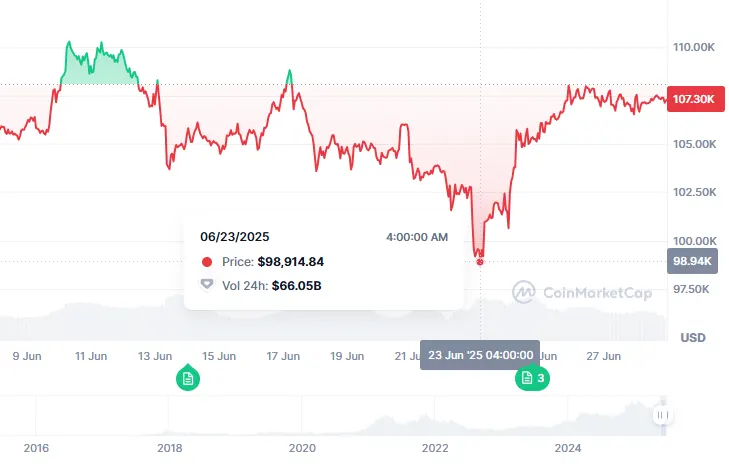

Weekend trading sessions witnessed considerable upheaval as conflict between Iran and Israel sent shockwaves through digital asset markets. Bitcoin experienced a precipitous decline, touching lows of $98,000 before mounting an impressive comeback that has caught the attention of institutional observers. The recovery trajectory has been particularly noteworthy when measured against Ethereum’s comparatively subdued performance.

With Bitcoin shedding 8.5% of its value between Saturday and Monday before orchestrating a robust reversal. Ethereum bore the brunt of selling pressure more severely, declining 17% during the same timeframe whilst struggling to match Bitcoin’s recovery momentum. This divergence has helped cement Bitcoin’s market supremacy, with its dominance ratio maintaining an impressive 66% throughout the trading week.

Historical precedent suggests digital assets may continue benefiting from geopolitical uncertainty. BlackRock’s analysis, referenced in the Binance report, indicates Bitcoin has historically delivered average gains of 37% in the sixty-day period following major geopolitical events. Whether this pattern holds true will largely depend upon broader macroeconomic conditions, including inflationary pressures, liquidity flows, and prevailing investor sentiment.

Alternative cryptocurrencies struggle for momentum

Whilst Bitcoin has demonstrated its defensive qualities, the alternative cryptocurrency market continues searching for its catalyst moment. The long-anticipated “altseason“—a period characterised by smaller digital assets outperforming Bitcoin—remains conspicuously absent, despite favourable market conditions that would typically encourage capital rotation.

Industry analysts point to fundamental structural changes within the cryptocurrency ecosystem that may be hampering traditional market cycles. The proliferation of new tokens has reached unprecedented levels, with Dune Analytics data revealing a near ten-fold increase in unique cryptocurrency tokens across eight major blockchain networks over the past three years. This dramatic expansion in supply appears to be diluting the capital flows that previously lifted alternative cryptocurrencies during Bitcoin consolidation phases.

The current market cycle lacks the compelling narratives that drove previous bull runs. Unlike earlier periods defined by Initial Coin Offerings or Decentralised Finance innovations, today’s landscape presents a fragmented picture. Emerging themes such as meme-based cryptocurrencies, Bitcoin-focused financial products, and decentralised physical infrastructure represent evolutionary rather than revolutionary developments. Even artificial intelligence applications, despite generating considerable discourse, have yet to demonstrate meaningful impact within cryptocurrency markets.

Political tensions undermine dollar strength

The United States Dollar Index has retreated to three-year lows following President Trump’s public criticism of Federal Reserve Chairman Jerome Powell’s monetary policy stance. Trump’s expressed dissatisfaction with the central bank’s reluctance to implement rate cuts has introduced fresh uncertainty into currency markets, whilst simultaneously providing tailwinds for cryptocurrency and risk assets.

Political commentary from the White House has extended beyond mere criticism, with reports suggesting the administration is actively considering replacement candidates for Powell’s position before his current term expires. This unprecedented public pressure on Federal Reserve independence has created a complex backdrop for monetary policy decisions.

Internal divisions within the Federal Reserve have become increasingly apparent, with varying perspectives on the appropriate timing for rate adjustments. Whilst Chairman Powell maintained a cautious stance during recent congressional testimony, Trump-appointed officials Michelle Bowman and Christopher Waller have signalled potential support for rate cuts as early as July. These conflicting signals have generated volatility across traditional markets whilst providing support for alternative assets.

Market indicators reflect this shifting sentiment, with ten-year Treasury yields declining to 4.27% by Friday’s close. The VIX volatility index has similarly retreated, falling 20% to 16.8—its lowest reading since February. These developments have coincided with renewed strength across both equity and cryptocurrency markets.

Bitcoin strengthens institutional appeal

Bitcoin’s ability to maintain elevated dominance levels whilst traditional markets approach record highs suggests the cryptocurrency market is finding equilibrium after recent turbulence. The digital asset’s performance during geopolitical stress has reinforced its credentials as a potential hedge against traditional market risks, attracting continued institutional attention.

However, the broader alternative cryptocurrency market continues awaiting a decisive catalyst that might trigger the capital rotation patterns observed in previous market cycles. Without compelling new narratives or technological breakthroughs, the anticipated altcoin surge may remain postponed indefinitely.

Future market direction will likely hinge upon forthcoming macroeconomic data releases, including inflation measurements and central bank policy decisions. Should monetary conditions continue easing or exchange-traded fund inflows persist, Bitcoin appears well-positioned to maintain its leadership role. Yet the alternative cryptocurrency sector still requires a significant spark to ignite widespread investor interest and drive meaningful price appreciation across smaller digital assets.