7-8-2025 – The notion of banning cryptocurrency in the U.S. has been dismissed, with Bloomberg columnist Matt Levine declaring the industry “too big and too global” to be shut down, as first reported in his recent op-ed. The Securities and Exchange Commission (SEC) is now pivoting toward tailored regulation to address the unique nature of digital assets.

Levine argues the SEC remains the best agency to oversee crypto but must move beyond applying outdated stock market rules. Under former Chair Gary Gensler, the SEC’s enforcement-heavy approach—treating most tokens as securities—led to market turbulence. Research showed crypto prices fell 5.2% on average within three days of SEC enforcement announcements, with trading volumes also declining sharply. This uncertainty stifled investment and weakened markets.

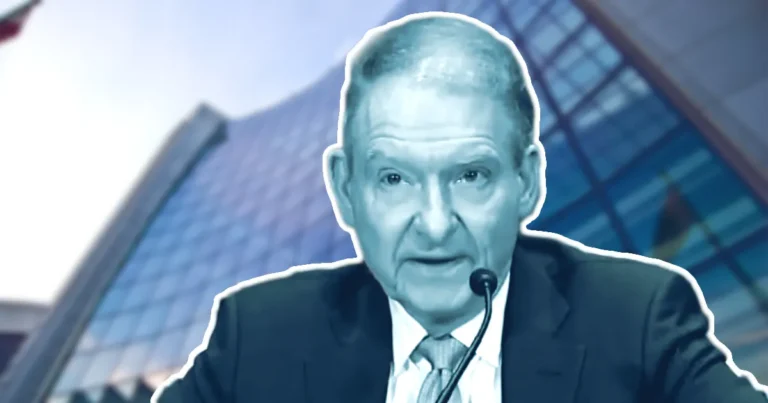

New SEC Chair Paul Atkins’ Project Crypto initiative signals a shift, aiming to simplify token registration in a way that aligns with the industry’s structure. The broader policy landscape is also changing. A July 30 White House report, “Strengthening American Leadership in Digital Financial Technology,” emphasizes supporting innovation and targeting bad actors rather than the entire crypto sector.

Major banks, like JPMorgan, are exploring tokenized investments and stablecoin services, indicating growing institutional acceptance. With a ban off the table and ignoring crypto no longer viable, the SEC’s only path forward is regulation that fosters growth while protecting investors. As the agency adapts, the crypto industry could see a more stable and supportive environment.