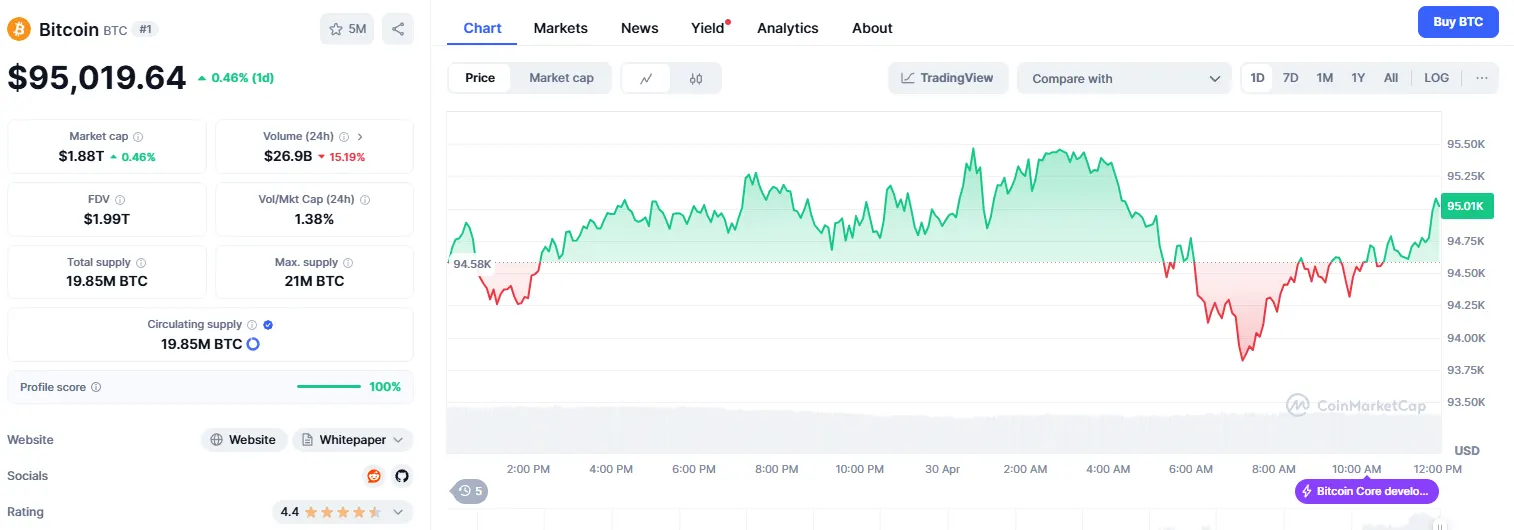

30-4-2025 – Bitcoin has shattered yet another psychological barrier, pushing beyond the 95,000 USDT threshold. The flagship cryptocurrency, whilst displaying modest daily gains of 0.28%, has managed to sustain its position at 95,019.828125 USDT, marking a significant milestone in its trading trajectory.

The relatively tight trading range over the past 24 hours suggests a period of consolidation at these elevated levels, as market participants digest the implications of Bitcoin’s sustained presence in this unprecedented territory.

Bitcoin’s trajectory continues to captivate the financial world as Q2 2025 unfolds, with analysts eyeing ambitious new price targets for the flagship digital asset.

Following its extraordinary performance in late 2024, which saw Bitcoin establish multiple record highs culminating in a peak of $109,000, the market underwent a necessary period of consolidation. Market specialists had anticipated this correction, viewing it as a vital recalibration after the asset’s particularly aggressive upward momentum.

Technical analysis now points to Bitcoin forming an ascending triangle pattern, traditionally a bullish indicator, as it maintains its position above the $90,000 threshold. Having recently surpassed the $95,000 mark, the digital currency appears poised for further gains, with analysts projecting immediate targets of $98,300 and an ambitious $125,000 thereafter.

The correction phase, which market observers deemed essential for sustainable growth, was prolonged by various geopolitical factors that simultaneously affected the broader alternative cryptocurrency market’s seasonal patterns. However, as the market emerges from this consolidation period, confidence in Bitcoin’s upward trajectory has been reinforced by its interaction with key technical indicators, particularly the golden ratio multiplier.

Notably, Bitcoin’s resilience during the recent market adjustment has strengthened institutional conviction in its long-term potential. The digital asset’s swift recovery from earlier setbacks, coupled with its successful defence of crucial support levels, has bolstered predictions for sustained momentum through the remainder of 2025.