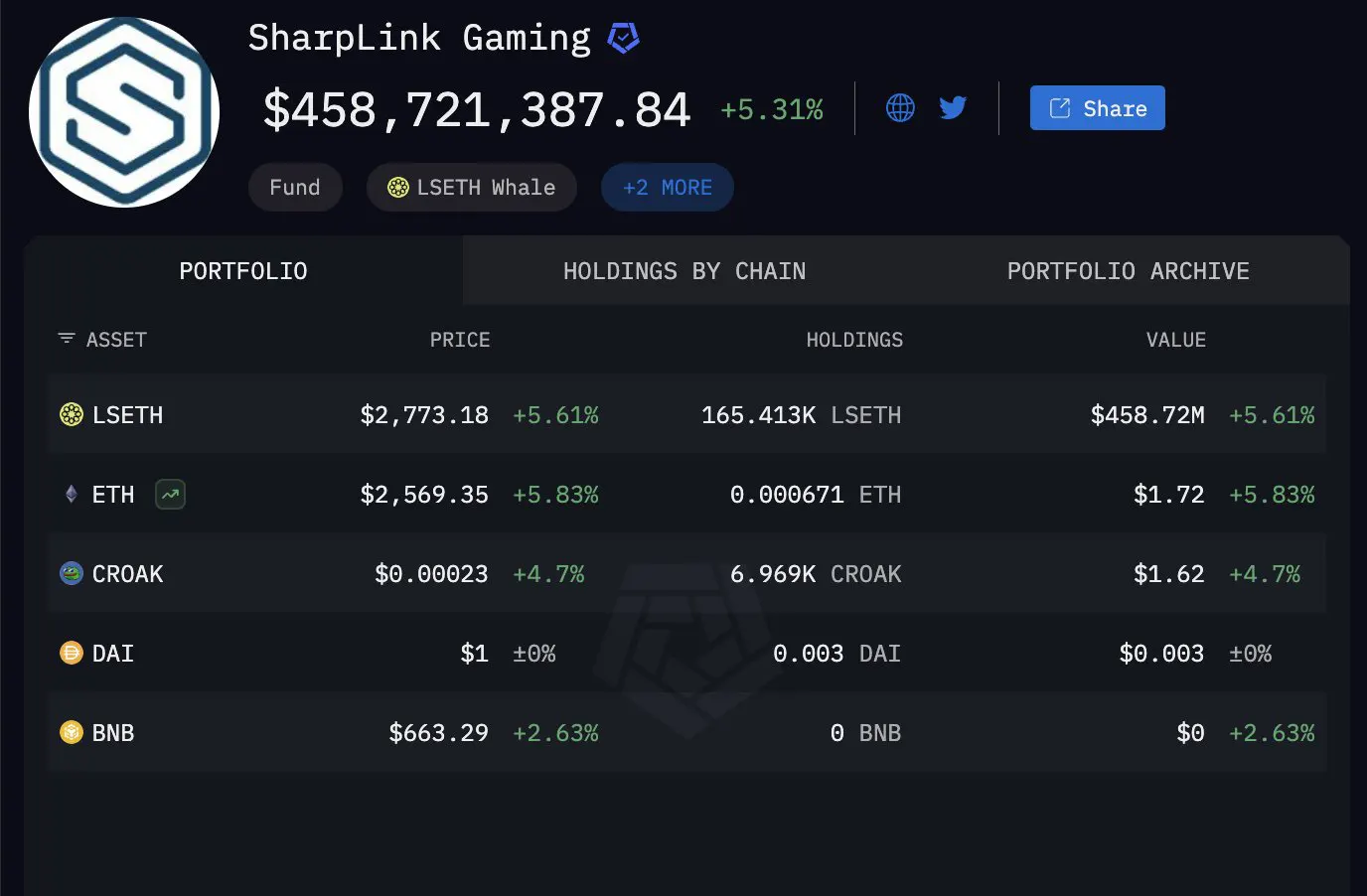

3-7-2025 – SharpLink Gaming Boosts Ethereum Staking with $2M lsETH Purchase, Stock Surges 28%July 3, 2025, 10:46 AM +08SharpLink Gaming has staked an additional $2 million in Ethereum as liquid staked ETH (lsETH), bringing its total lsETH holdings to $458 million, according to on-chain data from Arkham Intelligence shared on X.

The Nasdaq-listed company’s stock (SBET) surged 28% today, reaching $11.98, reflecting strong investor confidence in its aggressive crypto treasury strategy. The latest purchase pushes SharpLink’s staked Ethereum to over 165,000 ETH, primarily held in lsETH, which allows the firm to earn staking rewards while maintaining liquidity for DeFi opportunities.

Unlike traditional staking, lsETH enables SharpLink to actively manage its assets, with recent wallet activity showing ongoing fund adjustments to maximize yields. The company’s crypto portfolio remains heavily focused on lsETH, with minor holdings in ETH ($1,700), CROAK, DAI, and BNB, underscoring its Ethereum-centric approach. The price of lsETH itself rose over 5%, further boosting the value of SharpLink’s holdings. SharpLink’s strategy aligns with a growing trend among institutional investors, who favor liquid staking to balance yield generation with flexibility.

By staking significant ETH volumes, the company reduces market supply, potentially supporting Ethereum’s price growth. The stock rally, paired with high trading volume, suggests market optimism about SharpLink’s pivot to blockchain finance, led by Chairman Joseph Lubin, an Ethereum co-founder.

Lubin recently hinted at emulating MicroStrategy’s Bitcoin treasury model, signaling confidence in Ethereum’s long-term value.Investors should monitor SharpLink’s future ETH purchases and potential DeFi integrations, as these could further influence its stock performance and Ethereum’s market dynamics.