18-7-2025 – XRP derivatives open interest has spiked 18% to $10.52 billion amid a massive whale transfer of $173 million worth of tokens, signaling heightened speculation around the cryptocurrency’s potential breakout to new all-time highs.

The surge in open interest coincides with XRP derivatives volume jumping 139.84% to $39.61 billion, reflecting intense trading activity as the token trades at $3.47 following a 13.50% intraday rally. The whale movement of 53.47 million XRP tokens has drawn market attention, particularly following Ripple co-founder Chris Larsen’s recent $26 million transfer to Coinbase.

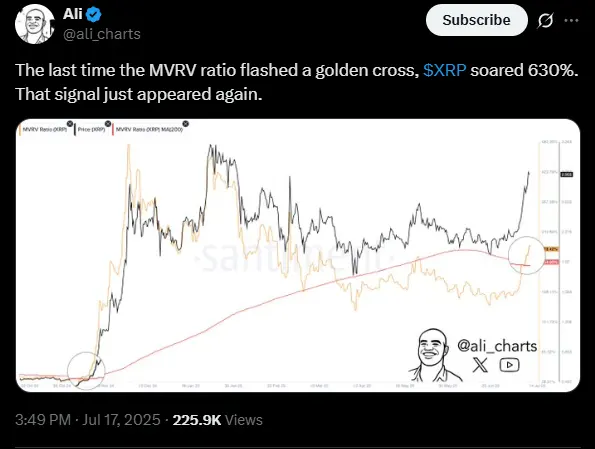

Crypto analyst Ali Charts has identified a bullish technical signal, noting that XRP’s MVRV ratio has formed a golden cross pattern that historically preceded a 630% price rally. The analysis supports XRP’s current momentum, with the token gaining 35% over the past week and its market capitalization crossing $200 billion for the first time.

The rally has been fueled by regulatory optimism following the House passage of the CLARITY Act, which aims to establish clearer digital asset regulations. The legislation, along with two other crypto-related bills, is viewed as particularly beneficial for Ripple given its ongoing legal challenges in the U.S. market.

Adding to the bullish sentiment, speculation surrounding the potential launch of the first U.S.-listed XRP ETF has intensified, with market participants anticipating a possible ProShares filing that could drive institutional adoption and further price appreciation.