3-6-2025 – Ripple’s stablecoin, RLUSD, has secured approval from the Dubai Financial Services Authority (DFSA), unlocking its use within the prestigious Dubai International Financial Centre (DIFC). This milestone, following prior authorisation from the New York Department of Financial Services, positions RLUSD as one of the few stablecoins worldwide to boast dual regulatory endorsements. Backed 1:1 by segregated reserves and high-quality liquid assets, RLUSD undergoes rigorous third-party audits, ensuring a level of trust and transparency tailored for enterprise-grade financial operations.

The DIFC, home to nearly 7,000 firms operating under stringent regulatory standards, has seen a remarkable 55% surge in stablecoin adoption in the UAE throughout 2024. As businesses increasingly seek swift settlement times and cost-effective transaction solutions, RLUSD’s entry into this dynamic ecosystem is poised to meet the demands of institutions wary of the volatility and regulatory ambiguity often associated with digital assets. Ripple’s Senior Vice President of Stablecoins, Jack McDonald, hailed the DFSA’s approval as a testament to the company’s commitment to delivering a stablecoin that upholds the highest standards of reliability and utility.

DFSA nod unlocks use in DIFC’s thriving financial ecosystem

Ripple is leveraging this regulatory green light to integrate RLUSD into its DFSA-licensed payments platform in Dubai, harnessing the XRP Ledger to facilitate a global payout network that promises reduced costs and accelerated settlement cycles. Strategic partnerships are further amplifying Ripple’s regional ambitions.

Tokenised real estate and fintech growth signal RLUSD utility

Collaborations with Zand Bank and fintech innovator Mamo are already tapping into Ripple’s regulated payment infrastructure, while a groundbreaking initiative with the Dubai Land Department and Ctrl Alt is tokenising property deeds on the XRP Ledger. Since Idi Looking ahead, RLUSD is set to expand its reach, integrating into Cardano’s decentralised finance ecosystem and serving as collateral on Hidden Road’s institutional platform, which processes over $3 trillion annually.

Market reaction: XRP rises as analysts eye $2.23 resistance

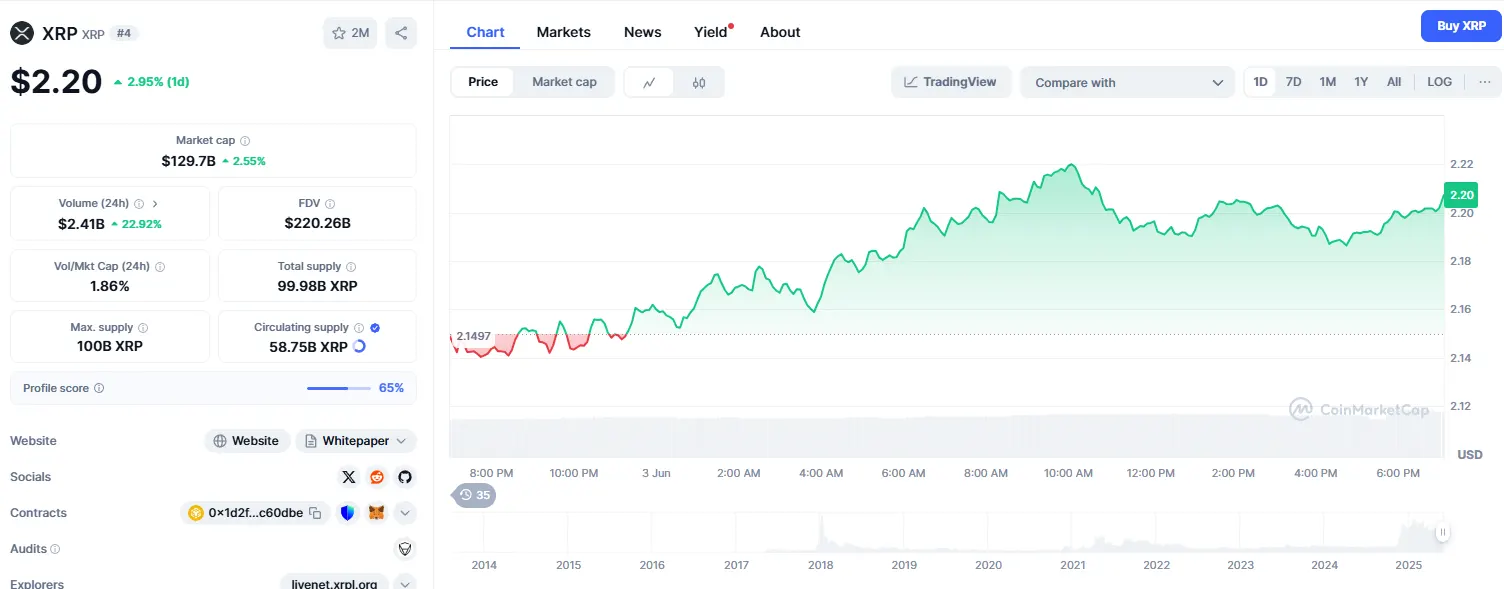

Since its debut in December 2024, RLUSD has been operational on both the XRP Ledger and Ethereum networks, and its growing influence is beginning to reflect in market dynamics. XRP, Ripple’s native cryptocurrency, experienced a 1.66% uptick to $2.19 in the 24 hours following the DFSA announcement.

However, analysts suggest that a sustained bullish trend hinges on breaking the $2.23 resistance level, leaving the prospect of a June 2025 rally uncertain but brimming with potential. Reece Merrick, Ripple’s Managing Director for the Middle East and Africa, praised the UAE’s progressive approach, noting that the nation continues to set a global standard for digital asset innovation.