25-6-2025 – SharpLink Gaming (SBET), a Minneapolis-based technology firm listed on public markets, has significantly bolstered its ether (ETH) reserves, cementing its position as a trailblazer among publicly traded companies diversifying into cryptocurrencies. On Tuesday, the company announced that its treasury now holds an impressive 188,478 ETH, valued at approximately $470 million at current market rates, making it the largest publicly traded holder of the world’s second-most prominent cryptocurrency.

$450 Million Backing and Leadership by Ethereum’s Joseph Lubin

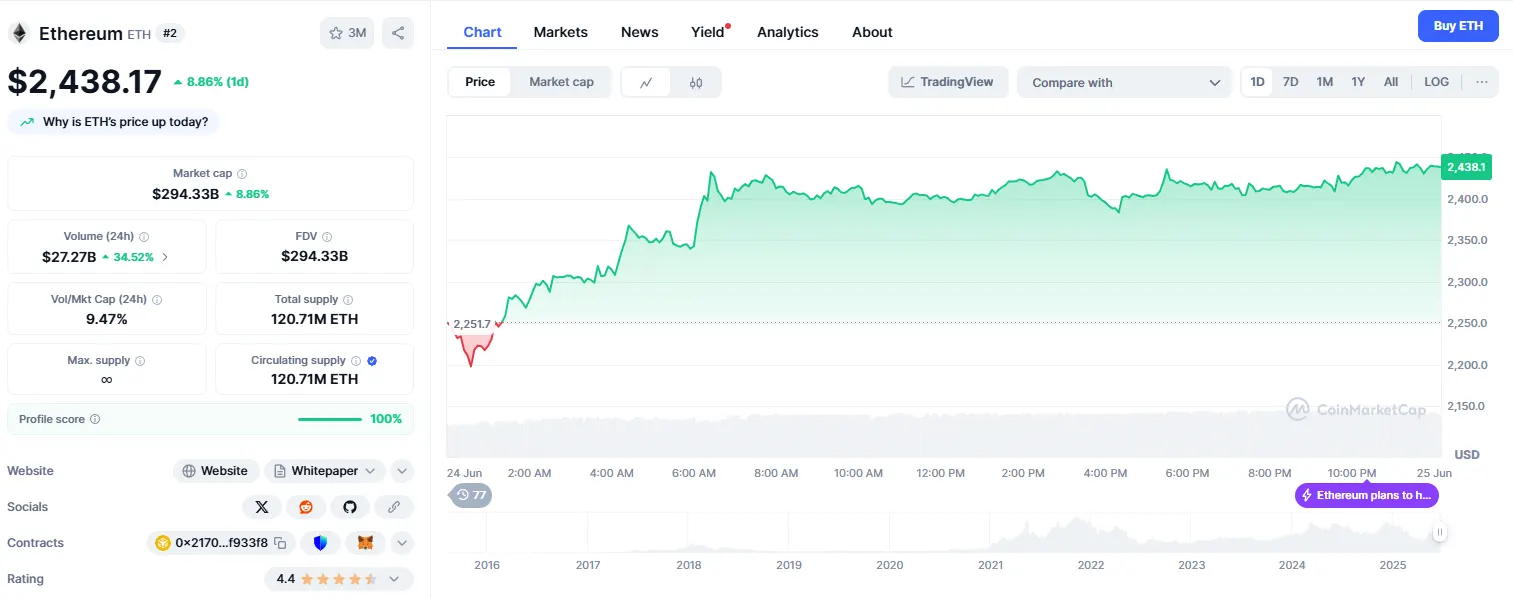

The company’s latest acquisition, executed between 16 and 20 June, saw it purchase 12,207 ETH at an average price of $2,513 per coin, with a total expenditure of $30.7 million. To finance this strategic move, SharpLink successfully raised $27.7 million through an at-the-market (ATM) offering, issuing over 2.5 million shares. This acquisition follows an earlier fundraising triumph this month, when the firm secured $450 million in a private investment round backed by prominent players such as ConsenSys, Galaxy, and Pantera Capital. The deal also ushered in a notable leadership transition, with Ethereum co-founder and ConsenSys CEO Joseph Lubin assuming the role of board chairman.

SharpLink’s pivot to cryptocurrencies mirrors the pioneering strategy of firms like MicroStrategy (MSTR), which famously embraced bitcoin as a core treasury asset. However, SharpLink’s focus on Ethereum underscores its belief in the blockchain’s transformative potential. “Our investment in Ethereum reflects our conviction in its technological promise and our dedication to harnessing innovative solutions that deliver value to our shareholders and business alike,” Lubin remarked in a statement.

Since adopting its ETH-focused treasury strategy, SharpLink has actively staked its entire cryptocurrency portfolio, generating 120 ETH in staking rewards. The company also reported a nearly 19% rise in ETH per share, a testament to the strategy’s early success. By integrating digital assets into its financial framework, SharpLink is positioning itself at the forefront of a growing trend among public companies seeking to leverage the opportunities presented by blockchain technology.

Since adopting its ETH-focused treasury strategy, SharpLink has actively staked its entire cryptocurrency portfolio, generating 120 ETH in staking rewards. The company also reported a nearly 19% rise in ETH per share, a testament to the strategy’s early success. By integrating digital assets into its financial framework, SharpLink is positioning itself at the forefront of a growing trend among public companies seeking to leverage the opportunities presented by blockchain technology.