23-6-2025 – Financial sage Robert Kiyosaki, famed for his bestseller Rich Dad Poor Dad, sounded the alarm on a looming global economic cataclysm. Taking to X, he forewarned of a debt bubble poised to rupture, urging his audience to seek refuge in gold, silver, and Bitcoin as bulwarks against financial ruin. “Those clinging to outdated notions of wealth—hoarding fiat currency or bonds—face the gravest losses,” he declared, casting savers as the unwitting casualties of a crumbling monetary order.

Kiyosaki’s latest admonition dovetails with his earlier forecasts of a 2025 economic collapse, one he claims could dwarf the 2008 crisis. A steadfast champion of alternative assets, he has long advocated for households to pivot from fiat cash to tangible stores of value like precious metals and Bitcoin, famously asserting that “savers are losers” in today’s fiscal climate. His bold price predictions for Bitcoin, including a $250,000 target tied to a potential central bank implosion, have stirred both intrigue and scepticism. Yet, his track record invites caution—projections of Bitcoin reaching $100,000 by June 2024 and $350,000 by August fell wide of the mark.

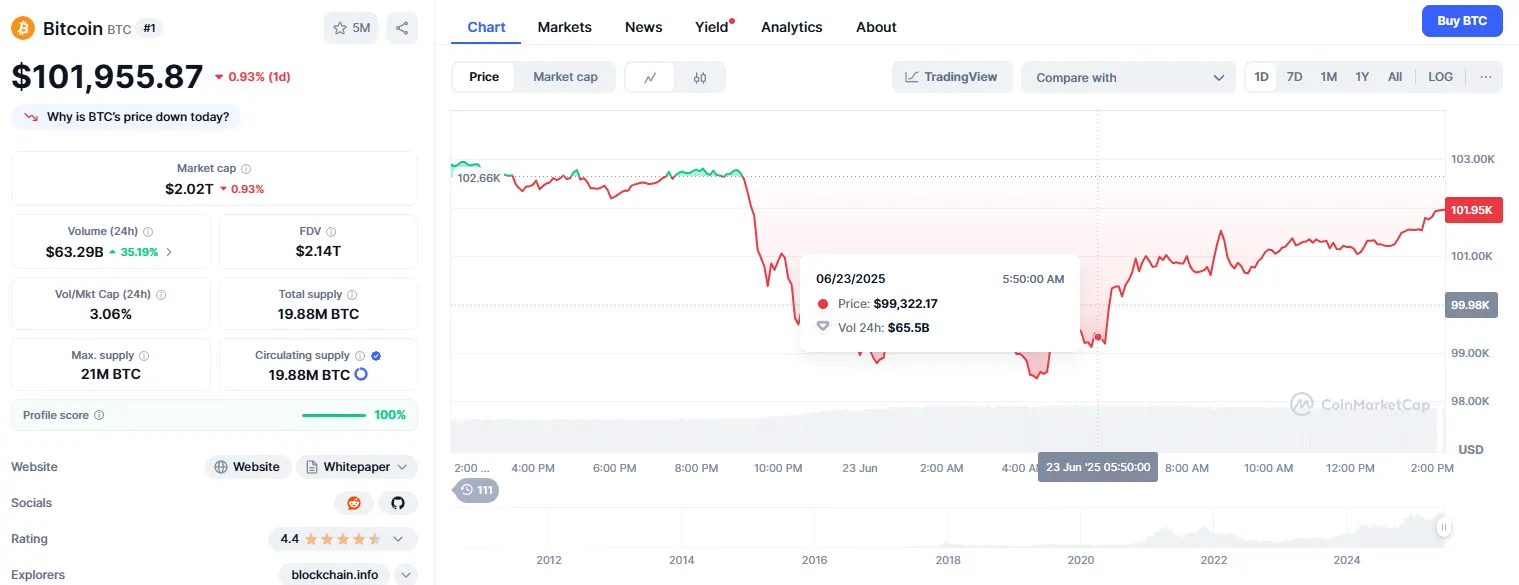

As of the latest market snapshot, Bitcoin traded at $101,227.88, reflecting a 1.35% dip over the past 24 hours, with a modest year-to-date gain of 7%, per Benzinga Pro data. Spot gold, meanwhile, stood at $3,360.19 per ounce, down 0.24%, while spot silver edged up 0.14% to $36.0445, underscoring the volatile terrain investors must navigate amid Kiyosaki’s dire warnings.