7-5-2025 – Tether has orchestrated another substantial USDT issuance on the Tron network, raising fresh questions about Ethereum’s previously unassailable position in the stablecoin realm.

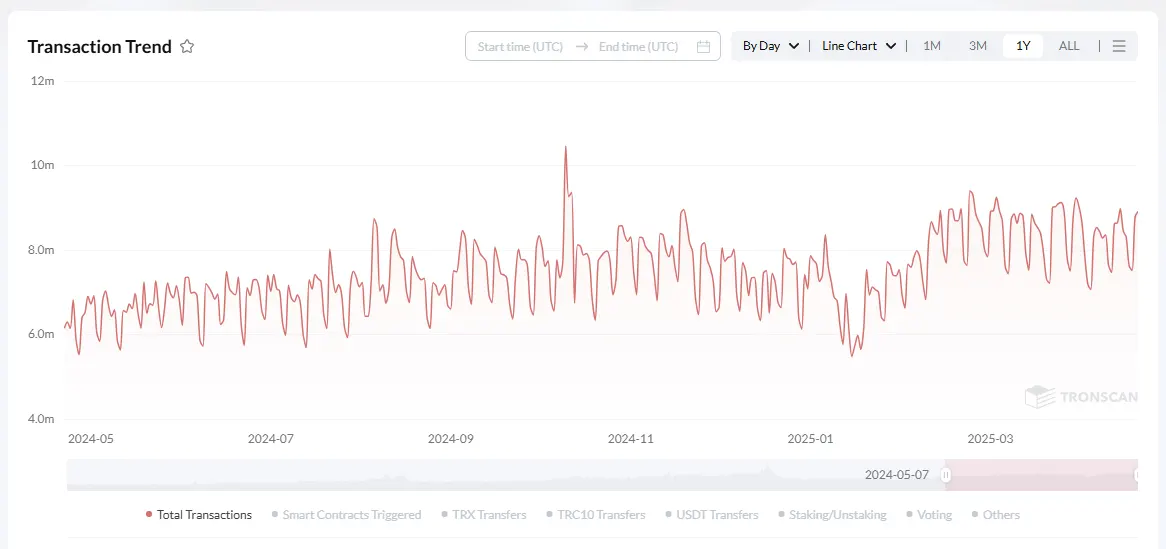

The digital assets landscape appears to be witnessing a paradigm shift, as Tron’s ascendancy in the stablecoin domain continues unabated. With daily transactions routinely surpassing nine million, and occasional surges approaching eleven million, Tron’s robust performance signals a marked departure from traditional market dynamics.

Market analytics paint a compelling picture of Ethereum’s waning influence. Whilst the network maintains a formidable \$74.5 billion in USDT circulation, its once-commanding lead has diminished considerably. The platform’s recent trajectory suggests a period of stagnation, with modest declines observed in recent months.

The crux of Ethereum’s challenge lies in its cost structure. Despite its established infrastructure and historical significance, the network’s substantial transaction fees have become increasingly problematic for both institutional players and retail users alike. This economic burden has prompted a strategic pivot towards more cost-effective alternatives.

Tron’s meteoric rise since early 2022 bears testament to this shifting sentiment. The network’s transaction volumes have demonstrated remarkable resilience, climbing steadily from six million daily transactions to their current impressive levels. This sustained growth trajectory, particularly pronounced since January 2025, underscores the platform’s expanding utility.

Industry observers note that unless Ethereum implements substantial scalability improvements beyond its current Layer 2 solutions, its longstanding dominance in the stablecoin ecosystem may face unprecedented challenges. The market appears to be favouring platforms that prioritise operational efficiency and cost-effectiveness, a trend that could reshape the digital asset landscape in the months ahead.