13-6-2025 – SharpLink Gaming, a sports betting platform listed on Nasdaq, has solidified its position as the world’s largest publicly traded holder of Ether (ETH), amassing 176,271 coins at a total cost of $463 million. The acquisition, announced on Friday, marks a bold step in corporate adoption of cryptocurrency, with the company positioning ETH as its primary treasury reserve asset. This strategic pivot, funded through a blend of private placements and at-the-market equity sales—including $79 million raised since May 30—saw SharpLink secure its Ether at an average price of $2,626 per coin.

Over 95% of SharpLink’s ETH holdings now staked

The company has wasted no time in putting its newfound assets to work, with over 95% of its ETH holdings now engaged in staking and liquid staking platforms. This approach not only generates yield but also bolsters the security of Ethereum’s network, aligning financial gain with technological contribution. Rob Phythian, SharpLink’s CEO, hailed the move as a “landmark moment” for both the company and the broader landscape of public companies embracing digital currencies. “Ether is now the cornerstone of our treasury strategy,” Phythian declared, underscoring the firm’s confidence in Ethereum’s long-term potential.

Chairman Joseph Lubin: ‘Capital allocation meets ecosystem contribution’

Drawing parallels with MicroStrategy’s well-documented Bitcoin accumulation, SharpLink’s ETH-centric strategy is a first among Nasdaq-listed firms. The company aims to provide its shareholders with significant exposure to Ethereum’s economic upside, a vision articulated by SharpLink chairman and Ethereum co-founder Joseph Lubin. He described the strategy as a “pivotal milestone” in institutional adoption, noting that SharpLink’s commitment to staking not only enhances Ethereum’s network integrity but also generates additional ETH rewards. “This is innovation in action—capital allocation that serves both corporate growth and the Ethereum ecosystem,” Lubin added.

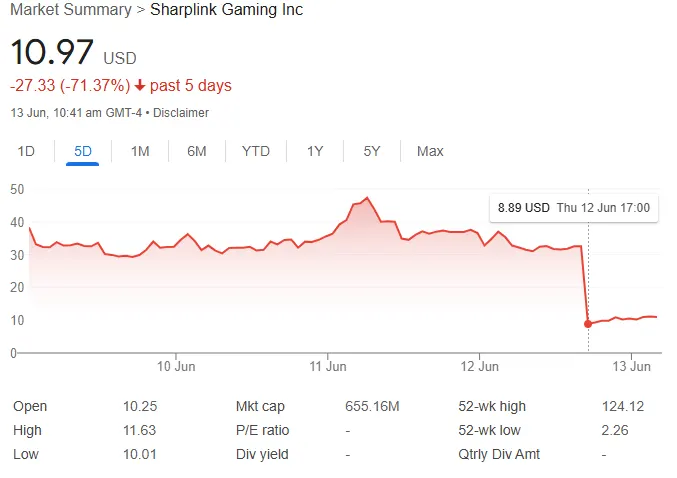

Stock volatility follows SEC filing confusion

However, SharpLink’s audacious strategy has sparked volatility and debate. Following the company’s initial ETH treasury announcement on May 27, its share price surged by over 400%, reflecting investor enthusiasm. Yet, a recent S-3 SEC filing triggered a sharp 73% drop in after-hours trading on Thursday, as shares plummeted from $32.53 to below $8. The sell-off stemmed from a misinterpretation of the filing, which outlined the potential resale of 58.7 million shares by private investment in public equity (PIPE) participants. Lubin was quick to clarify that this was a standard regulatory step, not an indication of insiders cashing out, and the stock later regained some ground.

Despite SharpLink’s dominance among publicly traded ETH holders, it is not the largest overall. The Ethereum Foundation, for instance, holds 214,129 ETH, valued at $594 million, according to Arkham data. Meanwhile, BlackRock’s iShares Ethereum Trust ETF manages a staggering 1.7 million ETH—worth approximately $4.5 billion—on behalf of its clients, dwarfing SharpLink’s holdings but operating in a different capacity.

SharpLink’s embrace of Ether mirrors a broader trend of corporate crypto adoption, reminiscent of Strategy’s Bitcoin playbook, but with a distinct focus on Ethereum’s unique attributes.