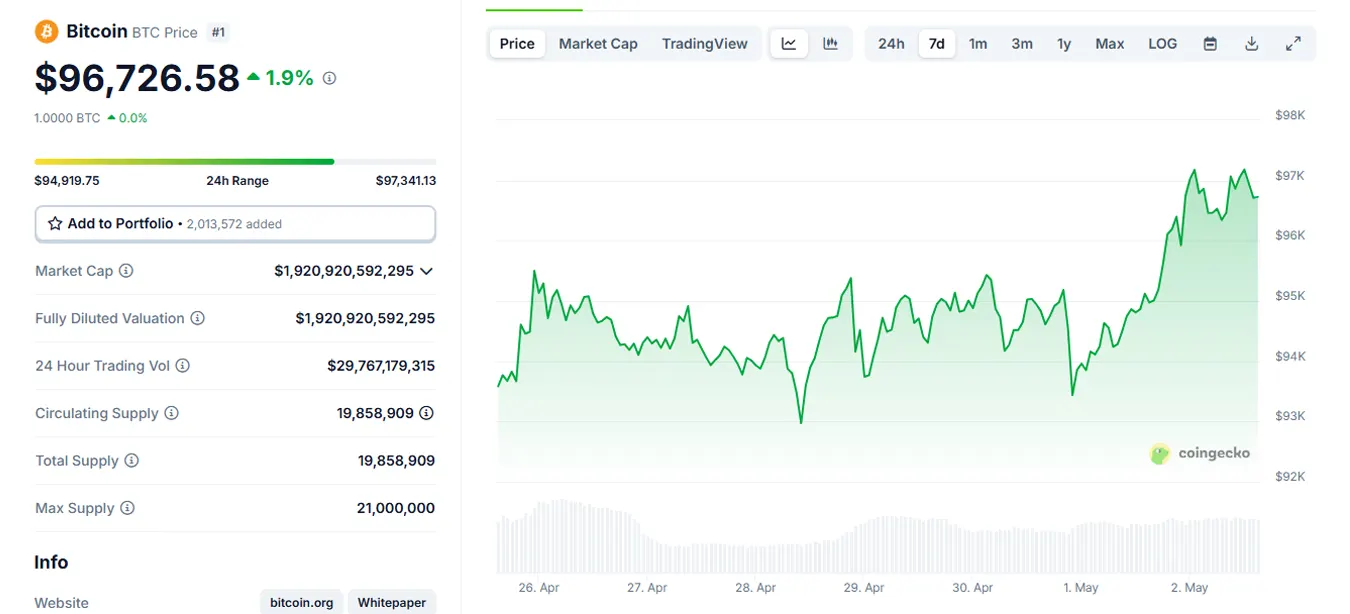

2-5-2025 – Bitcoin is steadily carving a path toward the coveted $100,000 threshold, its value ascending with measured confidence. As of now, the cryptocurrency trades at approximately $96,091, reflecting a 3.6% rise over the past seven days. This upward trajectory, following a brief correction in early April, signals robust market engagement and a gathering momentum that has analysts closely scrutinising the forces at play.

CryptoQuant analyst Crypto Dan offers a compelling perspective, drawing parallels between Bitcoin’s current dynamics and earlier periods of accumulation in 2024. He points to heightened activity among short-term holders—those retaining their coins for mere days to a week—as a precursor to significant price surges. Such patterns, observed in January and October, have historically heralded not only Bitcoin’s rallies but also broader altcoin market upswings. Dan’s analysis suggests the market is priming itself for a potentially transformative leap, with $100,000 within sight and a renewed bullish phase looming.

Elsewhere, CryptoQuant contributor Axel Adler Jr. provides a nuanced outlook through a recent QuickTake post titled “Bitcoin is warming up – 3 scenarios that could shape the next rally.” Adler’s analysis hinges on Bitcoin’s on-chain momentum, which currently sits at a momentum ratio of 0.8, entering what he terms the “start” rally zone. This metric, he argues, is pivotal in forecasting whether Bitcoin will soar or stagnate. In his optimistic scenario, a momentum ratio surpassing 1.0 could propel Bitcoin to a staggering $150,000–$175,000, echoing the explosive breakouts of 2017 and 2021.

A more tempered base case envisions the ratio holding between 0.8 and 1.0, confining Bitcoin to a $90,000–$110,000 trading range as investors adopt a cautious stance. Should the ratio slip to 0.75, a pessimistic outcome might see short-term holders cashing out, driving prices down to $70,000–$85,000. Yet, with April’s correction already absorbed, Adler leans toward the optimistic or base scenarios as the more likely paths forward.