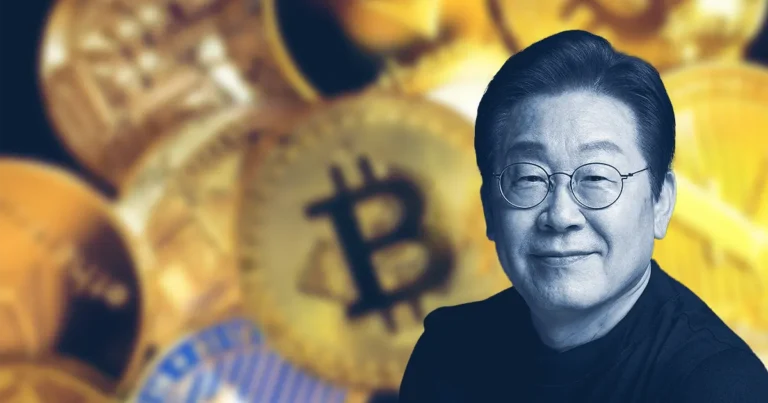

7-5-2025 – South Korea’s presidential frontrunner Lee Jae-myung has unveiled ambitious plans to modernise the nation’s cryptocurrency market through the introduction of spot bitcoin exchange-traded funds (ETFs).

The Democratic Party of Korea candidate, commanding an impressive 50% approval rating, outlined his vision via social media, emphasising the creation of a comprehensive monitoring framework to ensure secure virtual asset investments. This stance marks a significant departure from current regulatory restrictions, as the Financial Services Commission (FSC) presently prohibits both the trading and issuance of spot crypto ETFs.

The timing proves particularly significant, as South Korea prepares for its 3 June presidential election, following the impeachment of former President Yoon Suk-yeol. Market confidence in Lee’s prospects appears robust, with decentralised prediction platform Polymarket showing an 87% likelihood of victory, backed by $80 million in wagers.

In a noteworthy development, FSC Chairman Kim Byung-hwan has expressed alignment with the campaign promises regarding cryptocurrency ETFs, signalling potential regulatory shifts. The chairman indicated readiness to engage with the incoming administration on implementation strategies, as reported by MoneyToday.

Lee’s campaign platform extends beyond cryptocurrency reform, encompassing innovative financial initiatives targeting younger demographics. These include novel interest-bearing savings schemes and financial planning services, addressing what he describes as a “structural crisis” stemming from limited societal opportunities.

The cryptocurrency reform agenda has emerged as a key battleground in the presidential race, with right-wing People Power Party candidate Kim Moon-soo similarly advocating for the removal of existing crypto ETF restrictions. This cross-party consensus suggests impending transformative changes in South Korea’s digital asset regulatory framework, regardless of the election outcome.

FSC’s previous stance, which determined insufficient legal grounds for cryptocurrencies to underpin ETF products, appears poised for reassessment amid this evolving political landscape.