7-5-2025 – U.S. Senator Elizabeth Warren has reignited her critique of former President Donald Trump and his family’s involvement in the cryptocurrency sector, warning that a recent $2 billion deal linked to the United Arab Emirates (UAE) could open the door to potential corruption. Her concerns come as the Senate prepares to debate new stablecoin legislation that could reshape the regulatory landscape of digital currencies.

At the core of Warren’s critique is USD1, a stablecoin issued by World Liberty Financial, a company co-founded by Trump’s son, Eric Trump, alongside crypto investor Zach Witkoff. Backed by short-term U.S. Treasury bonds, USD1 has rapidly emerged as the seventh-largest stablecoin globally, according to CoinGecko, with analysts pointing to its ties to a major Emirati investment. This deal, valued at $2 billion, involves MGX, an Abu Dhabi-backed firm, and Binance, the world’s largest cryptocurrency exchange. The Massachusetts senator has characterised the arrangement as emblematic of the risks posed by unchecked influence in the crypto industry.

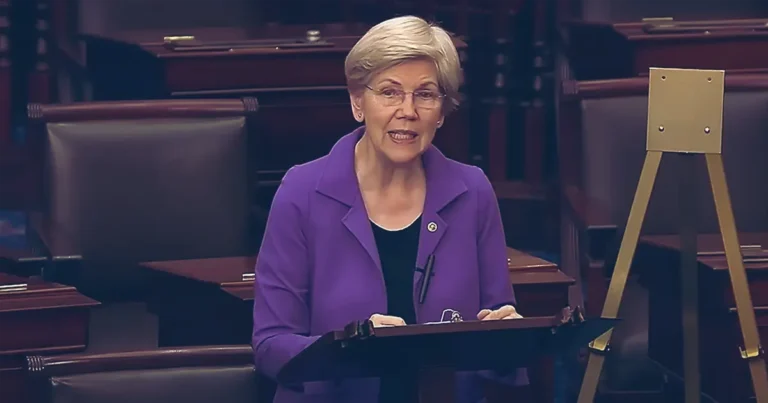

Speaking on the matter, Warren cautioned against passing the GENIUS Act, a Republican-led bill that seeks to establish the first regulatory framework for stablecoins in the United States. “This legislation, as it stands, would make it easier for a sitting president and their family to profit directly from financial instruments while skirting appropriate oversight,” she stated. Warren has previously criticised Trump’s framing of his crypto ambitions as a geopolitical necessity, with the former president asserting that the U.S. must advance its crypto infrastructure to counter China’s growing influence.

Warren expressed her concerns with sharp clarity on social media, tweeting, “The Trump family’s stablecoin climbed to the 7th largest in the world thanks to a shady deal with the UAE. The Senate must not pass legislation that facilitates corruption.” She also accused lawmakers of enabling Trump’s alleged financial misconduct by advancing the bill, which passed the Senate Banking Committee with bipartisan support earlier this year but has since faced resistance from some Democrats.

Critics of the legislation argue that the bill, in its current form, lacks sufficient safeguards against national security risks and fails to impose necessary restrictions on foreign issuers of stablecoins. Warren’s proposed amendments—aimed at prohibiting stablecoins tied to criminal activities and increasing oversight of foreign entities—were rejected, further fuelling her opposition to the bill. She warned, “If we do not address these flaws, every senator who votes in favour will be complicit in enabling corruption.”

The controversy over USD1 was further fuelled last week when Witkoff, alongside Eric Trump, publicly announced the deal with MGX during a crypto convention in Dubai. The partnership has raised eyebrows given its association with Abu Dhabi’s sovereign wealth and the potential for financial entanglements with foreign governments. Kristen Welker of Meet the Press recently questioned Trump about his family’s involvement in the crypto industry, to which he responded, “I haven’t even looked,” while suggesting that any financial gains would merely reflect his success in bolstering market performance.

Warren has repeatedly criticised the Trump family for allegedly exploiting crypto legislation for personal gain, accusing the former president of prioritising his own financial interests over the welfare of the American public. “Donald Trump promised lower costs for Americans, but instead, he’s orchestrating schemes to enrich himself while destabilising the economy,” she remarked.

The stablecoin market, which now exceeds $245 billion in circulation, has become a focal point of regulatory debates in Washington. While proponents of the GENIUS Act argue that it would provide much-needed clarity and structure to the burgeoning industry, Warren and her allies contend that the bill, as written, would fail to prevent misuse and could ultimately allow financial instruments to be weaponised for personal profit.

With nine Senate Democrats now opposing the bill in its current form, the legislation faces an uncertain future. In a joint statement, dissenting senators cited unresolved issues, including national security concerns and inadequate oversight mechanisms, as reasons for their opposition. Warren has urged her colleagues to reject the bill if amendments are not made, stating, “Congress must prioritise protecting the American people over advancing legislation that greenlights grift.”