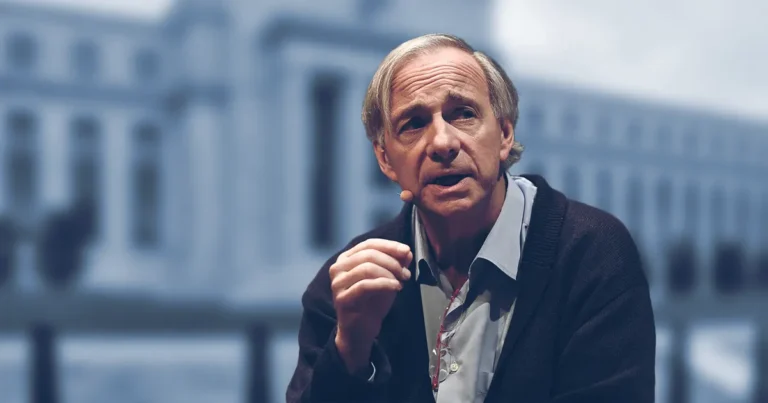

3-9-2025 – Billionaire investor Ray Dalio warned that the U.S. Dollar’s declining reserve currency status is accelerating adoption of Bitcoin and gold as alternative stores of wealth, citing mounting debt burdens that threaten traditional fiat systems.

Speaking in a recent Financial Times interview, the Bridgewater Associates founder identified structural issues undermining major reserve currencies, particularly rising debt levels that diminish the Dollar’s long-term stability. Dalio highlighted Bitcoin’s limited supply as a key advantage, stating that “if dollar supply rises and demand falls, crypto becomes an attractive alternative” to traditional currencies.

His comments coincide with gold’s historic surge past $3,600 per ounce for the first time, representing a 33% gain this year that outpaced the S&P 500 by 3.5 times. The yellow metal’s rally correlates strongly with Japanese bond yields amid expectations of Federal Reserve rate cuts at the September 17 FOMC meeting, according to market analysis.

While Dalio dismissed concerns about USD-pegged stablecoins’ Treasury exposure under proper regulation, he emphasized the declining real purchasing power of government bonds as a genuine investor concern. The macro environment remains complex with 30-year bond yields surging above 5.0%, creating uncertainty around traditional safe-haven assets.

Corporate treasury adoption of cryptocurrency continues expanding as companies seek alternatives to dollar-denominated reserves, reinforcing Dalio’s thesis about shifting monetary preferences among institutional investors.