3-6-2025 – XRP stands poised at a critical juncture, its price tethered at $2.17 after a prolonged 181-day period of constrained movement. Market watchers and seasoned traders are keenly observing the charts, detecting subtle signals that a significant price shift may loom on the horizon. As volatility contracts, both spot and derivatives markets are flashing indicators of an impending high-volume surge.

Technical signals point to mounting tension

XRP’s price has been locked in a tight corridor, fluctuating between $2.11 and $2.35 over the past week, a range that betrays market indecision. Trading volumes have slumped, with a 37% drop in the last 24 hours to $1.51 billion, mirrored by a decline in futures activity to $2.97 billion. Analysts are closely monitoring the $2.12 support level, with a potential slide to $2.00—or even $1.91 to $1.95—if breached. Crypto commentator Steph Is Crypto has highlighted a staggering $450 billion in liquidations lurking below $2, a threshold that could unleash a dramatic cascade of sell orders and leveraged position unwinds.

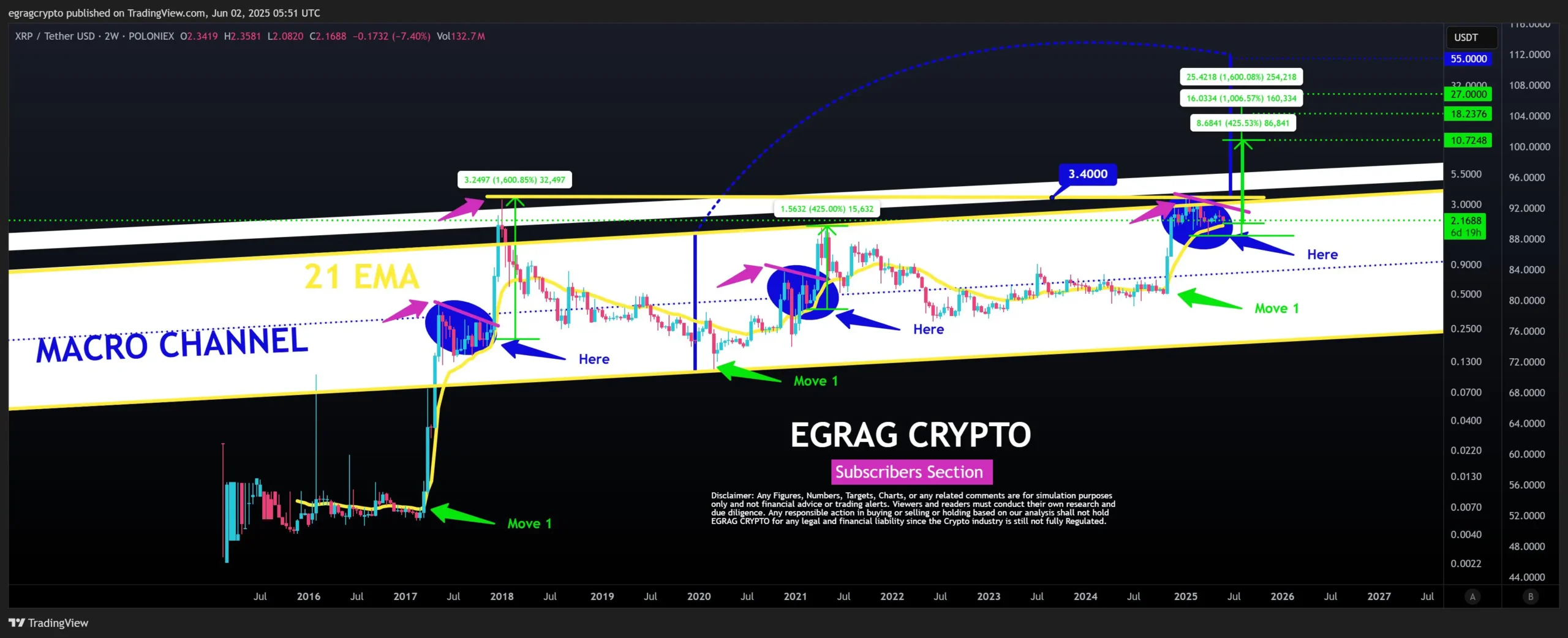

From a technical perspective, XRP is hovering near the lower Bollinger Band, with the Relative Strength Index (RSI) at 40.82, suggesting neither overbought nor oversold conditions. The Moving Average Convergence Divergence (MACD) remains in negative territory, and the token continues to trade within a broader bearish channel, though it clings above the 200-day Exponential Moving Average (EMA). These metrics paint a picture of cautious anticipation, with the market primed for a decisive move.

Institutional horizons broaden

Adding fuel to the speculative fire, Coinbase Institutional has unveiled plans to launch 24/7 XRP futures trading on June 13, following the introduction of regulated futures in April. Each contract will represent 10,000 XRP, with a 10% hourly price fluctuation cap to ensure stability. This move is designed to offer institutional investors safer and more flexible access to the asset. Andy Sears, Coinbase’s CEO, hailed the development as transformative, underscoring its potential to reshape the market landscape.

In parallel, Ault Capital Group has revealed an ambitious initiative to establish an XRP lending platform tailored for U.S. public companies. Leveraging futures-hedged, asset-backed loans recorded on the XRP Ledger, this platform aims to bolster institutional engagement with the cryptocurrency, further cementing its role in the financial ecosystem.

A market on the brink

As XRP teeters at this pivotal moment, traders are eyeing ambitious price targets—$10, $18, or even $27—should key resistance levels give way. Yet, the path forward hinges on the interplay of chart patterns and market catalysts. With technical indicators flashing caution and institutional infrastructure expanding, the stage is set for a potentially explosive move. The cryptocurrency world watches with bated breath, awaiting the spark that could ignite XRP’s next chapter.