4-5-2025 – Freight Technologies (FRGT), a logistics technology firm with a modest $4.8 million market cap, has embarked on an audacious financial strategy by committing to acquire up to $20 million in Official Trump Tokens (TRUMP). The company, which specialises in streamlining trade across the U.S.-Mexico border, aims to bolster its cryptocurrency treasury with this move, positioning itself as a trailblazer among publicly listed firms embracing digital assets. The initial funding, secured through a $1 million tranche from a convertible note facility with an institutional investor, will be exclusively channelled into purchasing TRUMP tokens.

This bold step follows Freight Technologies’ earlier foray into cryptocurrencies, with an $8 million investment in FET tokens tied to artificial intelligence, which powers the company’s suite of logistics platforms. These platforms, encompassing freight booking and transportation management tools, are designed to modernise the flow of goods across North America, particularly between the U.S. and Mexico, the latter being America’s foremost trading partner for both exports and imports.

The decision to amass TRUMP tokens is not merely a financial gambit but carries a strategic intent. Javier Selgas, Freight Technologies’ CEO, framed the acquisition as a dual-purpose endeavour: diversifying the company’s crypto holdings while advocating for equitable trade policies amid escalating tensions in U.S.-Mexico relations. “This investment reflects our commitment to fostering fair and open commerce,” Selgas declared on 30 April, underscoring the company’s mission to strengthen cross-border economic ties.

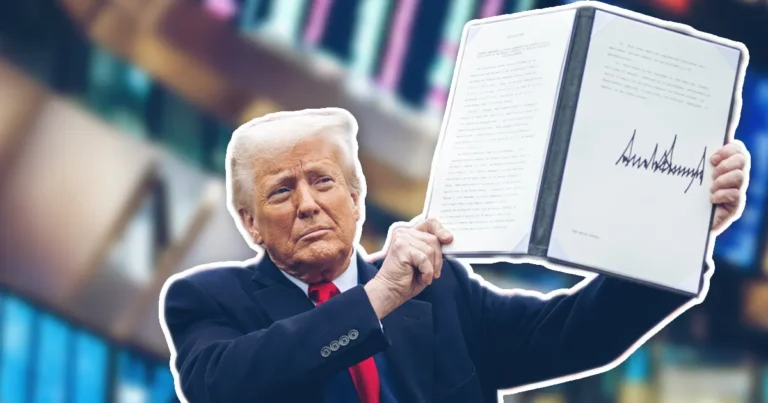

However, the move has sparked debate, with some questioning whether purchasing a memecoin linked to President Trump could blur ethical lines. Recent controversy surrounding the TRUMP token intensified after reports surfaced of a private dinner offered to top token holders, prompting sharp criticism from Democratic lawmakers. On 25 April, Senator Jon Ossoff of Georgia decried the event as an apparent attempt to monetise access to the presidency, raising concerns about potential conflicts of interest.

Freight Technologies’ strategy mirrors a broader trend among corporations diving into cryptocurrencies. Pioneered by Michael Saylor’s bitcoin-centric approach at Strategy, the practice has gained traction, with firms like Semler Scientific and Cantor following suit. In Japan, companies such as Metaplanet, which recently amassed 5,000 BTC and issued $25 million in bonds for further purchases, exemplify this growing appetite for digital assets. Smaller players, including Value Creation and Remixpoint, are also building crypto reserves, while firms like Sol Strategies and Janover are snapping up SOL tokens to offer investors exposure to the crypto market.

For Freight Technologies, whose stock has endured a bruising 90% decline over the past year, the TRUMP token investment appears to be a calculated effort to revive its fortunes. The announcement triggered a remarkable 111% surge in its share price before markets closed on Friday, though after-hours trading saw a 21.6% retreat. Meanwhile, TRUMP tokens, trading at $12.7, have risen 42% over the past month, buoyed by their association with the U.S. President.

The crypto space has also seen other Trump-linked investments, notably DWF Labs’ $25 million stake in World Liberty Financial (WLFI), a decentralised finance protocol backed by the Trump family. WLFI, which is preparing to launch a stablecoin pegged to U.S. Treasury bills, underscores the growing intersection of politics and digital finance.