9-9-2025 – Anton Kobyakov, a senior advisor to Russian President Vladimir Putin, claimed at the Eastern Economic Forum that the U.S. is using stablecoins to address its $37 trillion national debt, potentially at the expense of global markets.

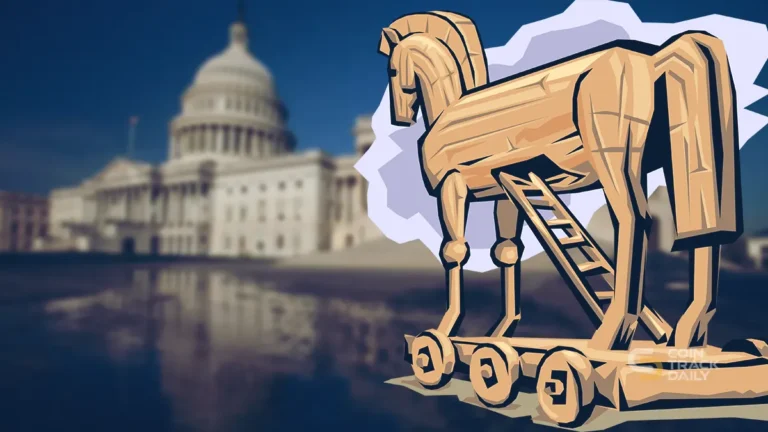

Speaking in Vladivostok, Kobyakov, accused Washington of manipulating crypto and gold markets to offload its debt burden. He suggested the U.S. plans to shift portions of its debt into stablecoins, only to devalue them, effectively resetting its financial obligations. This strategy, he argued, mirrors historical U.S. debt maneuvers in the 1930s and 1970s, aimed at preserving dollar dominance amid declining global trust.

The Trump administration’s recent embrace of stablecoins, bolstered by the GENIUS Act signed in July 2025, has fueled speculation about its motives. While the U.S. promotes stablecoins to expand dollar hegemony, Russia is cautiously developing its own crypto framework, focusing on international payments but banning domestic crypto transactions.

Kobyakov’s remarks reflect broader geopolitical tensions, as Russia pushes for de-dollarization and alternative financial systems through BRICS initiatives. Critics argue that converting massive Treasury debt into stablecoins is logistically complex and unlikely, but the narrative underscores growing scrutiny of U.S. financial strategies.