12-7-2025 – Ripple Labs has submitted an application for a national banking license with the U.S. Office of the Comptroller of the Currency, marking the company’s boldest move yet to integrate crypto services with traditional banking infrastructure. XRP jumped 3% following the news.

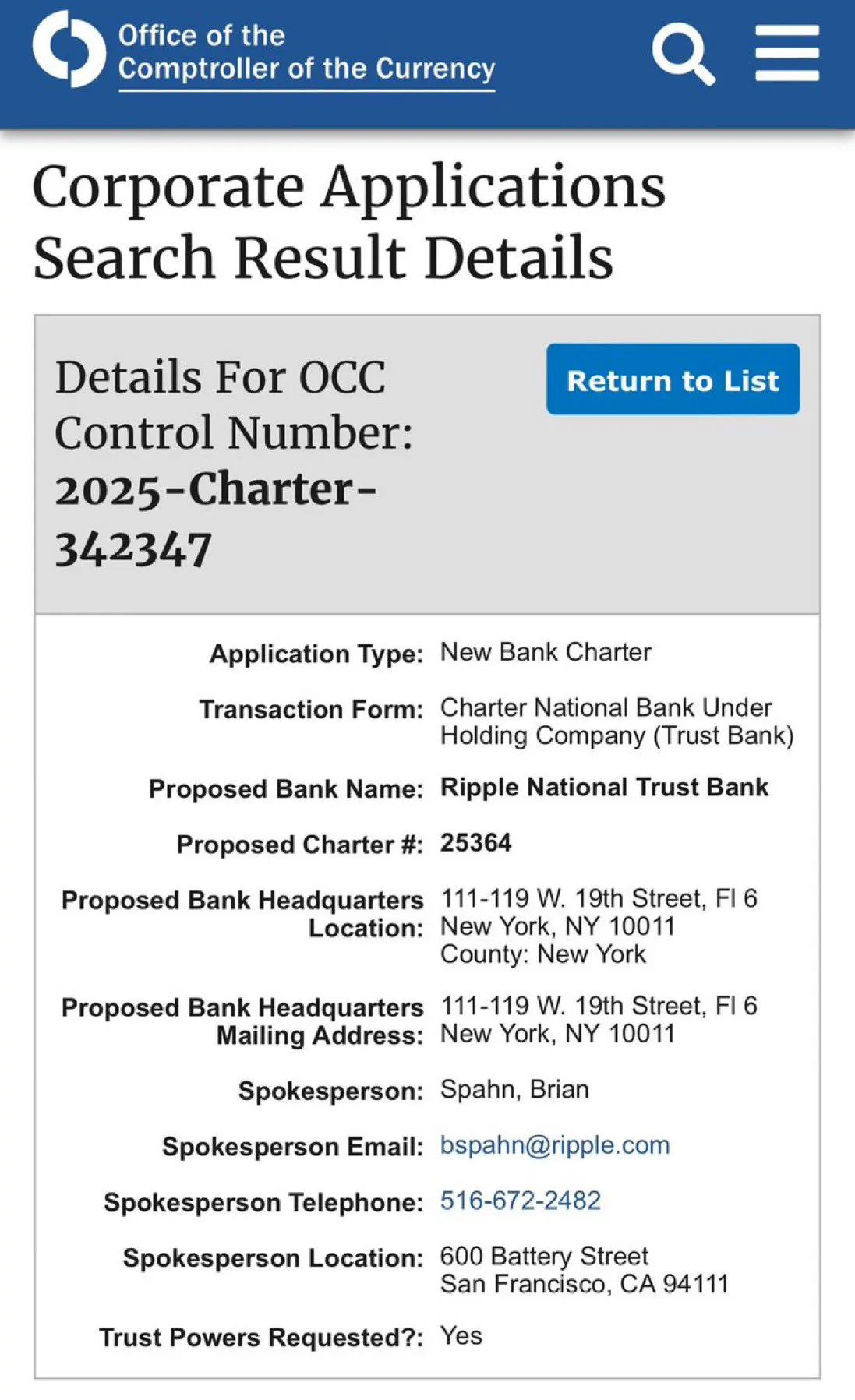

The San Francisco-based blockchain payments company filed the application on July 2, seeking a federal trust bank charter that would allow it to operate under direct federal oversight. If approved, the license would enable Ripple to function as a federally regulated trust bank, representing a significant step toward deeper integration between cryptocurrency and traditional banking systems. The charter would bring Ripple’s U.S. dollar-backed stablecoin RLUSD under OCC supervision alongside existing state regulatory frameworks.

Ripple already holds a New York Department of Financial Services BitLicense, positioning the company as a regulated entity in one of the most stringent crypto jurisdictions. The federal banking application follows a similar move by Circle, indicating a broader trend among major stablecoin issuers seeking federal oversight as U.S. cryptocurrency legislation advances. Market analysts suggest the banking license could accelerate institutional adoption of XRP, particularly for cross-border payments where Ripple has focused its business model.

XRP traded at $2.292 following the announcement, rising from $2.237 earlier in the session. The regulatory approval process typically takes several months, with market watchers now focused on the OCC’s response to Ripple’s application and potential implications for the broader crypto banking sector.