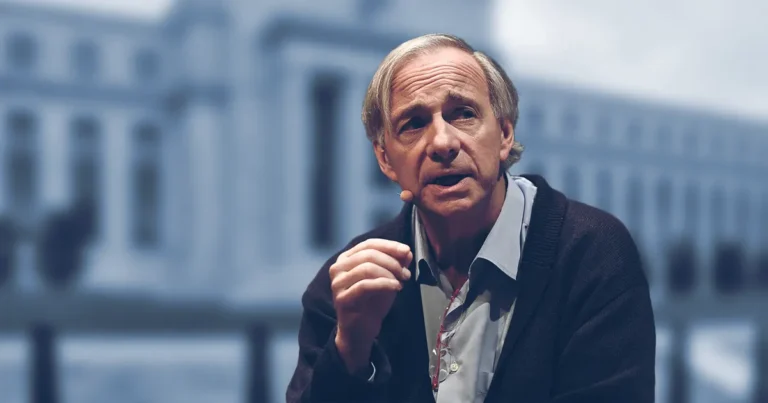

29-7-2025 – Bridgewater Associates founder Ray Dalio now advocates allocating 15% of investment portfolios to Bitcoin or gold, marking a significant shift from his previous 1-2% Bitcoin recommendation in January 2022.

Speaking on the Master Investor podcast Sunday, the billionaire hedge fund manager cited America’s mounting debt crisis as the primary driver behind his updated allocation strategy. With US national debt reaching $36.7 trillion and the Treasury Department projecting $12 trillion in new borrowing over the next year, Dalio warned of inevitable currency devaluation pressures.

“The issue is the devaluation of money,” Dalio explained, describing Bitcoin and gold as effective portfolio diversifiers against fiscal deterioration. A Monday Treasury report reinforced these concerns, projecting $1 trillion in third-quarter borrowing—$453 billion above previous estimates—due to weakened cash flows and depleted reserves.

While Dalio maintains a “strong preference” for gold over Bitcoin and holds only modest cryptocurrency positions, he acknowledged the allocation split “is up to you.” His recommendation extends beyond US borders, noting that other Western nations including the UK face similar “debt doom loop” challenges that will pressure their currencies against hard assets.

Despite endorsing Bitcoin as a diversification tool, Dalio remains skeptical about its reserve currency potential, citing transaction transparency concerns that allow government surveillance. Both assets have performed strongly recently, with Bitcoin trading near $118,100—roughly 4% below its July all-time high—while gold continues hitting new peaks.