18-6-2025 – The United States Senate has passed the GENIUS Act, a transformative piece of legislation that lays the groundwork for the issuance and trading of stablecoins across the nation. The vote, which concluded with a decisive 68-30 in favour, saw an unusual coalition of 18 Democrats aligning with their Republican counterparts, heralding a new era for cryptocurrency in America.

Industry reactions

Stablecoins, digital tokens typically tethered to the value of the US dollar, serve as a vital bridge between the volatile cryptocurrency markets and conventional financial systems, enabling seamless transitions without direct reliance on traditional currency. The passage of the GENIUS Act has ignited enthusiasm among industry leaders, who view it as a landmark triumph for innovation and a critical step towards robust oversight of the digital asset landscape. Liat Shetret, a senior figure at blockchain intelligence firm Elliptic, described the legislation as a “pivotal moment” in defining America’s role in the global digital economy, while Amanda Tuminelli of the DeFi Education Fund hailed it as a monumental victory for both innovation and prudent regulation.

Legislative journey & next steps

The legislation’s journey, however, is far from complete. It now awaits deliberation in the House of Representatives, where its fate remains uncertain. Senate Republicans are pressing for swift enactment, with some urging President Donald Trump to sign the bill into law by early July. Yet, House Republicans are reportedly considering merging the GENIUS Act with their own stablecoin proposal and a broader, struggling bill addressing the crypto market’s structure, in a bid to bolster its chances of passing both chambers.

Opposition and concerns

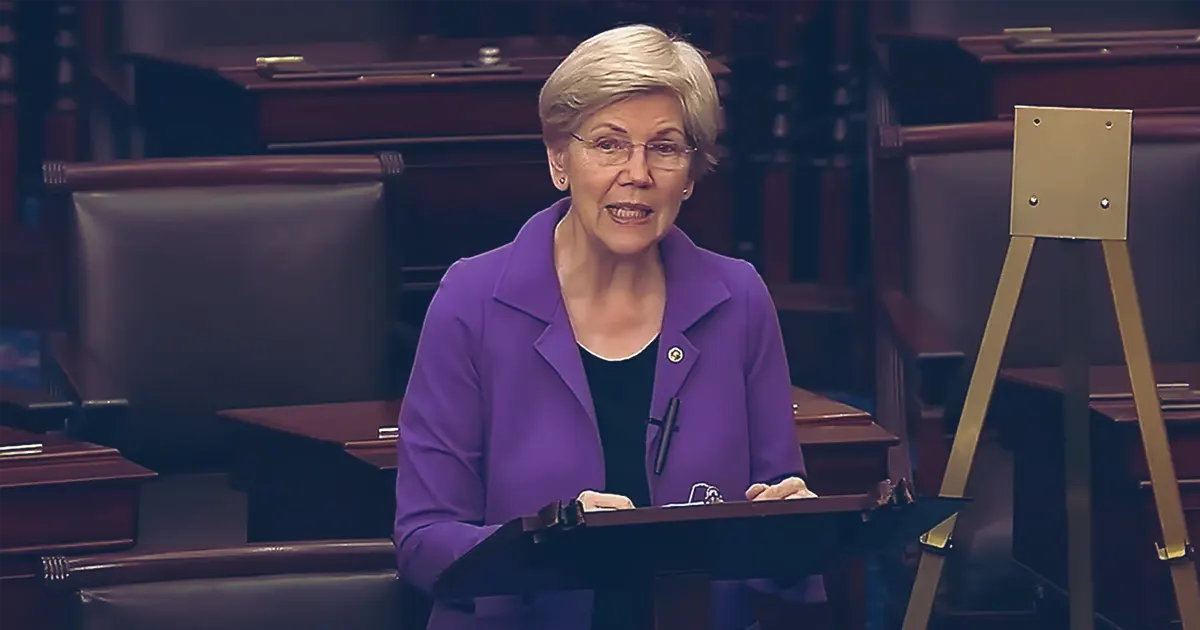

Opposition to the Act was notable, with progressive Democrats, including Massachusetts’ Elizabeth Warren, joining forces with Republican senators like Josh Hawley of Missouri and Rand Paul of Kentucky. Their dissent stems from concerns over provisions that could permit major technology firms to issue their own stablecoins, potentially enabling them to monitor consumer spending under specific circumstances—a prospect that has sparked unease among privacy advocates.

Economic implications

The implications of the GENIUS Act extend far beyond the crypto sphere. US Treasury Secretary Scott Bessent underscored its potential to stimulate private-sector demand for US Treasuries, which underpin stablecoins. This surge in demand, he argued, could reduce government borrowing costs, offering a pathway to curb the nation’s spiralling debt while drawing millions worldwide into the dollar-based digital asset ecosystem. Major players in finance and commerce—ranging from Wall Street titans and leading banks to retail giants like Walmart and tech behemoths such as Amazon—are poised to capitalise on the legislation, eyeing stablecoins as a means to bypass costly payment processing fees and harness yields from customer deposits. Should the Act become law, experts predict a torrent of investment from these sectors, potentially funnelling trillions into the cryptocurrency market.