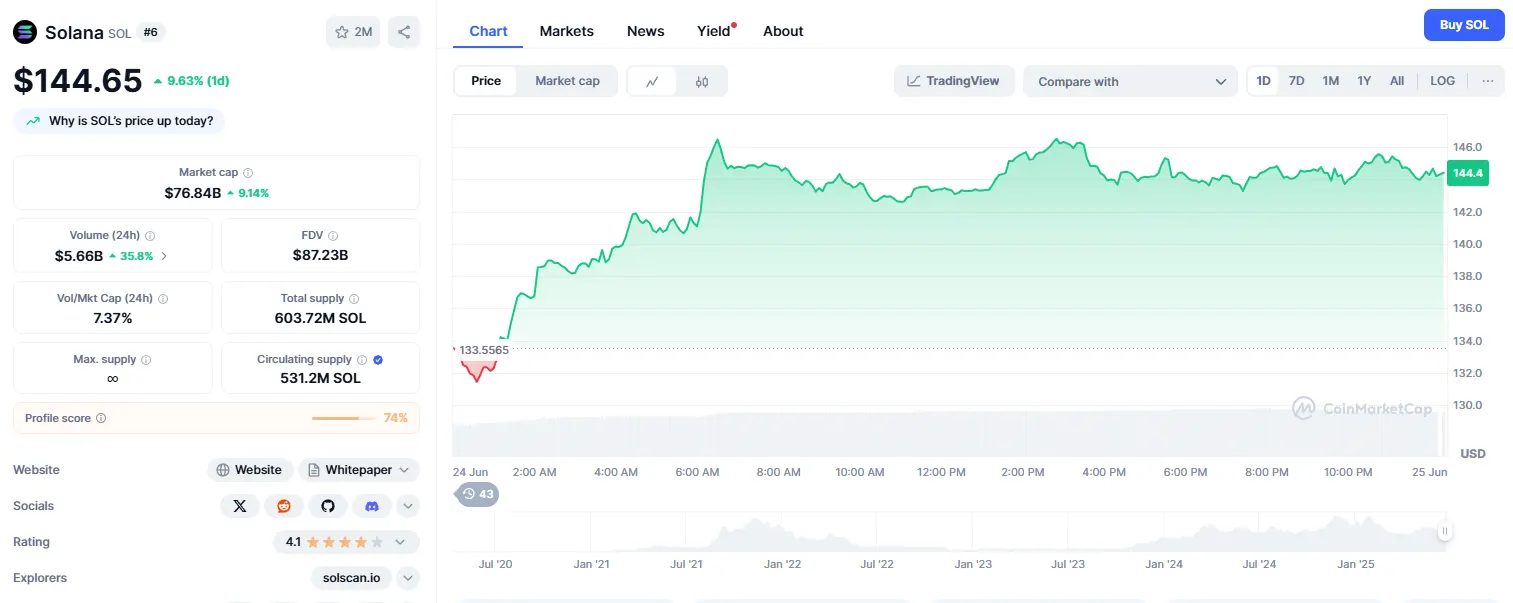

25-6-2025 – Solana’s SOL token has surged to $145.47, marking a robust 7.63% gain over the past 24 hours, as institutional appetite reaches unprecedented levels with futures activity hitting extraordinary heights during a compelling rally that has captivated sophisticated investors across global markets.

The cryptocurrency’s ascent has been particularly noteworthy during overnight trading sessions, with pronounced volume spikes occurring at specific intervals that suggest coordinated institutional positioning. Market dynamics have shifted dramatically following a decisive recovery from the $133.55 low point to $144.10, establishing a foundation for sustained upward momentum across a $15.94 trading range.

Central Asian blockchain pioneer

In a groundbreaking development that extends far beyond immediate price movements, Kazakhstan has taken a major leap in digital innovation by launching the first-ever Solana Economic Zone in Central Asia. This strategic initiative represents a significant milestone for blockchain adoption in the region, with implications that could reshape the technological landscape across Central Asian markets.

The ambitious project encompasses three fundamental components designed to accelerate Web3 integration. Asset tokenisation programmes will serve as testing grounds for traditional financial instruments to migrate onto blockchain infrastructure, whilst educational initiatives aim to cultivate homegrown expertise in decentralised technologies. Meanwhile, startup attraction schemes promise to establish Kazakhstan as a regional hub for international blockchain enterprises.

Technical momentum builds

Market technicians have observed compelling patterns emerging throughout recent trading sessions, with volume profiles suggesting genuine institutional accumulation rather than speculative retail activity. The asset’s trajectory has demonstrated resilience through multiple testing phases, with the most dramatic movement occurring at 22:00 when prices spiked to $146.90 on substantial 3.92M volume, establishing key support levels that provide confidence for continued advancement.

Recovery patterns have exhibited characteristic institutional fingerprints, with systematic accumulation occurring during periods of reduced volatility. The establishment of consolidation zones between $143 and $146, with resistance noted at $146.55, indicates measured positioning by sophisticated market participants who typically operate with longer-term investment horizons. A particularly robust support level emerged at $143.60, reinforced by substantial volume activity of 38,097 SOL at 13:53.

Derivatives market explosion

CME already offers bitcoin and ether futures, which have seen significant growth in trading activity, and the addition of Solana derivatives has unleashed unprecedented trading volumes that dwarf previous records. This surge in futures activity reflects growing confidence amongst institutional investors who require sophisticated risk management tools for their digital asset exposures.

The derivatives explosion has coincided with broader institutional adoption trends, suggesting that traditional financial players are increasingly comfortable with blockchain-based investments when appropriate infrastructure exists. Professional traders have embraced these instruments as essential components of comprehensive cryptocurrency trading strategies.

Professional market participants have demonstrated particular enthusiasm for the new trading instruments, with volume metrics indicating substantial commitment from hedge funds and proprietary trading firms. This institutional engagement provides crucial liquidity depth that enhances market stability and reduces volatility concerns that previously deterred conservative investors.

Strategic regional implications

The Kazakhstan initiative extends beyond immediate technological benefits, potentially establishing a template for blockchain adoption across emerging markets. Government backing for the project signals recognition of blockchain technology’s transformative potential for economic development and international competitiveness.

Partnership arrangements between local authorities and established blockchain foundations create precedents for public-private collaboration in the digital asset space. These relationships could inspire similar initiatives across neighbouring regions, amplifying the broader impact of Central Asian blockchain adoption.

Educational components of the programme address critical skills shortages that have historically limited regional participation in the global digital economy. University partnerships and professional development programmes promise to cultivate local expertise capable of supporting sustained technological advancement.

The convergence of technical momentum, institutional adoption, and strategic partnerships has created conditions that many analysts view as supportive for continued advancement. Market structure improvements through derivatives availability, combined with real-world utility demonstrations through government partnerships, provide fundamental underpinnings that distinguish current conditions from previous speculative episodes.

Trading volumes and institutional participation levels suggest that current movements reflect genuine adoption rather than temporary speculative interest, indicating potential for sustained growth as blockchain technology achieves broader mainstream acceptance.