29-6-2025 – A growing tide of alarm is sweeping across the American crypto investing community, as tax authorities intensify their scrutiny of digital asset holders. CoinLedger, a leading crypto tax software firm, has reported an astonishing 758% surge in the number of U.S. users receiving letters from the Internal Revenue Service (IRS) over the past two months, a development echoed by major accounting firms such as Taxing Cryptocurrency.

Despite former President Donald Trump voicing support for scrapping taxes on cryptocurrency investments made within the United States, there has been no corresponding legislative move in Congress. In the meantime, millions of everyday investors remain unaware of their obligations, wrongly assuming that digital asset transactions fall outside the scope of taxable income. According to CoinLedger CEO David Kemmerer, the recent wave of IRS correspondence has stoked widespread concern, potentially heralding a broader enforcement clampdown, especially with the new Form 1099-DA rules set to come into effect in 2026.

Complex regulation meets everyday confusion

At the heart of the anxiety lies a disconnect between regulatory clarity and investor understanding. “There’s a wave of fear and confusion gripping honest investors,” Kemmerer explained. “Many of them genuinely tried to comply with tax requirements. But with 1099-DA on the horizon, enforcement will only become more aggressive. The IRS is seeing more, but incomplete or misaligned cost basis records mean even compliant individuals are at risk of being flagged.”

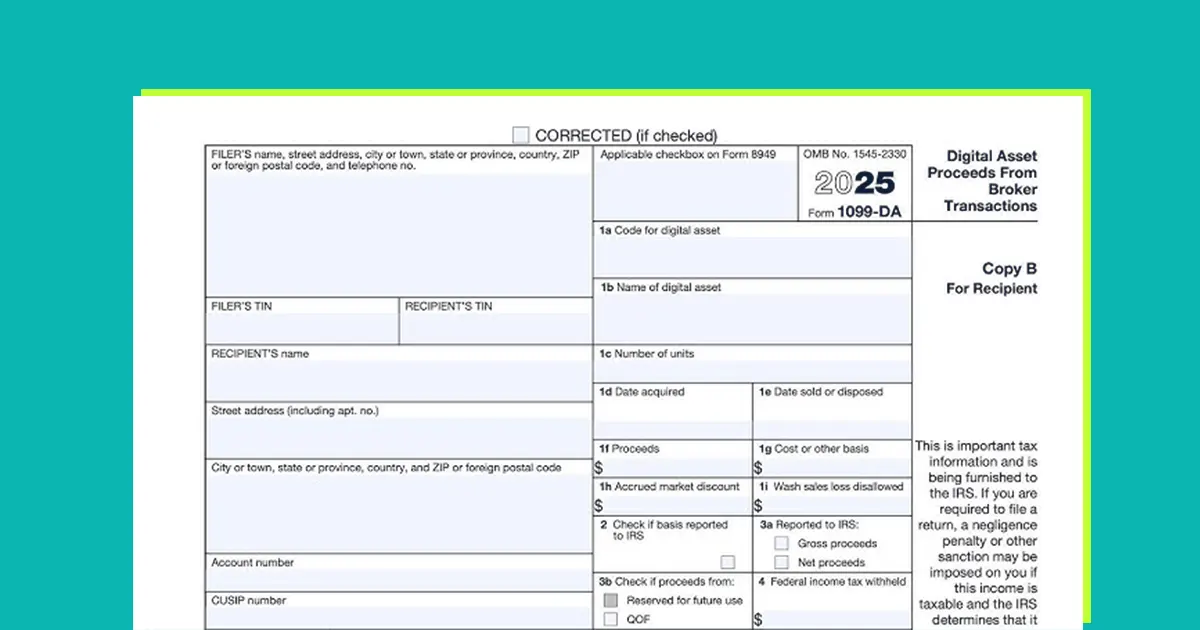

Beginning 1 January 2026, U.S.-based crypto brokers will be required to report both the gross proceeds and cost basis of digital asset sales via Form 1099-DA. This will enable the IRS to calculate taxable gains and losses automatically—thereby tightening compliance oversight and making tax evasion more difficult. However, Trump earlier signed a resolution striking down a rule implemented during Joe Biden’s presidency that would have extended broker status to decentralised finance (DeFi) platforms—a move that somewhat limits the scope of enforcement for now.

A spectrum of IRS letters, from mild to critical

The IRS has dispatched several variations of crypto-related notices, each signalling a different level of urgency. The most common is Letter 6174, intended as a general educational nudge rather than an accusation, informing recipients that cryptocurrency transactions may be taxable. These letters are often sent to individuals identified through John Doe summonses, which compel exchanges like Coinbase to share user data.

Slightly more serious is Letter 6174-A, which implies a suspicion of underreporting, although no action is required unless the taxpayer recognises a mistake. Then comes Letter 6173, a more pointed communication which assumes underreported income, demanding a formal response to avoid escalation. The most critical warning, Notice CP2000, outlines a proposed tax liability based on identified discrepancies. Taxpayers have just 30 days to respond before the matter potentially advances to collections or penalties.

Honest investors caught in the crosshairs

For many recipients, these letters are more bewildering than damning. Ben Yoder, CoinLedger’s Customer Success Manager, notes that “the majority of users reaching out are shocked. These are not tax dodgers—they’re regular people who’ve held assets like Bitcoin or Ethereum for years and thought they were doing everything right.”

He highlighted that wallet-to-wallet transfers have emerged as a leading source of confusion. While these transfers are not in themselves taxable events, failure to maintain accurate records can complicate cost basis calculations, triggering mismatched information during audits.

Yoder advised that recipients who believe their taxes were correctly reported should respond with detailed documentation, including trade history or Form 1099s from exchanges, to clarify their position. For those who omitted prior crypto transactions, an amended return can be filed using Form 1040X, with a supporting memo to explain any significant updates. Less severe notices, such as 6174 and 6174-A, can often be addressed manually or with the help of tax software. However, for more serious letters like CP2000 or 6173, professional advice is strongly recommended.

Investor gains amid rising scrutiny

Despite the regulatory headwinds, crypto investors saw tangible returns in the past year. In February, CoinLedger reported that the average investor’s portfolio realised gains of $5,482 in 2024, with coins like HYPE and BTC delivering the most significant increases, while ETH, ADA, and POL posted the largest unrealised losses.