10-6-2025 – Ethereum, the titan of altcoins, is witnessing a surge of vitality in its ecosystem, with a remarkable upswing in network engagement. Recent data reveals that weekly active addresses have soared to an unprecedented 17.4 million, a testament to burgeoning interest from both retail investors and institutional players. This flurry of activity persists despite a dip in cross-chain interactions, underscoring Ethereum’s enduring allure in the volatile world of digital assets.

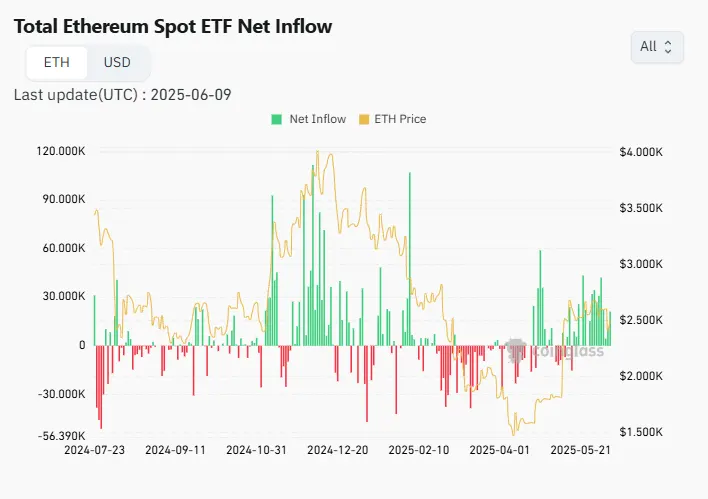

The price of ETH, however, tells a more turbulent tale. After sliding from $2,667 to $2,414 in early June, the cryptocurrency has struggled to regain its footing. Ethereum Spot ETFs, which enjoyed consistent net inflows for much of the preceding six weeks, have seen a slowdown since 5 June. While this deceleration spans only a fe w trading days, it raises questions about whether a broader trend is emerging, particularly if Monday and Tuesday follow suit. Yet, the market’s undercurrents remain complex, with Bitcoin’s robust recovery over the weekend and into Monday hinting at a potential spillover of bullish sentiment into the altcoin sphere.

Meanwhile, the behaviour of Ethereum’s whale addresses—those holding between 1,000 and 10,000 ETH—offers a mixed narrative. From November 2024 to April 2025, the number of these heavyweight holders trended upward, peaking between 31 March and 13 April when the count rose from 4,808 to 4,954. However, this growth has tapered off over the past two months, with a gradual decline in whale numbers. This slowdown coincides with a price recovery, as ETH rebounded from a low of $1,537 on 22 April to $2,738 by 13 May. Intriguingly, the rally unfolded without significant whale accumulation, a departure from earlier patterns where a 20% drop in whale counts between April and June 2024 accompanied a sustained price climb until mid-May.

Market signals remain ambiguous. Data from Coinglass points to a potential trading range for ETH, with whale sell orders clustering around local highs of $2,700 and $2,800, while buy orders bolster support at $2,460 and $2,370. As Ethereum hovers at this crossroads, the interplay of whale dynamics, ETF flows, and broader market sentiment will likely dictate its next move, with cautious optimism buoyed by Bitcoin’s upward momentum.